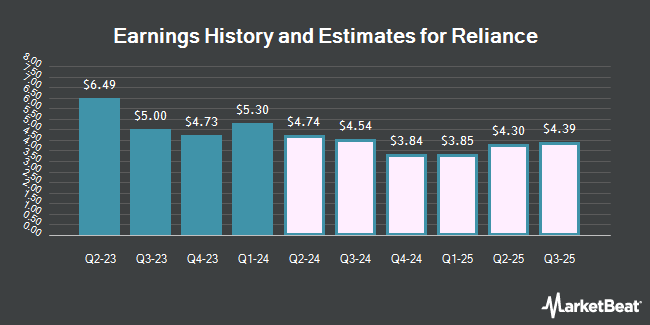

Reliance, Inc. (NYSE:RS - Free Report) - Research analysts at Seaport Res Ptn lifted their Q1 2026 earnings estimates for shares of Reliance in a research report issued on Thursday, July 24th. Seaport Res Ptn analyst M. Englert now anticipates that the industrial products company will earn $5.05 per share for the quarter, up from their previous estimate of $4.89. The consensus estimate for Reliance's current full-year earnings is $16.98 per share. Seaport Res Ptn also issued estimates for Reliance's Q3 2026 earnings at $4.54 EPS, Q4 2026 earnings at $3.57 EPS and FY2026 earnings at $18.42 EPS.

Reliance (NYSE:RS - Get Free Report) last issued its quarterly earnings data on Wednesday, July 23rd. The industrial products company reported $4.43 earnings per share for the quarter, missing the consensus estimate of $4.72 by ($0.29). Reliance had a return on equity of 10.48% and a net margin of 5.39%. The business had revenue of $3.66 billion during the quarter, compared to the consensus estimate of $3.66 billion. During the same quarter last year, the company earned $4.65 EPS. Reliance's revenue for the quarter was up .5% on a year-over-year basis.

Reliance Stock Performance

Shares of NYSE:RS traded down $0.42 during trading on Monday, hitting $299.68. The company's stock had a trading volume of 558,672 shares, compared to its average volume of 414,878. The company has a 50-day moving average of $313.44 and a 200-day moving average of $296.36. Reliance has a 12 month low of $250.07 and a 12 month high of $347.43. The company has a debt-to-equity ratio of 0.14, a current ratio of 3.18 and a quick ratio of 1.51. The firm has a market cap of $15.76 billion, a price-to-earnings ratio of 21.87, a P/E/G ratio of 1.42 and a beta of 0.89.

Hedge Funds Weigh In On Reliance

Several institutional investors have recently made changes to their positions in the business. TCTC Holdings LLC increased its holdings in Reliance by 138.9% in the 1st quarter. TCTC Holdings LLC now owns 86 shares of the industrial products company's stock worth $25,000 after acquiring an additional 50 shares in the last quarter. Private Trust Co. NA increased its holdings in Reliance by 417.6% in the 2nd quarter. Private Trust Co. NA now owns 88 shares of the industrial products company's stock worth $28,000 after acquiring an additional 71 shares in the last quarter. N.E.W. Advisory Services LLC purchased a new stake in Reliance in the 1st quarter worth approximately $29,000. Wayfinding Financial LLC purchased a new stake in Reliance during the 1st quarter valued at approximately $30,000. Finally, Transamerica Financial Advisors LLC grew its holdings in Reliance by 595.5% during the 1st quarter. Transamerica Financial Advisors LLC now owns 153 shares of the industrial products company's stock valued at $45,000 after buying an additional 131 shares in the last quarter. Institutional investors own 79.26% of the company's stock.

Reliance Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, August 29th. Stockholders of record on Friday, August 15th will be paid a $1.20 dividend. This represents a $4.80 annualized dividend and a dividend yield of 1.60%. The ex-dividend date is Friday, August 15th. Reliance's dividend payout ratio (DPR) is presently 35.04%.

About Reliance

(

Get Free Report)

Reliance, Inc operates as a diversified metal solutions provider and the metals service center company in the United States, Canada, and internationally. The company distributes a line of approximately 100,000 metal products, including alloy, aluminum, brass, copper, carbon steel, stainless steel, titanium, and specialty steel products; and provides metals processing services to general manufacturing, non-residential construction, transportation, aerospace, energy, electronics and semiconductor fabrication, and heavy industries.

See Also

Before you consider Reliance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Reliance wasn't on the list.

While Reliance currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.