Advanced Micro Devices NASDAQ: AMD shares rallied into the company’s first-quarter earnings release on April 27. The chipmaker then reported outstanding numbers:

- Revenue went up 93% yoy to $3.45 billion, beating consensus estimates of $3.21 billion.

- Adjusted earnings were 52 cents a share, comparing favorably to expectations of 44 cents a share and the 14 cents a share reported a year ago.

- AMD increased its second-quarter guidance, and now expects revenue of $3.5 billion to $3.7 billion. Wall Street had been expecting revenue of $3.29 billion.

- AMD also increased its full-year guidance, forecasting revenue to increase 50% yoy to $14.64 billion for full-year 2021 – that was well above consensus estimates of $13.54 billion.

There weren’t really any bones to pick with the release, and shares opened 4.3% higher on April 28. But AMD stock quickly turned lower, closing the session 1.4% lower. In the nine sessions since then, shares have dipped another 8.8%.

This looks like a classic case of “buy the rumor, sell the news.”

But the sell-off has gone too far, presenting investors with an excellent buying opportunity.

AMD Holds a Big Lead Over Intel

Intel NASDAQ: INTC made headlines back in March when it announced plans to increase its manufacturing capacity, with an eye on pushing up the release of its 7-nanometer processors. The company had previously disappointed investors by saying that the processors wouldn’t hit the market until late 2022 at the earliest.

AMD has taken advantage of Intel’s incompetence, growing its lead in the CPU market.

On the first-quarter earnings call, AMD CEO Lisa Su said, ““Ryzen Mobile 5000 Series processor revenue has ramped twice as fast as the prior generation. We expect continued growth in 2021 as the number of notebook platforms powered by our new processors is on track to increase by 50% compared to our prior generation.”

AMD is in much better shape than Intel, but the stock trades at a significant premium.

AMD is trading at 36.3x forward earnings, and Intel is trading at 11.8x forward earnings. Intel is actually a solid investment; if the company can get its act together, shares would have plenty of room to run. But it’s not like Intel shares should be trading at 20x forward earnings.

The AMD valuation is reasonable, but a significant percentage of AMD’s projected cash flows are far into the future. Which could be why shares have been pulling back. You see, interest rates are rising and could continue to rise. A stock is worth the present value of its future cash flows, and that present value is lower if it is discounted with a higher interest rate.

The concern is somewhat justifiable, but we’re not talking about a company that is losing money and doesn’t expect to turn a nice profit until 2027. AMD is going to generate a lot of net income over the first half of the 2020s.

How Should You Play AMD?

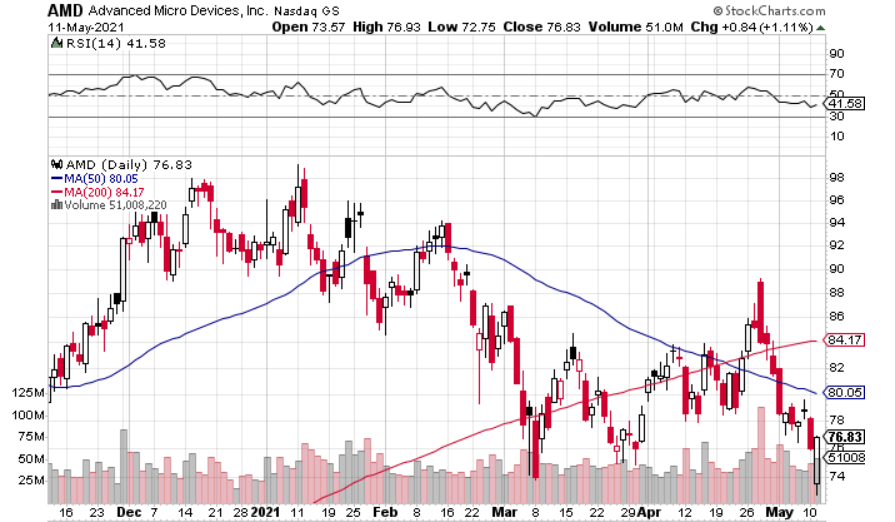

AMD is an excellent long-term risk-reward in the mid-$70s. And, as it turns out, the chart is giving investors the green light.

In January, AMD was pushing $100 a share, before dropping to the mid-$70s in March. A March rally petered out and shares returned to that mid-$70s range, where they again got support. The next rally lost steam when the first quarter earnings were released, as mentioned earlier.

The post-earnings dip has again taken shares down to the mid-$70s. In yesterday’s session, shares dipped all the way down to $72.75 before closing at $76.83. The closing price was just shy of the day’s highs and volume was on the higher-end – two bullish signs.

There is a good chance that AMD will head back towards $90 a share in the short-term. Combine that with the long-term upside, and getting into AMD today starts to makes a lot of sense.

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.