Stunning News, To Say The Least

Stunning News, To Say The Least

The market just received a stunning jobs report but I can’t say that I am surprised. The consensus target for this month was way too low considering the environment we are in. This is not like any ordinary recession we have ever seen. There was no collapse of business conditions, no depression set in. What we have here is a case of everyone going on vacation for a few months (euphemistically speaking) and now many are on their way back to work if not already there. The old methods of predicting labor market swings will not work, this is no natural economic recovery, and that’s why I thought the headline figure would exceed 5 million.

The Biggest Data Point Of The Month

The headline NFP figure is always the most exciting data point of the month and I have never understood why. The figure is inherently flawed and is at best a lagging indicator of the economy. The headline number is not just an estimate, its the difference of two estimates that are themselves revised not once but twice. This means the really important figure is the headline (+4.8 million in June) and the revisions (net +90,000) which bring the total number of new jobs in June just shy of 4.9 million. Not bad.

The best part is that job gains were broad. The biggest gains were in hospitality and leisure but that is to be expected, those industries were hurt the worst in terms of shut-downs and lost business. Also noted are job gains in retail trade, education and health services, other services, manufacturing, and professional and business services.

On the unemployment front, total unemployment fell 220 basis points to 11.1%. This figure is compounded by a large number of reentrants to the labor force (up 711,000) and a large number of temporary-layoffs who’ve been recalled to work. In total, unemployment is up 7.6% since February which at once is alarming and not as bad as it could have been. Based on the pace of reopening, even considering the slow-down of reopening plans, I expect to see these figures continue to improve over the summer.

It’s Not All Sunshine And Roses

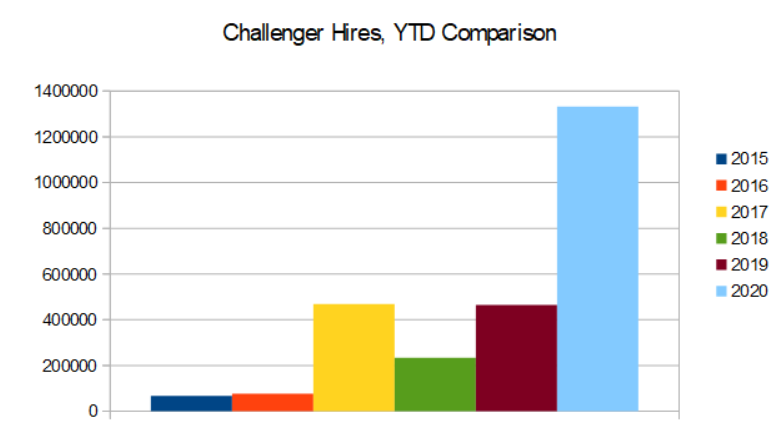

The only negative in the report is a rising number of permanent job-losers but even that is mitigated. The number of permanent job losers rose 588,000 to 2.9 million due to businesses and capacity that have been permanently lost. The mitigating factor is found in the Challenger, Gray & Christmas report on planned layoffs. The company also tracks planned hiring within the report and plans for hires are at record levels.

There 75,000 announced new jobs in June, a record high for the month, bringing the annual total to over 1.3 million. To put this in perspective 1.3 million is about 3X the previous YTD record and well above the previous all-time annual high. Bottom line, this has been the best year for hiring ever recorded

Turning to wages the average hourly wage fell sharply in June by -1.1%. At face value this is alarming, we never want to see wages in decline, but there is a caveat. Wages spiked in April when the mass layoffs began because it was mostly lower-income jobs that were lost. Now, wages are equalizing to more normalized levels near last years +3.0% YOY average. In that light, June’s decline in wages is merely data reverting to the mean. The takeaways for investors is that labor market conditions remain strong.

The Outlook Is Bullish, New Highs Are In Sight For The S&P 500

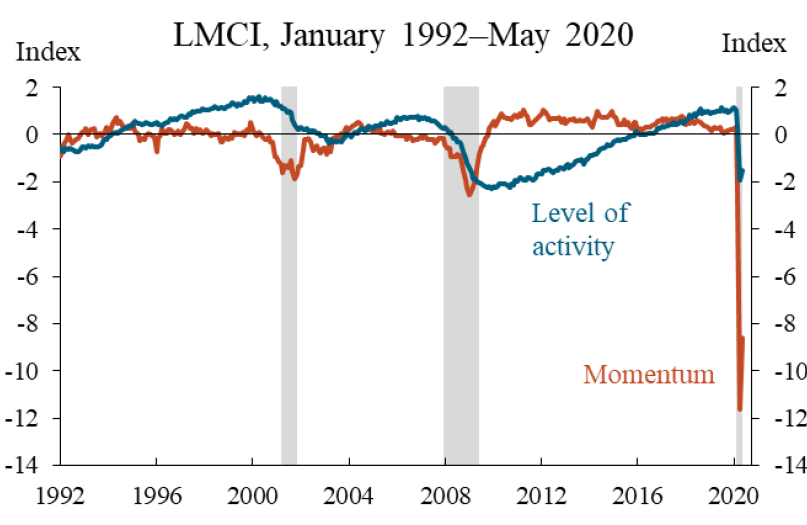

The data point no one ever talks about that I want to bring up now is the Kansas City Federal Reserve’s Labor Market Condition Index. The LMCI is a broad gauge of labor market conditions and combines data from all 24 of the labor market indicators tracked by the Fed. The reason why I find this indicator so important is because it has accurately predicted every economic boom in American since it was initiated.

The last reading was released mid-May. At that time it showed a modest uptick in activity following the April bottom that is sure to have accelerated in the time since. The signal we are looking for is when the LMCI crosses back above zero, a sign that labor market conditions have reached their pre-pandemic levels and begun to heat up. Notably, the two biggest contributors to last month’s LMIC were the unemployment rate (positive effect) and the non-farm payroll figure (negative), both of which have improved considerably from early May.

The market is understandably cheering the news. Better than expected labor market data is fuel to fire the market melt-up and help drive it back to the all-time high. Today’s action in the S&P is very bullish as it extends a bounce that confirms support at the short-term EMA, is setting a two-week high, and supported by the indicators. The indicators, MACD and stochastic, are firing simultaneous bullish-crossovers that point to a continuation of the near-term trend. With this in mind, and the possibly 2nd quarter earnings season will be much better than forecast, there is more than a possibility the S&P 500 (ARCA: SPY) will break out to new highs by the end of the summer.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.