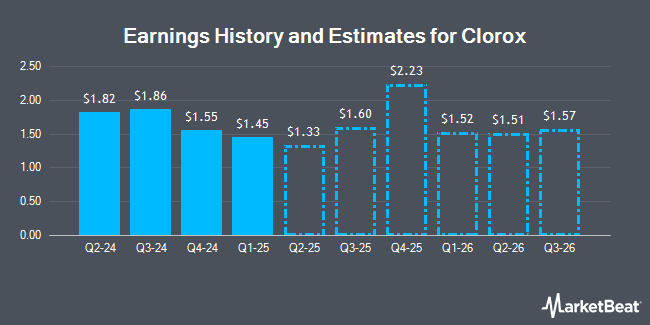

The Clorox Company (NYSE:CLX - Free Report) - Analysts at Zacks Research lowered their Q4 2026 earnings estimates for shares of Clorox in a report released on Thursday, August 14th. Zacks Research analyst Team now forecasts that the company will post earnings per share of $2.08 for the quarter, down from their prior forecast of $2.11. The consensus estimate for Clorox's current full-year earnings is $7.15 per share. Zacks Research also issued estimates for Clorox's Q3 2027 earnings at $1.69 EPS, Q4 2027 earnings at $2.24 EPS, FY2027 earnings at $6.90 EPS and FY2028 earnings at $7.30 EPS.

Clorox (NYSE:CLX - Get Free Report) last issued its earnings results on Thursday, July 31st. The company reported $2.87 EPS for the quarter, beating analysts' consensus estimates of $2.24 by $0.63. Clorox had a net margin of 11.40% and a return on equity of 377.86%. The business had revenue of $1.99 billion for the quarter, compared to the consensus estimate of $1.94 billion. During the same quarter last year, the firm posted $1.82 EPS. The business's revenue for the quarter was up 4.5% compared to the same quarter last year. Clorox has set its FY 2026 guidance at 5.950-6.30 EPS.

A number of other equities analysts also recently commented on CLX. Morgan Stanley cut their target price on shares of Clorox from $150.00 to $137.00 and set an "equal weight" rating on the stock in a research note on Friday, August 1st. UBS Group cut their target price on shares of Clorox from $150.00 to $134.00 and set a "neutral" rating on the stock in a research note on Thursday, July 17th. Barclays cut their target price on shares of Clorox from $129.00 to $119.00 and set an "underweight" rating on the stock in a research note on Tuesday, July 15th. Wells Fargo & Company raised their target price on shares of Clorox from $135.00 to $138.00 and gave the company an "equal weight" rating in a research note on Friday, August 1st. Finally, JPMorgan Chase & Co. dropped their price target on shares of Clorox from $144.00 to $140.00 and set a "neutral" rating on the stock in a research note on Friday, July 25th. One analyst has rated the stock with a Buy rating, eight have assigned a Hold rating and three have given a Sell rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Reduce" and an average target price of $143.36.

View Our Latest Research Report on CLX

Clorox Trading Up 0.5%

Shares of CLX stock traded up $0.5720 during mid-day trading on Monday, reaching $120.4120. The company's stock had a trading volume of 710,127 shares, compared to its average volume of 1,635,806. The company's 50 day simple moving average is $124.31 and its 200-day simple moving average is $135.57. Clorox has a 12-month low of $117.35 and a 12-month high of $171.37. The company has a quick ratio of 0.57, a current ratio of 0.84 and a debt-to-equity ratio of 5.15. The firm has a market capitalization of $14.73 billion, a PE ratio of 18.47, a price-to-earnings-growth ratio of 0.97 and a beta of 0.49.

Clorox Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, August 29th. Stockholders of record on Wednesday, August 13th will be issued a $1.24 dividend. This is a boost from Clorox's previous quarterly dividend of $1.22. The ex-dividend date of this dividend is Wednesday, August 13th. This represents a $4.96 annualized dividend and a dividend yield of 4.1%. Clorox's dividend payout ratio (DPR) is presently 76.07%.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently modified their holdings of CLX. Rockefeller Capital Management L.P. boosted its holdings in shares of Clorox by 5.6% in the 4th quarter. Rockefeller Capital Management L.P. now owns 16,003 shares of the company's stock valued at $2,599,000 after buying an additional 847 shares during the period. CreativeOne Wealth LLC boosted its holdings in shares of Clorox by 78.3% in the 4th quarter. CreativeOne Wealth LLC now owns 2,332 shares of the company's stock valued at $379,000 after buying an additional 1,024 shares during the period. United Capital Financial Advisors LLC boosted its holdings in shares of Clorox by 20.7% in the 4th quarter. United Capital Financial Advisors LLC now owns 3,449 shares of the company's stock valued at $560,000 after buying an additional 591 shares during the period. NewEdge Advisors LLC boosted its holdings in shares of Clorox by 1.0% in the 4th quarter. NewEdge Advisors LLC now owns 13,447 shares of the company's stock valued at $2,184,000 after buying an additional 131 shares during the period. Finally, CANADA LIFE ASSURANCE Co boosted its holdings in shares of Clorox by 6.2% in the 4th quarter. CANADA LIFE ASSURANCE Co now owns 155,886 shares of the company's stock valued at $25,317,000 after buying an additional 9,141 shares during the period. 78.53% of the stock is owned by institutional investors and hedge funds.

About Clorox

(

Get Free Report)

The Clorox Company manufactures and markets consumer and professional products worldwide. It operates through four segments: Health and Wellness, Household, Lifestyle, and International. The Health and Wellness segment offers cleaning products, such as laundry additives and home care products primarily under the Clorox, Clorox2, Scentiva, Pine-Sol, Liquid-Plumr, Tilex, and Formula 409 brands; professional cleaning and disinfecting products under the CloroxPro and Clorox Healthcare brands; professional food service products under the Hidden Valley brand; and vitamins, minerals and supplement products under the RenewLife, Natural Vitality, NeoCell, and Rainbow Light brands in the United States.

See Also

Before you consider Clorox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clorox wasn't on the list.

While Clorox currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.