Automotive Stocks are issued by companies that design, manufacture, and distribute automobiles. From four-door sedans to semi-trailer trucks, these companies help the people of the world move from point A to point B.

Top Auto Companies in the World

Some of these automotive companies have been around for more than a century, and others showed up on Wall Street less than a decade ago. While the Dow Jones specifically does not track transportation (car companies are not listed here), they do appear on the Fortune 500 and boast large market capitalization.

The companies of the auto industry are poised at an interesting crossroads and have the firepower read: money to handle it well. That said, these industry frontrunners are great stock picks for investors looking to reap the rewards of actualized earnings estimates through a generous dividend yield.

Automotive Industry

The auto industry is relatively recent, though many of the biggest auto makers are as old (or nearly as old) as the auto industry itself. The auto industry has its roots in steam-powered vehicles, such as trains, which started during the Industrial Revolution, and for several decades afterward, the only self-propelling cars were steam-powered.

Auto makers began to play around with internal combustion from 1800 onward, and the first auto maker to create a truly practical vehicle powered by internal combustion was Karl Benz. This is the man behind the name that would later become Mercedes-Benz. As the 19th century turned into the 20th, the main self-powering vehicle on the road was the high-wheel motor buggy, whose hegemony of the road would eventually be replaced by Model T produced by the Ford Motor Company.

During the earliest decades of the 20th century, consumers were still using horse-powered buggies, trains, and trolleys to get around. While some of the earliest American car companies opened up shop at this time, such as General Motors, Ford Motor, and Chrysler (today Fiat Chrysler after a 2014 merger with an Italian company), car ownership was still somewhat of a luxury. Not every family had a car, let alone the two or more that have become common features of suburban life today.

Then, the end of WWII fueled American mass production and the subsequent availability of consumer goods, like cars and suburban housing, to a large population of veterans returning home. This is when the car industry really took off. America developed an entire culture around cars, from drive-in movie theatres to diners where waitresses on roller skates would bring customers their meals.

Today, there is less of a cultural component to car ownership, but it is still widely regarded as an indispensable lifestyle component. Consumer tastes have shifted away from trucks and SUVs in favor of more economic models, such as electric or hybrid. Part of this shift was spurred by a series of oil shortages, increasing discussion about the end of fossil fuels, and economic downturns that have prevented consumers from purchasing bigger vehicles. As a result, the shift has severely crippled industry names like Fiat Chrysler Automobiles. Moreover, many automotive news pundits have pointed out that the number of cars produced worldwide is declining. This decline coincides with an increasing trend in ridesharing, carsharing, public transit, and increased urbanization.

The auto industry is poised at an interesting crossroads. Not only will the gasoline-powered model of the auto industry need to be reconsidered, but ideas about car ownership are changing as well. Even so, the giants of the auto industry are positioned to deal with the changes, such as creating new generations of vehicle types like Ford, and dabbling in carsharing software like GM. All of this bodes well for investors in the stock market, who can benefit from these exciting times as the auto industry enters a new phase in its existence. They can do so by piggybacking off the biggest publicly-traded names on Wall Street.

Top Auto Companies in the World

Tesla NASDAQ: TSLA

Tesla NASDAQ: TSLA specializes in manufacturing electric cars like their Model S sedan, Roadster sports car, and futuristic Cyber Truck, whose somewhat controversial form was unveiled at Tesla Design Studios in Los Angeles in 2019. Tesla was founded in 2003 but has only had cars on the market for around a decade.

Though Tesla has never had a profitable year, the number of Teslas on the road continues to grow; in the 2017-2018 calendar year, US sales grew by a whopping 280% and global sales by 138%. To give you some sense of those numbers, 2017 saw around 48,000 Teslas on American roads—by 2018 there were more than 180,000. Tesla’s business strategy is and has been about targeting higher-end consumers first, before expanding into larger markets with lower pricing points.

Toyota NYSE: TM

Toyota NYSE: TM is headquartered in Tokyo, Japan, and claims the number 10 spot on the list of the world’s largest companies in terms of revenue. Toyota is also the world’s second-largest car manufacturer, behind the German Volkswagen. Over the last eight years, Toyota has produced 10 million vehicles per year, and it was the first to do so since 2012.

The AA Sedan of 1936 was its first passenger car, and today Toyota manufactures vehicles under five brand names: Daihatsu, Ranz, Hino, Toyota, and Lexus. The first three are sold primarily in Japan, and the last two are common vehicles in the United States. In fact, the top 2 most popular cars on the road as of 2019 were the Toyota Camry (81,684) and the Toyota Corolla (78,608). Toyota also owns sizable stakes in Mazda and Subaru. The Toyota Prius is the top-selling hybrid globally, and Toyota is the world sales leader of hybrid electric vehicles.

Ford NYSE: F

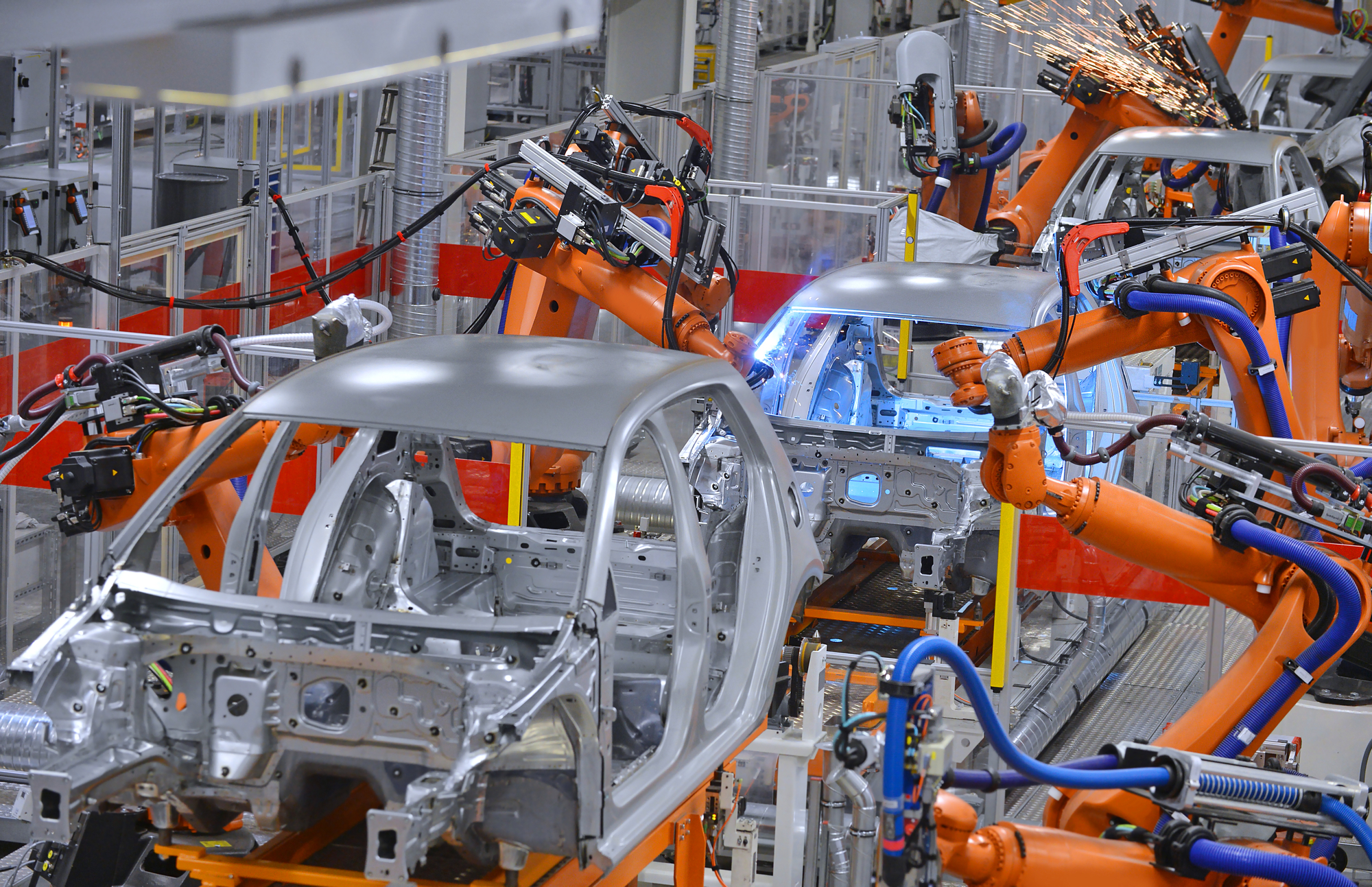

Ford NYSE: F is a Detroit-based car manufacturer. Though Ford is not the oldest car company in America, it is one of the oldest and has been in business since 1901. In those early years, Ford cars were hand-assembled by small groups of workers. But in the years that followed, Ford led the way in refining the assembly line process, becoming the first mass producer of an automobile: the Model T. Over the next century Ford expanded its offerings, making vehicles to appeal to a wide range of consumers: From the sporty Mustang to the luxury Lincoln to the F-series trucks.

As the 21st century came to an end, Ford’s economic performance suffered from rising fuel prices, a declining economy, and rising healthcare costs for an aging workforce. This resulted in lower sales and a tarnished reputation. But in recent years, Ford has seen a revitalization and rebuilding of their brand name with a shift toward smaller, electric cars. This is in stark contrast to its previous focus of large SUVs and trucks. Ford has also shed some of its offerings, selling Jaguar and Land Rover to the Indian car company Tata Motors.

General Motors NYSE: GM

GM or General Motors NYSE: GM is another Detroit-based car manufacturer. It also has deep roots in American history, founded just a few years after Ford in 1908 by William C. Durant. Today General Motors is the largest automaker in America, and one of the largest globally. From 1931 to 2007, GM was the global leader in vehicle sales, a distinction it held for more than seven decades. The four core brands of GM are Chevrolet, Buick, GMC, and Cadillac. In addition, GM has sizable stakes in other car companies from around the world and frequently participates in joint ventures with them.

GM has responded to shifts in the automobile market by dabbling in new technology through its car-sharing service, Maven. GM also has a defense division that focuses on hydrogen fuel cell power. Like most American auto makers, GM was affected by the economic crisis of 2008, but emerged from bankruptcy by shedding some of its brands and returning to profitability.

Volkswagen FWB: VOW

Volkswagen FWB: VOW, popularly known as VW, is the flagship brand of the Volkswagen Group, the largest automaker in the world. It also has around 40% of its sales in China. In addition to its namesake marquee, Audi, Bentley, Porsche, Lamborghini, and Bugatti are just a few of its recognizable brands.

The inception of Volkswagen lends it a small degree of notoriety since it was started in Nazi-era Germany to create an economy car called The Beetle, which remains one of its most iconic models. After the war, VW struggled to regain its market share, but with help from the British and American governments, it was able to regain power and become a cultural and economic symbol of postwar German regeneration. VW also increased its global market share by diversifying from economy models like its Beetle into sportier models through mergers and acquisitions. Today VW is at the vanguard of electric car making and boasts global profits of almost $280 billion.

BMW FWB: BMW

BMW FWB: BMW or Bavarian Motor Works is another German car manufacturer, albeit from 1916. BMW manufactured aircraft engines during the last years of the First World War and then again in the Second World War. BMW cars today are associated with an upper-class lifestyle and drivers who appreciate quality mechanics and craftsmanship.

Although it is only the twelfth largest car maker in the world, BMW revenues surpassed $107 billion in 2018. It is a recognized name that is associated with excellent car making, as are its British subsidiaries Mini and Rolls Royce. The architecture of BMW’s Munich headquarters, made to look like a four-cylinder engine and declared a historic European building, is remarkable. BMW has often paired up with world-famous artists like Andy Warhol to create collector vehicles. The design of their logo incorporates the blue and white checkers of the Bavarian flag which is the German state which BMW calls home.

Honda NYSE: HMC

Honda NYSE: HMC is one of the most trusted brand names among American drivers and produces some of the most popular cars on the road such as the Honda Civic, Accord, and CRV. This Japanese company is also the world’s largest producer of motorcycles, having produced a lifetime total of 400 million at the end of 2019. With its manufacture of 14 million internal combustion engines, Honda is also the world’s biggest producer of such engines.

Honda started out making auto parts for Toyota and then during WWII switched to manufacturing airplane propellers. After the war, they began to build motorcycles, then started making four-wheel vehicles in 1963 with the T360 Truck. Over the next few decades, Honda branched out into other types of auto sales and became the first Japanese car company to develop a luxury brand with a separate identity: Acura. Today Honda makes cars, engines, motorcycles. It is also engaged in the research and development of robots like its ASIMO model, named after science fiction writer Isaac Asimov.

Electric Car Stocks

A few decades ago, electric car stocks would have been in the list of dollar stocks that seemed like speculative risks. Even though oil prices could lead to a global crisis and scientists were already insisting that fossil fuels only exist in a limited quantity, the idea of electric cars and hybrid cars still seemed like something of the future.

It’s always been said that necessity is the mother of invention. For decades, American car companies were a fixture in the domestic, and global, economy. But when recessions hit in 2008, car companies fell into severely difficult financial situations. Even with government bailouts and downsizing, they needed a rebirth.

Coupled to this fact was the continuing growth of awareness about the future of fuel and its cost in terms of consumer spending and political stability. Companies like Ford and GM began to look at restructuring their business model, which has since included a shift to smaller, electric cars and hybrid vehicles.

Part of the explosion of consumer interest in electric cars has been the dashing entrepreneurial spirit of exciting venture capitalists like Elon Musk, who has taken the Tesla brand and it made it one of the more intriguing and talked-about cars on the road. Venture capitalists and car makers around the world are following the lead of domestic car makers and severing the automobile from its traditional dependence on gasoline and diesel. As electric cars become more commonplace, there is no doubt that investors will reap the rewards of owning stock in these companies through generous dividends.

Automotive ETF

If the history of the automobile industry has shown us anything, it's that the success or failure of a car maker is hard to predict. Though most people today can’t think of life without a car it remains a consumer discretionary which can be affected by the market, unlike food and household goods which are consumer staples.

Stocks, in general, are hard to predict, but when industries go global and enter massive states of change, as car making is, it’s even harder to know which companies will be the biggest stock winners, and which ones will be the biggest stock losers. To that end, purchasing a share of an exchange-traded fund (ETF) might be a better way to go.

An ETF is like a mutual fund in that it’s a pooled investment vehicle, but it’s like a stock in that shares are bought and sold at market prices, rather than retail investors selecting how much money they’d like to deposit. One of the most visible automobile ETFs on the market is the First Trust Nasdaq Global Auto Index Fund ETF (appropriately abbreviated as CARZ), with more than 30 holdings which include some of the names discussed above: Honda, Ford, Toyota, GM, and VW. But with 18% of the portfolio invested in Tesla, CARZ is definitely looking toward a future of hybrid and electric cars and growth in Tesla.

Should You Invest in Automotive Stocks?

Since the economic recession of 2008, certain automotive stocks in the industry (noticeably Ford) have become some of the best cheap stocks to buy now. What’s even better is that these car companies are also poised to storm the future with a new wave of smarter vehicles. Though these companies might be involved in some internal restructuring as they emerge into new markets right now, eventually they will plateau and reallocate earnings into dividends, which bodes well for retail investors with a dividend investing strategy.

A quick look over publicly traded car companies will show you that the stock price of many such stocks is reasonably priced, but it may not be that way forever. Now is a good time to hit the gas on these stock picks, which represent the biggest names in a global industry.

Other more recent additions to the car making industry have not yet shown a profit but have shown incredible growth. As the economics of it all even out for these cutting edge businesses as well, they too will most likely enter a state of ongoing consistency and profitability. So, though automotive stocks should certainly not make up your entire stock portfolio, it would seem that now is a great time to invest in automotive stocks.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report