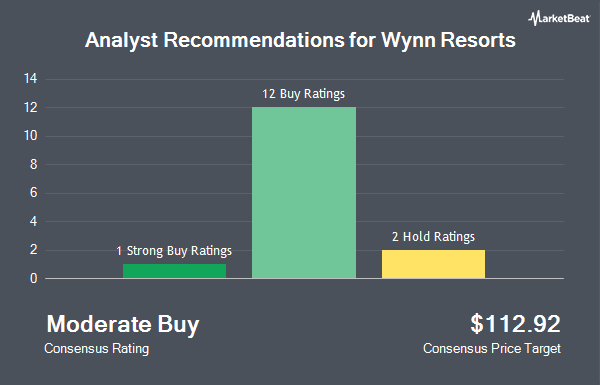

Shares of Wynn Resorts, Limited (NASDAQ:WYNN - Get Free Report) have been assigned a consensus recommendation of "Moderate Buy" from the fifteen analysts that are currently covering the firm, MarketBeat Ratings reports. One research analyst has rated the stock with a hold recommendation and fourteen have assigned a buy recommendation to the company. The average 1-year price target among brokers that have issued a report on the stock in the last year is $125.4667.

WYNN has been the subject of a number of analyst reports. Macquarie raised their target price on shares of Wynn Resorts from $110.00 to $124.00 and gave the company an "outperform" rating in a research report on Friday, August 8th. JPMorgan Chase & Co. initiated coverage on shares of Wynn Resorts in a research report on Monday, June 23rd. They issued an "overweight" rating and a $109.00 target price for the company. Barclays raised their target price on shares of Wynn Resorts from $101.00 to $127.00 and gave the company an "overweight" rating in a research report on Friday, July 18th. Morgan Stanley increased their price target on shares of Wynn Resorts from $113.00 to $128.00 and gave the company an "overweight" rating in a research note on Thursday, September 11th. Finally, UBS Group upgraded shares of Wynn Resorts from a "neutral" rating to a "buy" rating and increased their price target for the company from $101.00 to $147.00 in a research note on Thursday, August 28th.

Read Our Latest Analysis on Wynn Resorts

Wynn Resorts Stock Performance

Wynn Resorts stock traded up $5.40 during mid-day trading on Friday, reaching $128.68. The company's stock had a trading volume of 1,952,259 shares, compared to its average volume of 1,866,411. The company has a market capitalization of $13.38 billion, a price-to-earnings ratio of 38.64, a price-to-earnings-growth ratio of 6.34 and a beta of 1.37. Wynn Resorts has a 12 month low of $65.25 and a 12 month high of $129.01. The business's 50 day simple moving average is $114.73 and its 200 day simple moving average is $96.32.

Wynn Resorts (NASDAQ:WYNN - Get Free Report) last released its earnings results on Thursday, August 7th. The casino operator reported $1.09 earnings per share for the quarter, missing analysts' consensus estimates of $1.20 by ($0.11). The business had revenue of $1.74 billion during the quarter, compared to the consensus estimate of $1.74 billion. Wynn Resorts had a net margin of 5.51% and a negative return on equity of 56.78%. The firm's revenue for the quarter was up .6% on a year-over-year basis. During the same period last year, the business posted $1.12 EPS. As a group, sell-side analysts expect that Wynn Resorts will post 5.17 EPS for the current year.

Wynn Resorts Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, August 29th. Shareholders of record on Monday, August 18th were paid a $0.25 dividend. The ex-dividend date was Monday, August 18th. This represents a $1.00 dividend on an annualized basis and a yield of 0.8%. Wynn Resorts's dividend payout ratio (DPR) is currently 30.03%.

Insider Buying and Selling

In other Wynn Resorts news, Director Patricia Mulroy sold 4,438 shares of the stock in a transaction on Tuesday, September 2nd. The shares were sold at an average price of $125.00, for a total value of $554,750.00. Following the completion of the sale, the director owned 3,066 shares in the company, valued at $383,250. This trade represents a 59.14% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. 0.52% of the stock is currently owned by corporate insiders.

Institutional Trading of Wynn Resorts

A number of hedge funds have recently modified their holdings of the stock. Thrivent Financial for Lutherans lifted its stake in shares of Wynn Resorts by 6,391.3% during the 2nd quarter. Thrivent Financial for Lutherans now owns 748,769 shares of the casino operator's stock worth $70,138,000 after buying an additional 737,234 shares during the last quarter. Hudson Bay Capital Management LP lifted its stake in shares of Wynn Resorts by 1,848.5% during the 2nd quarter. Hudson Bay Capital Management LP now owns 83,982 shares of the casino operator's stock worth $7,867,000 after buying an additional 79,672 shares during the last quarter. Nomura Holdings Inc. lifted its stake in shares of Wynn Resorts by 2.6% during the 2nd quarter. Nomura Holdings Inc. now owns 15,811 shares of the casino operator's stock worth $1,481,000 after buying an additional 395 shares during the last quarter. Hollencrest Capital Management lifted its stake in shares of Wynn Resorts by 18.3% during the 2nd quarter. Hollencrest Capital Management now owns 1,537 shares of the casino operator's stock worth $144,000 after buying an additional 238 shares during the last quarter. Finally, Public Sector Pension Investment Board lifted its stake in shares of Wynn Resorts by 55.5% during the 2nd quarter. Public Sector Pension Investment Board now owns 18,157 shares of the casino operator's stock worth $1,701,000 after buying an additional 6,481 shares during the last quarter. Institutional investors and hedge funds own 88.64% of the company's stock.

Wynn Resorts Company Profile

(

Get Free Report)

Wynn Resorts, Limited designs, develops, and operates integrated resorts. The company operates through four segments: Wynn Palace, Wynn Macau, Las Vegas Operations, and Encore Boston Harbor. The Wynn Palace segment operates private gaming salons and sky casinos; a luxury hotel tower with suites, and villas, including a health club, spa, salon, and pool; food and beverage outlets; retail space; meeting and convention space; and performance lake and floral art displays.

Further Reading

Before you consider Wynn Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wynn Resorts wasn't on the list.

While Wynn Resorts currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.