Yum! Brands (NYSE:YUM - Get Free Report) will likely be issuing its Q2 2025 quarterly earnings data before the market opens on Tuesday, August 5th. Analysts expect the company to announce earnings of $1.45 per share and revenue of $1.94 billion for the quarter.

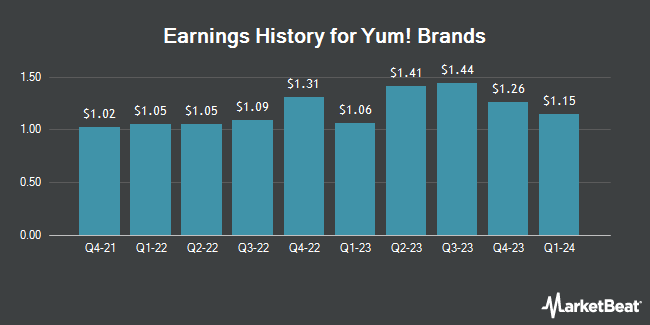

Yum! Brands (NYSE:YUM - Get Free Report) last issued its quarterly earnings data on Wednesday, April 30th. The restaurant operator reported $1.30 EPS for the quarter, beating the consensus estimate of $1.29 by $0.01. Yum! Brands had a negative return on equity of 20.80% and a net margin of 18.42%. The company had revenue of $1.79 billion for the quarter, compared to analyst estimates of $1.85 billion. During the same period last year, the company earned $1.15 earnings per share. Yum! Brands's quarterly revenue was up 11.8% compared to the same quarter last year. On average, analysts expect Yum! Brands to post $6 EPS for the current fiscal year and $7 EPS for the next fiscal year.

Yum! Brands Trading Up 1.3%

YUM traded up $1.89 during trading on Wednesday, hitting $147.07. The company's stock had a trading volume of 1,643,813 shares, compared to its average volume of 1,577,187. Yum! Brands has a twelve month low of $122.13 and a twelve month high of $163.30. The business's fifty day simple moving average is $145.68 and its 200 day simple moving average is $145.98. The firm has a market capitalization of $40.88 billion, a price-to-earnings ratio of 29.30, a P/E/G ratio of 2.11 and a beta of 0.74.

Yum! Brands Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, June 6th. Stockholders of record on Tuesday, May 27th were given a $0.71 dividend. The ex-dividend date of this dividend was Tuesday, May 27th. This represents a $2.84 annualized dividend and a dividend yield of 1.93%. Yum! Brands's dividend payout ratio (DPR) is presently 56.57%.

Wall Street Analyst Weigh In

Several research firms have recently weighed in on YUM. Redburn Atlantic upgraded Yum! Brands from a "neutral" rating to a "buy" rating and raised their target price for the company from $145.00 to $177.00 in a research report on Tuesday, June 10th. Citigroup lifted their price objective on Yum! Brands from $148.00 to $151.00 and gave the stock a "neutral" rating in a research report on Tuesday, April 15th. JPMorgan Chase & Co. upgraded Yum! Brands from a "neutral" rating to an "overweight" rating and reduced their target price for the company from $170.00 to $162.00 in a research report on Wednesday, June 25th. The Goldman Sachs Group raised Yum! Brands from a "neutral" rating to a "buy" rating and set a $167.00 price objective for the company in a research report on Wednesday, June 4th. Finally, Morgan Stanley raised their price objective on Yum! Brands from $151.00 to $153.00 and gave the stock an "equal weight" rating in a research report on Monday, July 14th. Thirteen research analysts have rated the stock with a hold rating and ten have given a buy rating to the company. According to MarketBeat, Yum! Brands presently has a consensus rating of "Hold" and an average target price of $159.86.

Get Our Latest Research Report on YUM

Insider Activity at Yum! Brands

In related news, CEO Scott Mezvinsky sold 272 shares of Yum! Brands stock in a transaction that occurred on Tuesday, July 1st. The stock was sold at an average price of $148.28, for a total value of $40,332.16. Following the sale, the chief executive officer directly owned 1,755 shares in the company, valued at $260,231.40. The trade was a 13.42% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, CEO David W. Gibbs sold 7,117 shares of the stock in a transaction on Tuesday, July 15th. The stock was sold at an average price of $146.60, for a total value of $1,043,352.20. Following the completion of the transaction, the chief executive officer owned 102,893 shares of the company's stock, valued at $15,084,113.80. The trade was a 6.47% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 14,720 shares of company stock worth $2,150,965 over the last quarter. Company insiders own 0.33% of the company's stock.

Institutional Inflows and Outflows

An institutional investor recently raised its position in Yum! Brands stock. Brighton Jones LLC boosted its holdings in Yum! Brands, Inc. (NYSE:YUM - Free Report) by 8.0% in the 4th quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 7,861 shares of the restaurant operator's stock after acquiring an additional 583 shares during the quarter. Brighton Jones LLC's holdings in Yum! Brands were worth $1,055,000 as of its most recent filing with the SEC. Hedge funds and other institutional investors own 82.37% of the company's stock.

Yum! Brands Company Profile

(

Get Free Report)

Yum! Brands, Inc, together with its subsidiaries, develops, operates, and franchises quick service restaurants worldwide. The company operates through the KFC Division, the Taco Bell Division, the Pizza Hut Division, and the Habit Burger Grill Division segments. It also operates restaurants under the KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill brands, which specialize in chicken, pizza, made-to-order chargrilled burgers, sandwiches, Mexican-style food categories, and other food products.

Read More

Before you consider Yum! Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yum! Brands wasn't on the list.

While Yum! Brands currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.