Whitecap Resources (TSE:WCP - Get Free Report) was upgraded by analysts at Raymond James Financial from a "moderate buy" rating to a "strong-buy" rating in a research report issued on Thursday, Marketbeat.com reports. The firm currently has a C$13.00 price target on the stock, up from their previous price target of C$12.00. Raymond James Financial's price target indicates a potential upside of 39.63% from the company's previous close.

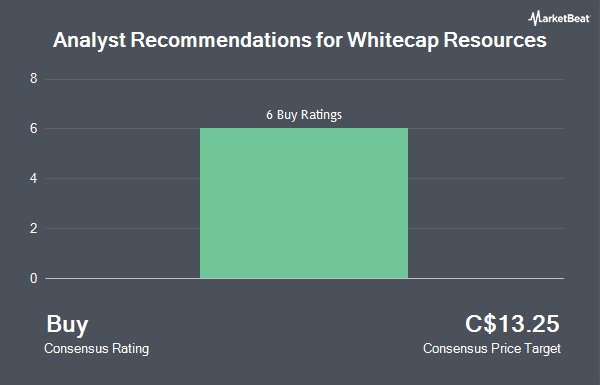

Several other research firms have also recently issued reports on WCP. Desjardins cut shares of Whitecap Resources from a "moderate buy" rating to a "hold" rating in a research note on Tuesday, June 3rd. National Bankshares raised their price target on Whitecap Resources from C$14.50 to C$15.00 and gave the stock an "outperform" rating in a research note on Thursday, May 22nd. Scotiabank upgraded Whitecap Resources from a "sector perform" rating to an "outperform" rating and set a C$12.00 price objective for the company in a research report on Thursday, May 22nd. CIBC lowered their target price on Whitecap Resources from C$14.50 to C$13.00 in a report on Thursday, April 10th. Finally, National Bank Financial raised Whitecap Resources to a "strong-buy" rating in a research report on Monday, May 12th. One analyst has rated the stock with a hold rating, four have issued a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Buy" and a consensus target price of C$13.00.

Check Out Our Latest Report on Whitecap Resources

Whitecap Resources Stock Up 0.8%

Shares of TSE:WCP traded up C$0.07 on Thursday, hitting C$9.31. 2,643,969 shares of the company traded hands, compared to its average volume of 6,117,182. The stock has a 50 day simple moving average of C$8.73 and a 200-day simple moving average of C$9.13. The company has a quick ratio of 0.67, a current ratio of 0.88 and a debt-to-equity ratio of 21.58. The company has a market cap of C$5.44 billion, a PE ratio of 6.28, a PEG ratio of -0.33 and a beta of 2.67. Whitecap Resources has a 52 week low of C$6.87 and a 52 week high of C$11.31.

Insider Transactions at Whitecap Resources

In other news, Director Bradley John Wall bought 11,500 shares of Whitecap Resources stock in a transaction that occurred on Thursday, May 29th. The stock was bought at an average cost of C$8.77 per share, with a total value of C$100,855.00. Also, Director Grant Bradley Fagerheim bought 15,000 shares of the firm's stock in a transaction on Friday, May 9th. The shares were purchased at an average price of C$8.06 per share, for a total transaction of C$120,900.00. Insiders have purchased 65,000 shares of company stock valued at $529,430 over the last quarter. 0.84% of the stock is currently owned by company insiders.

About Whitecap Resources

(

Get Free Report)

Whitecap Resources Inc is engaged in the business of acquiring, developing, and holding interests in petroleum and natural gas properties and assets. The company acquires assets with discovered petroleum initially in place and low current recovery factors. Light oil is the primary byproduct of Whitecap's Canadian assets.

Recommended Stories

Before you consider Whitecap Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Whitecap Resources wasn't on the list.

While Whitecap Resources currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.