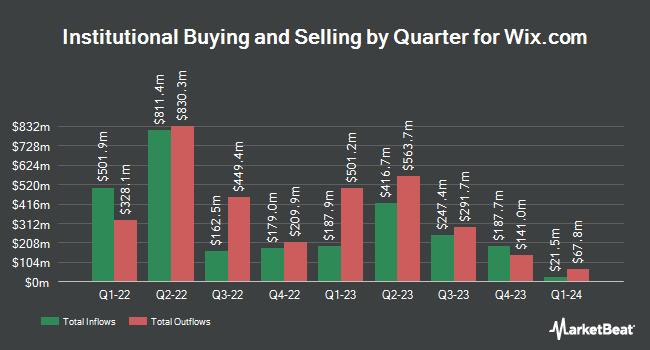

Tudor Investment Corp ET AL reduced its holdings in Wix.com Ltd. (NASDAQ:WIX - Free Report) by 87.1% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 10,015 shares of the information services provider's stock after selling 67,790 shares during the quarter. Tudor Investment Corp ET AL's holdings in Wix.com were worth $2,149,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also added to or reduced their stakes in WIX. Flagship Harbor Advisors LLC acquired a new stake in Wix.com during the 4th quarter worth about $256,000. Bank of New York Mellon Corp raised its holdings in shares of Wix.com by 9.7% during the fourth quarter. Bank of New York Mellon Corp now owns 124,622 shares of the information services provider's stock valued at $26,738,000 after acquiring an additional 11,048 shares during the period. Sumitomo Mitsui Trust Group Inc. lifted its position in shares of Wix.com by 5.3% in the 4th quarter. Sumitomo Mitsui Trust Group Inc. now owns 105,353 shares of the information services provider's stock valued at $22,603,000 after acquiring an additional 5,286 shares in the last quarter. Ameritas Advisory Services LLC acquired a new position in Wix.com in the 4th quarter worth approximately $321,000. Finally, Harbor Capital Advisors Inc. raised its stake in Wix.com by 159.7% during the 4th quarter. Harbor Capital Advisors Inc. now owns 22,596 shares of the information services provider's stock valued at $4,848,000 after purchasing an additional 13,894 shares during the period. 81.52% of the stock is owned by institutional investors and hedge funds.

Wix.com Stock Performance

Shares of NASDAQ:WIX opened at $166.83 on Friday. Wix.com Ltd. has a 52-week low of $118.61 and a 52-week high of $247.11. The company has a market cap of $9.36 billion, a P/E ratio of 70.99, a P/E/G ratio of 2.83 and a beta of 1.56. The stock's 50-day moving average is $169.00 and its 200-day moving average is $196.20.

Wix.com declared that its Board of Directors has approved a share repurchase program on Thursday, February 27th that allows the company to buyback $200.00 million in shares. This buyback authorization allows the information services provider to repurchase up to 1.8% of its stock through open market purchases. Stock buyback programs are usually an indication that the company's leadership believes its shares are undervalued.

Analyst Upgrades and Downgrades

A number of research analysts have recently weighed in on the company. JPMorgan Chase & Co. lowered their price target on Wix.com from $205.00 to $189.00 and set a "neutral" rating on the stock in a report on Wednesday, February 19th. JMP Securities reiterated a "market outperform" rating and issued a $240.00 target price on shares of Wix.com in a report on Tuesday, February 18th. StockNews.com raised shares of Wix.com from a "buy" rating to a "strong-buy" rating in a research report on Thursday, April 3rd. Needham & Company LLC reiterated a "buy" rating and issued a $235.00 price objective on shares of Wix.com in a research note on Wednesday, February 19th. Finally, Oppenheimer cut their target price on shares of Wix.com from $250.00 to $220.00 and set an "outperform" rating for the company in a research report on Wednesday. Five investment analysts have rated the stock with a hold rating, fifteen have issued a buy rating and three have issued a strong buy rating to the company's stock. According to data from MarketBeat, Wix.com presently has an average rating of "Moderate Buy" and an average price target of $237.74.

View Our Latest Research Report on WIX

Wix.com Profile

(

Free Report)

Wix.com Ltd., together with its subsidiaries, operates as a cloud-based web development platform for registered users and creators worldwide. The company offers Wix Editor, a drag-and-drop visual development and website editing environment platform; and Wix ADI that enables users to have the freedom of customization that the classic editor offers.

Read More

Want to see what other hedge funds are holding WIX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Wix.com Ltd. (NASDAQ:WIX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Wix.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wix.com wasn't on the list.

While Wix.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.