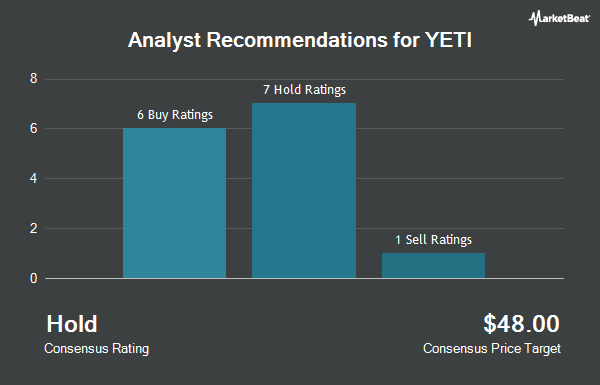

YETI Holdings, Inc. (NYSE:YETI - Get Free Report) has earned a consensus recommendation of "Hold" from the fifteen brokerages that are currently covering the stock, MarketBeat.com reports. Ten analysts have rated the stock with a hold recommendation and five have assigned a buy recommendation to the company. The average 1-year target price among analysts that have covered the stock in the last year is $39.4667.

Several equities analysts recently commented on the company. Morgan Stanley raised their target price on YETI from $33.00 to $34.00 and gave the stock an "equal weight" rating in a research report on Friday, May 9th. KeyCorp raised YETI from an "underweight" rating to a "sector weight" rating in a report on Thursday, April 17th. Jefferies Financial Group reaffirmed a "buy" rating and set a $55.00 price target on shares of YETI in a report on Monday, May 5th. Robert W. Baird dropped their price target on YETI from $50.00 to $40.00 and set an "outperform" rating for the company in a report on Friday, April 11th. Finally, Stifel Nicolaus dropped their price target on YETI from $40.00 to $34.00 and set a "hold" rating for the company in a report on Thursday, April 10th.

View Our Latest Stock Report on YETI

YETI Stock Performance

YETI traded up $0.08 during midday trading on Monday, reaching $37.10. The company's stock had a trading volume of 1,721,566 shares, compared to its average volume of 2,463,419. The stock has a market cap of $3.07 billion, a P/E ratio of 15.96, a PEG ratio of 3.19 and a beta of 1.84. The company has a fifty day simple moving average of $32.84 and a 200 day simple moving average of $32.97. The company has a current ratio of 2.58, a quick ratio of 1.47 and a debt-to-equity ratio of 0.09. YETI has a twelve month low of $26.61 and a twelve month high of $45.25.

YETI (NYSE:YETI - Get Free Report) last announced its quarterly earnings data on Thursday, May 8th. The company reported $0.31 EPS for the quarter, topping analysts' consensus estimates of $0.27 by $0.04. YETI had a return on equity of 26.48% and a net margin of 9.59%. The company had revenue of $351.13 million during the quarter, compared to the consensus estimate of $347.72 million. During the same quarter last year, the company earned $0.34 EPS. The company's quarterly revenue was up 2.8% on a year-over-year basis. Research analysts expect that YETI will post 2.57 earnings per share for the current year.

Institutional Trading of YETI

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. LPL Financial LLC raised its position in YETI by 29.8% in the fourth quarter. LPL Financial LLC now owns 35,425 shares of the company's stock valued at $1,364,000 after purchasing an additional 8,141 shares during the period. JPMorgan Chase & Co. boosted its position in shares of YETI by 30.3% in the 4th quarter. JPMorgan Chase & Co. now owns 569,184 shares of the company's stock valued at $21,919,000 after purchasing an additional 132,374 shares during the period. Norges Bank acquired a new stake in shares of YETI in the 4th quarter valued at about $36,778,000. Pictet Asset Management Holding SA raised its stake in YETI by 16.5% during the 4th quarter. Pictet Asset Management Holding SA now owns 12,740 shares of the company's stock valued at $491,000 after acquiring an additional 1,801 shares during the last quarter. Finally, Franklin Resources Inc. raised its stake in shares of YETI by 81.9% during the 4th quarter. Franklin Resources Inc. now owns 27,760 shares of the company's stock worth $1,069,000 after buying an additional 12,498 shares in the last quarter.

YETI Company Profile

(

Get Free Report)

YETI Holdings, Inc designs, retails, and distributes products for the outdoor and recreation market under the YETI brand. It offers coolers and equipment, including hard and soft coolers, cargo, bags, outdoor living, and associated accessories, as well as backpacks, duffel bags, luggage, packing cubes, carryalls, camp chairs, blankets, dog beds, dog bowls, and gear cases under the LoadOut, Panga, Crossroads, Camino, Hondo Base, Trailhead, Lowlands, Boomer, and SideKick Dry brands.

See Also

Before you consider YETI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and YETI wasn't on the list.

While YETI currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.