NeoGenomics (NASDAQ:NEO - Get Free Report)'s stock had its "market perform" rating restated by equities researchers at William Blair in a note issued to investors on Tuesday.

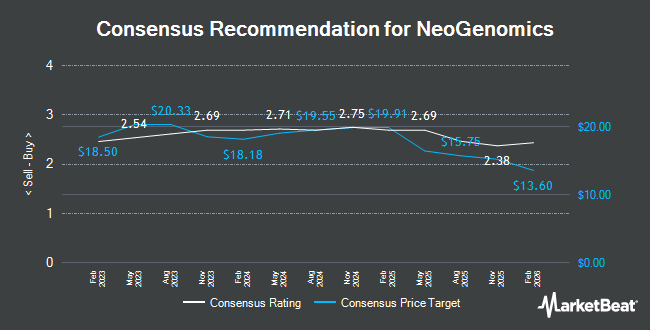

A number of other research firms have also recently issued reports on NEO. Morgan Stanley decreased their price target on shares of NeoGenomics from $17.00 to $10.00 and set an "equal weight" rating for the company in a report on Thursday, May 1st. Piper Sandler set a $12.00 price target on shares of NeoGenomics and gave the stock an "overweight" rating in a research report on Tuesday, May 6th. Wall Street Zen upgraded shares of NeoGenomics from a "sell" rating to a "hold" rating in a report on Tuesday, May 13th. Needham & Company LLC cut their target price on shares of NeoGenomics from $18.00 to $8.50 and set a "buy" rating on the stock in a research note on Tuesday, April 29th. Finally, The Goldman Sachs Group lowered their price target on shares of NeoGenomics from $15.00 to $10.00 and set a "buy" rating for the company in a report on Wednesday, April 30th. Eight investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat.com, NeoGenomics presently has an average rating of "Hold" and a consensus price target of $13.83.

Read Our Latest Stock Analysis on NeoGenomics

NeoGenomics Stock Down 20.8%

NEO traded down $1.34 on Tuesday, hitting $5.12. The company had a trading volume of 7,856,188 shares, compared to its average volume of 1,837,027. The stock has a fifty day simple moving average of $7.18 and a 200-day simple moving average of $9.48. NeoGenomics has a 52-week low of $4.80 and a 52-week high of $19.11. The firm has a market capitalization of $658.43 million, a P/E ratio of -8.24 and a beta of 1.63. The company has a debt-to-equity ratio of 0.38, a current ratio of 2.05 and a quick ratio of 1.95.

NeoGenomics (NASDAQ:NEO - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The medical research company reported ($0.06) EPS for the quarter, missing the consensus estimate of $0.03 by ($0.09). NeoGenomics had a negative net margin of 11.54% and a negative return on equity of 2.21%. As a group, equities analysts expect that NeoGenomics will post -0.2 EPS for the current fiscal year.

Insider Activity at NeoGenomics

In other NeoGenomics news, Director Lynn A. Tetrault purchased 7,000 shares of NeoGenomics stock in a transaction dated Friday, May 9th. The shares were acquired at an average cost of $8.14 per share, with a total value of $56,980.00. Following the completion of the transaction, the director owned 7,000 shares in the company, valued at approximately $56,980. This trade represents a ∞ increase in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, Director Stephen M. Kanovsky purchased 4,000 shares of the firm's stock in a transaction that occurred on Wednesday, May 7th. The stock was bought at an average cost of $7.78 per share, for a total transaction of $31,120.00. Following the completion of the purchase, the director directly owned 40,090 shares in the company, valued at $311,900.20. This represents a 11.08% increase in their position. The disclosure for this purchase can be found here. Insiders have bought 70,600 shares of company stock valued at $550,438 over the last 90 days. Insiders own 2.40% of the company's stock.

Institutional Investors Weigh In On NeoGenomics

A number of institutional investors and hedge funds have recently bought and sold shares of NEO. Vanguard Group Inc. boosted its position in NeoGenomics by 1.4% during the fourth quarter. Vanguard Group Inc. now owns 14,239,887 shares of the medical research company's stock worth $234,673,000 after acquiring an additional 195,793 shares during the last quarter. First Light Asset Management LLC increased its stake in NeoGenomics by 90.8% during the 1st quarter. First Light Asset Management LLC now owns 6,042,822 shares of the medical research company's stock worth $57,346,000 after buying an additional 2,875,237 shares during the period. Greenhouse Funds LLLP grew its holdings in NeoGenomics by 5.3% during the 4th quarter. Greenhouse Funds LLLP now owns 4,701,897 shares of the medical research company's stock worth $77,487,000 after acquiring an additional 237,491 shares in the last quarter. Dimensional Fund Advisors LP grew its holdings in NeoGenomics by 2.3% during the 4th quarter. Dimensional Fund Advisors LP now owns 3,436,858 shares of the medical research company's stock worth $56,645,000 after acquiring an additional 78,211 shares in the last quarter. Finally, American Century Companies Inc. grew its holdings in NeoGenomics by 14.7% during the 1st quarter. American Century Companies Inc. now owns 3,319,602 shares of the medical research company's stock worth $31,503,000 after acquiring an additional 426,341 shares in the last quarter. 98.50% of the stock is owned by hedge funds and other institutional investors.

About NeoGenomics

(

Get Free Report)

NeoGenomics, Inc operates a network of cancer-focused testing laboratories in the United States and the United Kingdom. It operates through Clinical Services and Advanced Diagnostics segments. The company offers testing services to hospitals, academic centers, pathologists, oncologists, clinicians, pharmaceutical companies, and clinical laboratories.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NeoGenomics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NeoGenomics wasn't on the list.

While NeoGenomics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.