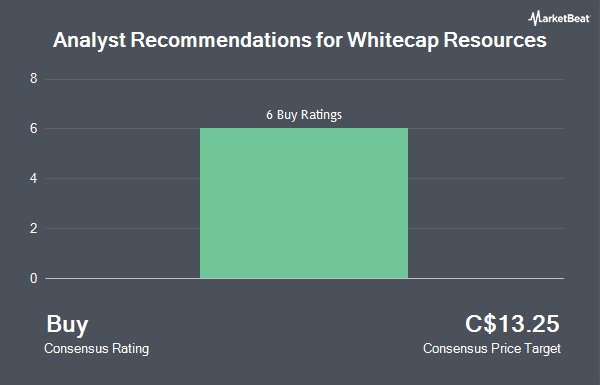

Whitecap Resources Inc. (TSE:WCP - Get Free Report) has earned an average rating of "Buy" from the seven brokerages that are presently covering the firm, Marketbeat reports. Six investment analysts have rated the stock with a buy recommendation and one has issued a strong buy recommendation on the company. The average 1-year target price among brokers that have issued a report on the stock in the last year is C$12.88.

WCP has been the subject of several research analyst reports. Desjardins cut their price objective on Whitecap Resources from C$12.00 to C$11.50 and set a "buy" rating for the company in a report on Tuesday, April 15th. Scotiabank raised Whitecap Resources from a "sector perform" rating to an "outperform" rating and set a C$12.00 target price for the company in a report on Thursday, May 22nd. National Bankshares upped their target price on Whitecap Resources from C$14.50 to C$15.00 and gave the company an "outperform" rating in a report on Thursday, May 22nd. National Bank Financial raised Whitecap Resources to a "strong-buy" rating in a report on Monday, May 12th. Finally, CIBC reduced their target price on Whitecap Resources from C$14.50 to C$13.00 in a report on Thursday, April 10th.

View Our Latest Research Report on Whitecap Resources

Whitecap Resources Stock Performance

WCP stock traded up C$0.01 during trading on Friday, reaching C$8.76. 5,614,502 shares of the company's stock were exchanged, compared to its average volume of 5,852,663. The company has a quick ratio of 0.67, a current ratio of 0.88 and a debt-to-equity ratio of 21.58. Whitecap Resources has a 1-year low of C$6.87 and a 1-year high of C$11.31. The company's fifty day moving average price is C$8.31 and its 200-day moving average price is C$9.32. The firm has a market cap of C$5.11 billion, a PE ratio of 5.91, a P/E/G ratio of -0.33 and a beta of 2.67.

Whitecap Resources Announces Dividend

The company also recently announced a apr 25 dividend, which was paid on Thursday, May 15th. Stockholders of record on Thursday, May 15th were given a dividend of $0.0608 per share. The ex-dividend date was Wednesday, April 30th. This represents a dividend yield of 8.97%. Whitecap Resources's payout ratio is currently 49.25%.

Insiders Place Their Bets

In other Whitecap Resources news, Director Grant Bradley Fagerheim purchased 5,000 shares of the company's stock in a transaction dated Friday, April 4th. The shares were bought at an average price of C$7.60 per share, with a total value of C$38,000.00. Also, Director Bradley John Wall acquired 11,500 shares of the business's stock in a transaction dated Thursday, May 29th. The shares were acquired at an average price of C$8.77 per share, for a total transaction of C$100,855.00. In the last three months, insiders bought 143,120 shares of company stock valued at $1,205,866. 0.84% of the stock is currently owned by insiders.

About Whitecap Resources

(

Get Free ReportWhitecap Resources Inc is engaged in the business of acquiring, developing, and holding interests in petroleum and natural gas properties and assets. The company acquires assets with discovered petroleum initially in place and low current recovery factors. Light oil is the primary byproduct of Whitecap's Canadian assets.

Further Reading

Before you consider Whitecap Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Whitecap Resources wasn't on the list.

While Whitecap Resources currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.