Sweetgreen, Inc. (NYSE:SG - Free Report) - Stock analysts at William Blair cut their FY2025 earnings per share estimates for Sweetgreen in a report released on Monday, October 20th. William Blair analyst S. Zackfia now forecasts that the company will earn ($0.76) per share for the year, down from their previous estimate of ($0.75). William Blair currently has a "Outperform" rating on the stock. The consensus estimate for Sweetgreen's current full-year earnings is ($0.74) per share. William Blair also issued estimates for Sweetgreen's Q4 2025 earnings at ($0.22) EPS, FY2026 earnings at ($0.85) EPS and FY2027 earnings at ($0.88) EPS.

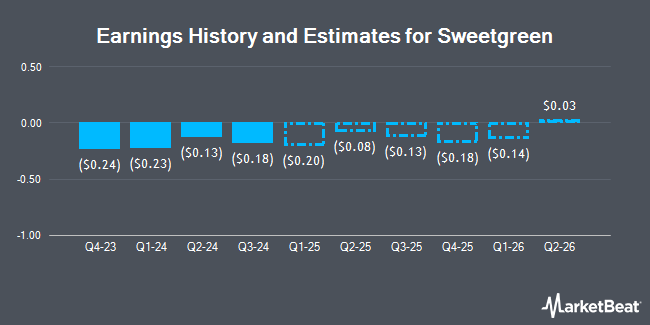

Sweetgreen (NYSE:SG - Get Free Report) last posted its earnings results on Thursday, August 7th. The company reported ($0.20) EPS for the quarter, missing the consensus estimate of ($0.12) by ($0.08). The company had revenue of $185.58 million for the quarter, compared to the consensus estimate of $193.47 million. Sweetgreen had a negative net margin of 14.29% and a negative return on equity of 22.21%. The firm's revenue for the quarter was up .5% compared to the same quarter last year. During the same period last year, the company posted ($0.13) earnings per share. Sweetgreen has set its FY 2025 guidance at EPS.

SG has been the subject of several other reports. Piper Sandler lowered their target price on Sweetgreen from $20.00 to $12.00 and set a "neutral" rating for the company in a report on Friday, August 8th. JPMorgan Chase & Co. lowered their target price on Sweetgreen from $20.00 to $16.00 and set a "neutral" rating for the company in a report on Wednesday, June 25th. TD Cowen reduced their price objective on Sweetgreen from $15.00 to $10.00 and set a "hold" rating for the company in a research report on Friday, August 8th. Wells Fargo & Company reduced their price objective on Sweetgreen from $19.00 to $13.00 and set an "overweight" rating for the company in a research report on Thursday, October 16th. Finally, Zacks Research downgraded Sweetgreen from a "hold" rating to a "strong sell" rating in a research report on Tuesday, October 14th. Six analysts have rated the stock with a Buy rating, nine have given a Hold rating and two have given a Sell rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $15.73.

Check Out Our Latest Research Report on SG

Sweetgreen Trading Up 9.3%

NYSE:SG opened at $8.12 on Wednesday. The firm has a market capitalization of $960.22 million, a PE ratio of -9.67 and a beta of 1.97. The stock has a 50 day moving average of $8.48 and a 200-day moving average of $12.84. Sweetgreen has a 52 week low of $7.23 and a 52 week high of $45.12.

Institutional Investors Weigh In On Sweetgreen

A number of institutional investors have recently added to or reduced their stakes in SG. Oppenheimer Asset Management Inc. lifted its position in Sweetgreen by 51.1% in the first quarter. Oppenheimer Asset Management Inc. now owns 38,826 shares of the company's stock worth $971,000 after purchasing an additional 13,130 shares during the period. Oppenheimer & Co. Inc. lifted its position in Sweetgreen by 81.8% in the first quarter. Oppenheimer & Co. Inc. now owns 48,070 shares of the company's stock worth $1,203,000 after purchasing an additional 21,625 shares during the period. Spire Wealth Management lifted its position in Sweetgreen by 47.1% in the first quarter. Spire Wealth Management now owns 1,983 shares of the company's stock worth $50,000 after purchasing an additional 635 shares during the period. Bessemer Group Inc. lifted its position in Sweetgreen by 19,183.8% in the first quarter. Bessemer Group Inc. now owns 20,248 shares of the company's stock worth $507,000 after purchasing an additional 20,143 shares during the period. Finally, Sequoia Financial Advisors LLC lifted its position in Sweetgreen by 50.8% in the first quarter. Sequoia Financial Advisors LLC now owns 13,280 shares of the company's stock worth $332,000 after purchasing an additional 4,474 shares during the period. 95.75% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In other news, CFO Mitch Reback sold 11,530 shares of the business's stock in a transaction that occurred on Monday, August 18th. The stock was sold at an average price of $9.19, for a total transaction of $105,960.70. Following the completion of the transaction, the chief financial officer directly owned 322,891 shares in the company, valued at approximately $2,967,368.29. The trade was a 3.45% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Corporate insiders own 19.78% of the company's stock.

Sweetgreen Company Profile

(

Get Free Report)

Sweetgreen, Inc, together with its subsidiaries, operates fast food restaurants serving healthy foods at scale in the United States. The company also accepts orders through its online and mobile ordering platforms, as well as sells gift cards that do not have an expiration date and can be redeemed. The company was founded in 2006 and is headquartered in Los Angeles, California.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sweetgreen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sweetgreen wasn't on the list.

While Sweetgreen currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.