Whether you’re new to or are experienced with stock options trading, you’ll always be exposed to the Greeks on any stock that has options contracts in any stock sector. We're not referring to the people, fraternities, or sororities, but the options Greek symbols that accompany every option contract with their respective values.

Whenever you pull up a price quote on a stock option, most platforms will also provide you with the Greeks, which are financial metrics that impact the pricing of options. There are five Greeks, which are the Delta, Theta, Gamma, Vega, and Rho. We’ll review each one and explain how they can affect an option’s price. Keep in mind that the Greeks are all theoretical, not factual. Think more in terms of "should," "would," and "could" rather than "will" and "does." For example, a call option with a 40 Delta implies the call option should move 40 cents higher if the underlying stock rises $1. Let’s start with Delta.

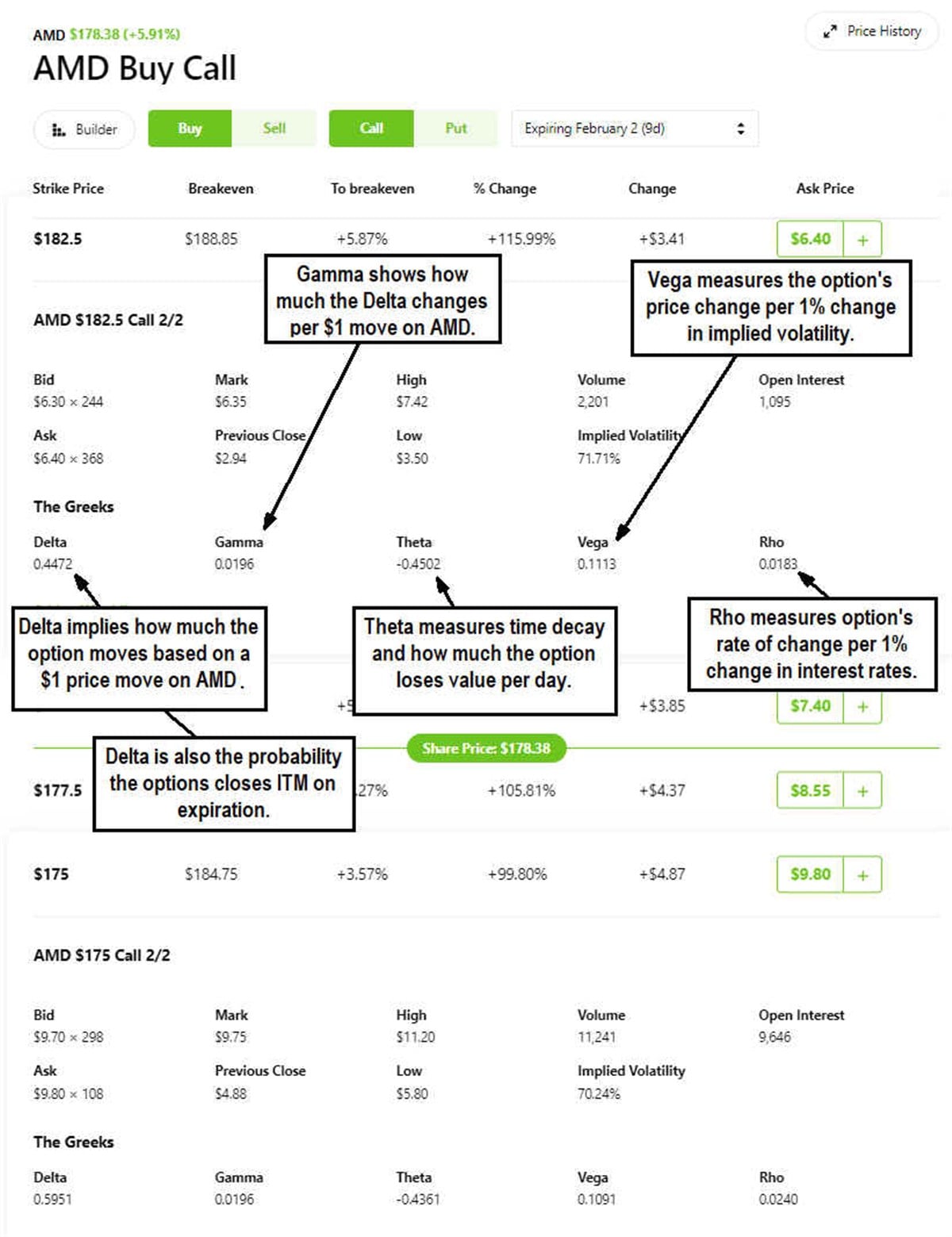

Delta

The Delta implies how much an option's price can move per every $1 price move of the underlying stock. It's represented as a positive number between 0.00 and 1.00 for a call option. A put option is represented as a negative number between 0.00 and -1.00, as it has a negative correlation. For example, if a call option on XYZ stock has a 0.35 Delta, then it “should” rise in price by 35 cents for each $1 that XYZ rises. A put option with a -0.25 Delta should fall 25 cents in value for every $1 that XYZ stock drops.

Delta is considered the most important Greek to focus on. A larger Delta value results in a larger price move in the option relative to the underlying stock price. In-the-money options (ITM) will have a larger Delta value that gets closer to 1.00 as it gets deeper into ITM as the expiration date nears. Options that are out-of-the-money (OTM) have smaller price moves as the price gets further away. OTM options drop closer to -1.00 as its expiration date nears. Delta can also be used to calculate the probability that the option will expire ITM. Delta can also be used as a gauge of how the number of shares of the underlying stock will move based on the option.

Theta

Theta represents how much the option's value drops each day as it gets closer to its expiration, the time decay. When you hold long option positions, whether it's calls or puts, the clock is ticking. Every day the option gets closer to its expiration, it loses value. The closer the expiration date approaches, the faster the erosion occurs, meaning the theta rises in value.

For example, if you have an OTM option with a theta of -0.06, this means the value of the option drops 6 cents each day. Theta is also premium or extrinsic value tacked on to the price of an option. Incidentally, options that are far OTM actually have theta decrease as they get closer to expiration, whereas at-the-money (ATM) and ITM options generally experience an acceleration, or rising theta, in price erosion as the expiration nears. The further out the expiration date is, the lower the Theta value will be initially.

Gamma

Gamma measures the rate of change for the Delta. It’s gauged from 0.00 to 1.00. This can start getting confusing. Delta is how much the option’s price will move relative to a $1 price move in the underlying stock. Gamma is how much the Delta will move based on the $1 price move in the underlying stock. For example, if a call option on XYZ has a 0.50 Delta and XYZ rises $1, then the call option should rise 50 cents in value. If the Gamma is 0.10, then the new Delta should rise to 0.60. Remember, everything is dynamic as the underlying price changes.

ATM options then have higher Gamma as they get closer to expiration. Gamma values fall as an option goes further ITM, and Delta gets closer to 1.00 as expiration nears. Gamma values rise as the option goes further OTM as Delta nears -1.00 as expiration approaches.

Vega

Vega measures how much an option’s price should change when the underlying stock’s volatility changes. It can be used to gauge an option’s sensitivity to volatility. Vega is the rate of change for an option’s price per 1% change in the implied volatility of its underlying stock. When Vega rises, then both calls and puts tend to rise in value. When Vega falls, then both calls and puts also tend to fall in value. It’s advantageous to buy options when the Vega is low and sell when the Vega is high. Vega is an important metric for volatility trades.

Rho

Rho is the expected rate of change in an option's price per 1% change in interest rates. If interest rates rise, then call options tend to rise in value, while put options tend to fall in value. If interest rates fall, then call options tend to fall in value and put options tend to rise in value. Rho has negative correlations between calls and put options. High interest rates tend to widen the gap between call and put prices and vice versa on low-interest rates. The Rho is not very significant for retail options traders since internet rates don’t move in 100 bps increments. They are gradually raised or cut. Rho may have some relevance if you’re trading Long-Term Equity Anticipation Securities (LEAP) options, which are options with expirations longer than a year away.

Which Greeks to prioritize based on the options strategy.

While it’s useful to use all the Greeks with your options trades, certain Greeks should be the focus for specific types of options trades. The Greeks to prioritize depends on what type of options strategy you're trying to execute.

For directional trades like buying or selling puts, your key Greek will be focusing on the Delta. This relies on the underlying stock price movement, so it pays to do your technical analysis ahead of time to identify chart patterns.

If you’re selling covered calls, selling puts, or playing debit spreads, you can look at the Theta as the daily income you are making as time decays by that amount daily.

If you are playing an options straddle strategy because you believe a stock will make a large move, then Vega will be your key Greek.

For short-term trades with options nearing expiration, it’s important to focus on Gamma. Gamma determines how quickly the Delta is changing. Seasoned traders can perform gamma scalping. We’ll cover this in a future article.

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report