In our 24-7 news cycle world, it’s hard not to be a prisoner of the moment. It seems like every quarter; we hear the next “event” is the most important in history. So I won’t say that this upcoming earnings season for banks is the most important in history.

But let’s not kid ourselves; it’s still really important. Probably one of the most important since the great financial crisis back in 2008.

JPMorgan Chase & Co. NYSE: JPM CEO Jamie Dimon made it clear in the bank’s annual letter to shareholders that the banking crisis is not over. To understand why Dimon says that, you have to understand the underlying catalyst, or catalysts, that created the crisis. That means understanding the role that interest rates and inflation will continue to play.

Banks Didn’t Fight the Fed...And Still Lost

Capital goes where it’s treated best. For years, investors couldn’t get a decent return by holding cash. So money poured into the stock market. But since the pandemic, the stimulus money that entered the banking system needed a place to go. The banks simply couldn’t lend it out fast enough. So they put it in long-term bonds and U.S. Treasuries. In fact, the banking system bought $150 billion worth of U.S. Treasuries in the second quarter of 2021 alone.

Still, that worked until it didn’t. The Federal Reserve raised interest rates at the most aggressive pace in 40 years. This had two predictable consequences. First, it lowered the value of the bonds that the banks were holding. And second, once the long-term rates on Treasury bills reached approximately 5%, high net-worth depositors, who had over $250,000 in the banking system began to move their money out of banks.

That means that as long as the Federal Reserve continues to raise interest rates, banks still face the possibility that depositors will look to move their money.

Inflation Isn’t Going Away Anytime Soon

We have a bifurcated economic system, to say the least. Let me use a quick example. A six-month Treasury Bill pays approximately 4.75% at the time of this writing. That means depositors with the ability to move $1 million out of the banking system can put that in a short-term T-bill and receive a risk-free return of about $47,500 which they will likely use to put back into the economy.

The effect of inflation is too much money chasing too few goods. It doesn’t appear that individuals will stop spending on products and/or experiences. Yes, inflation is likely to continue falling from the 40-year highs it was at one year ago, but to believe it will go down to the Federal Reserve’s target rate of 2% seems unlikely anytime soon.

No Easy Solutions

The specific collapse of Silicon Valley Bank was indeed largely due to the bank’s mismanagement. But that specific example doesn’t take away from the general problem facing the banking industry.

It would help if the Federal Reserve would pause on its campaign of interest rate hikes. But that won’t necessarily stem the flight of cash from banks if depositors become concerned about a prolonged recession or stagflation.

But there is value to find in the banking sector right now. Many of the big banks, including JPMorgan Chase, Bank of America NYSE: BAC, and Wells Fargo & Co. NYSE: WFC are trading at attractive P/E ratios. And you can collect a dividend for taking on this risk.

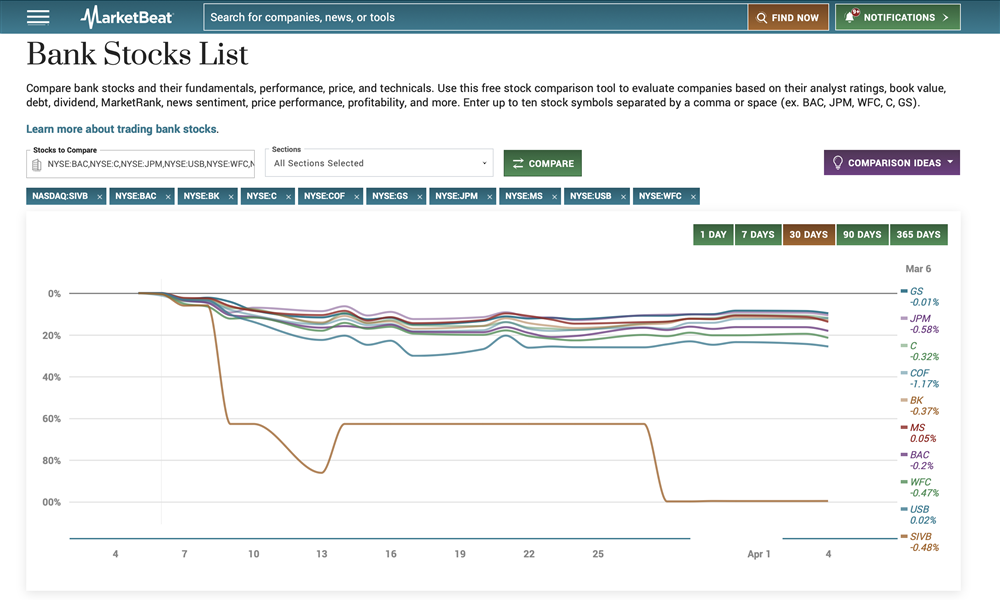

But you should still be looking for quality names. And MarketBeat makes it easy to screen bank stocks based on several key metrics. Under Stock Lists, choose Bank Stocks, enter the ticker symbols you want to look at, and then use the pull-down menus to choose the criteria that you want to screen for. The example below shows my results when I was comparing the dividend metrics for a group of bank stocks.

Before you consider JPMorgan Chase & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JPMorgan Chase & Co. wasn't on the list.

While JPMorgan Chase & Co. currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.