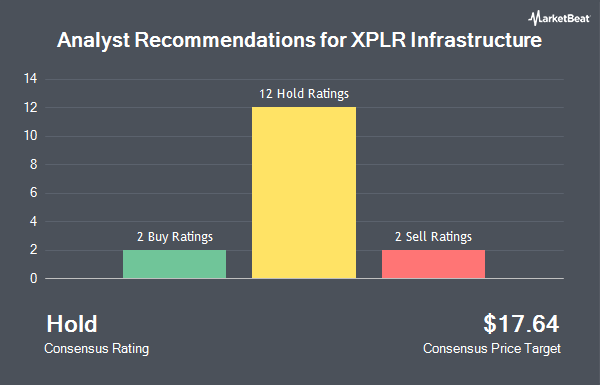

Shares of XPLR Infrastructure, LP (NYSE:XIFR - Get Free Report) have been assigned a consensus recommendation of "Hold" from the thirteen brokerages that are presently covering the company, Marketbeat reports. Two investment analysts have rated the stock with a sell recommendation, nine have assigned a hold recommendation and two have assigned a buy recommendation to the company. The average 1 year target price among brokerages that have updated their coverage on the stock in the last year is $16.9231.

Several research firms have recently issued reports on XIFR. Barclays upped their price target on XPLR Infrastructure from $9.00 to $11.00 and gave the stock an "underweight" rating in a research note on Tuesday, August 12th. Jefferies Financial Group upped their price target on XPLR Infrastructure from $13.00 to $16.00 and gave the stock a "buy" rating in a research note on Wednesday, July 9th. Mizuho decreased their price target on XPLR Infrastructure from $15.00 to $12.00 and set a "neutral" rating for the company in a research note on Monday, May 12th. Finally, Wall Street Zen cut XPLR Infrastructure from a "hold" rating to a "sell" rating in a research report on Saturday, August 16th.

Check Out Our Latest Analysis on XIFR

Hedge Funds Weigh In On XPLR Infrastructure

Several large investors have recently made changes to their positions in XIFR. Steward Partners Investment Advisory LLC acquired a new position in shares of XPLR Infrastructure during the 2nd quarter worth about $25,000. JPMorgan Chase & Co. acquired a new position in shares of XPLR Infrastructure during the 2nd quarter worth about $55,000. CANADA LIFE ASSURANCE Co acquired a new position in shares of XPLR Infrastructure during the 2nd quarter worth about $77,000. MAI Capital Management acquired a new position in shares of XPLR Infrastructure during the 2nd quarter worth about $94,000. Finally, Headlands Technologies LLC acquired a new position in shares of XPLR Infrastructure during the 2nd quarter worth about $111,000. Institutional investors and hedge funds own 66.01% of the company's stock.

XPLR Infrastructure Stock Up 3.6%

Shares of XIFR traded up $0.37 during trading hours on Tuesday, hitting $10.57. 1,009,972 shares of the company were exchanged, compared to its average volume of 1,246,596. The company has a market cap of $993.26 million, a PE ratio of -6.15 and a beta of 0.86. The firm's 50 day moving average is $9.34 and its 200-day moving average is $9.00. XPLR Infrastructure has a 52 week low of $7.53 and a 52 week high of $28.25. The company has a debt-to-equity ratio of 0.50, a quick ratio of 0.72 and a current ratio of 0.77.

XPLR Infrastructure (NYSE:XIFR - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The solar energy provider reported $0.84 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.20 by $0.64. The company had revenue of $342.00 million during the quarter, compared to the consensus estimate of $359.64 million. XPLR Infrastructure had a positive return on equity of 1.86% and a negative net margin of 12.94%.The company's revenue for the quarter was down 5.0% on a year-over-year basis. On average, equities research analysts forecast that XPLR Infrastructure will post 2.33 EPS for the current fiscal year.

About XPLR Infrastructure

(

Get Free Report)

XPLR Infrastructure LP engages in the acquisition, management, and ownership of contracted clean energy projects with long-term cash flows. It owns interests in wind and solar projects in North America and natural gas infrastructure assets in Texas. The company was founded on March 6, 2014 and is headquartered in Juno Beach, FL.

Featured Stories

Before you consider XPLR Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and XPLR Infrastructure wasn't on the list.

While XPLR Infrastructure currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.