Wolfe Research lowered shares of Blueprint Medicines (NASDAQ:BPMC - Free Report) from a strong-buy rating to a hold rating in a report issued on Tuesday, MarketBeat reports.

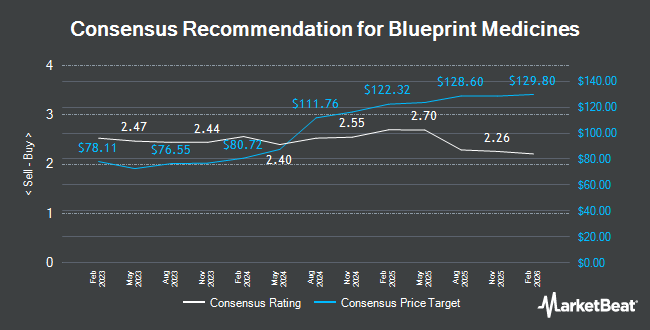

A number of other research firms have also weighed in on BPMC. Needham & Company LLC lowered shares of Blueprint Medicines from a "buy" rating to a "hold" rating and set a $130.00 price objective on the stock. in a research note on Monday. JMP Securities reiterated a "market outperform" rating and issued a $125.00 price objective on shares of Blueprint Medicines in a research note on Friday, February 14th. Scotiabank lowered shares of Blueprint Medicines from a "strong-buy" rating to a "sector perform" rating and set a $135.00 price objective on the stock. in a research note on Monday. HC Wainwright reiterated a "buy" rating and issued a $135.00 price objective on shares of Blueprint Medicines in a research note on Friday, May 2nd. Finally, JPMorgan Chase & Co. reiterated a "neutral" rating and issued a $129.00 price objective (down previously from $130.00) on shares of Blueprint Medicines in a research note on Monday. Seventeen investment analysts have rated the stock with a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $129.35.

Check Out Our Latest Research Report on Blueprint Medicines

Blueprint Medicines Stock Performance

Blueprint Medicines stock traded down $0.05 during mid-day trading on Tuesday, reaching $127.85. 3,067,543 shares of the company traded hands, compared to its average volume of 1,110,342. The company has a debt-to-equity ratio of 1.15, a current ratio of 2.85 and a quick ratio of 2.80. Blueprint Medicines has a fifty-two week low of $73.04 and a fifty-two week high of $128.24. The company has a market capitalization of $8.26 billion, a price-to-earnings ratio of -118.38 and a beta of 0.83. The firm's fifty day moving average is $95.59 and its two-hundred day moving average is $95.88.

Blueprint Medicines (NASDAQ:BPMC - Get Free Report) last issued its quarterly earnings results on Thursday, May 1st. The biotechnology company reported ($0.74) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.42) by ($0.32). Blueprint Medicines had a negative net margin of 13.19% and a negative return on equity of 77.49%. The company had revenue of $149.41 million for the quarter, compared to analyst estimates of $158.31 million. During the same quarter in the previous year, the company posted $1.40 EPS. The company's revenue for the quarter was up 55.5% compared to the same quarter last year. On average, equities research analysts expect that Blueprint Medicines will post -1.28 earnings per share for the current fiscal year.

Insider Buying and Selling at Blueprint Medicines

In other Blueprint Medicines news, insider Ariel Hurley sold 2,752 shares of the stock in a transaction on Monday, May 5th. The shares were sold at an average price of $103.13, for a total transaction of $283,813.76. Following the transaction, the insider now directly owns 16,944 shares of the company's stock, valued at $1,747,434.72. This trade represents a 13.97% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, COO Christina Rossi sold 2,274 shares of the stock in a transaction dated Monday, March 24th. The shares were sold at an average price of $95.02, for a total transaction of $216,075.48. Following the completion of the sale, the chief operating officer now owns 69,266 shares of the company's stock, valued at $6,581,655.32. This trade represents a 3.18% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 14,574 shares of company stock valued at $1,465,528 over the last ninety days. Corporate insiders own 4.21% of the company's stock.

Institutional Investors Weigh In On Blueprint Medicines

A number of hedge funds have recently modified their holdings of BPMC. Avoro Capital Advisors LLC acquired a new stake in shares of Blueprint Medicines in the fourth quarter valued at about $103,356,000. Siren L.L.C. acquired a new stake in shares of Blueprint Medicines in the first quarter valued at about $64,273,000. Norges Bank acquired a new stake in shares of Blueprint Medicines in the fourth quarter valued at about $62,028,000. T. Rowe Price Investment Management Inc. raised its position in shares of Blueprint Medicines by 86.9% in the first quarter. T. Rowe Price Investment Management Inc. now owns 1,302,810 shares of the biotechnology company's stock valued at $115,312,000 after buying an additional 605,783 shares during the last quarter. Finally, Braidwell LP acquired a new stake in shares of Blueprint Medicines in the first quarter valued at about $38,942,000.

About Blueprint Medicines

(

Get Free Report)

Blueprint Medicines Corporation, a precision therapy company, develops medicines for genomically defined cancers and blood disorders in the United States and internationally. The company is developing AYVAKIT for the treatment of systemic mastocytosis (SM) and gastrointestinal stromal tumors; BLU-263, an orally available, potent, and KIT inhibitor for the treatment of indolent SM, and other mast cell disorders.

Recommended Stories

Before you consider Blueprint Medicines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blueprint Medicines wasn't on the list.

While Blueprint Medicines currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.