S&P 4200 Is In Sight

The S&P 500 (SPY), arguably the best gauge of broad-market performance, has been rocketing higher over the past two months and many are still wondering why. Well, let me spell it out for you if you don’t already know. The market is in a classic melt-up. A melt-up is driven by rapidly improving market sentiment that sparks a re-valuation of equity prices. In this case, the re-valuation happened so quickly it sparked a catch-up trade that is still being fueled by FOMO. The Fear of Missing Out.

What makes this melt-up so different from previous, why new all-time highs are in sight, is that it is happening in in-line with underlying secular trends. Those trends point to years of bullish economic activity despite the pandemic and the data proves it. Last month's NFP figures are only the beginning. This week’s Retail Sales figures were not only better than expected, they were more than double the consensus showing just how resilient the American economy is.

It’s All About The Earnings

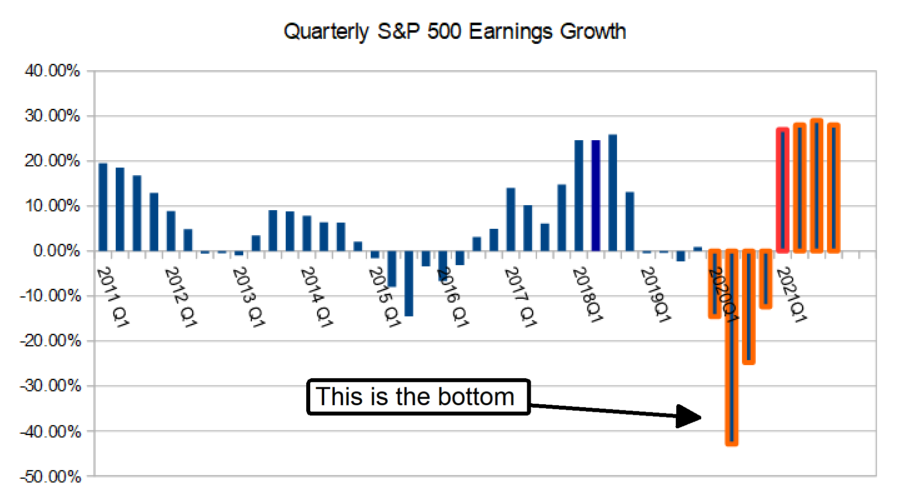

The value of the equity market is all about the earnings, I’ve said it time and time again and the market proves me right every time. While the 2nd quarter outlook for EPS is not good there are several mitigating factors that have this market set up for more gains. First, the trajectory of earnings from this quarter forward is positive. The 2nd quarters going to see S&P 500 EPS shrink roughly 50% from last year but this is the bottom. From this quarter forward, earnings will only get better.

We already know that economic recovery is underway. It began in early to mid-May and has been gaining momentum ever since. In that light, and based on the strength of eCommerce across the business universe, it is very possible EPS contraction in the 2nd quarter won’t be as bad as feared, at least not for the businesses that count. The ones that are leading the market. Regardless, this has the market set up to perform better than expected.

As I’ve mentioned, the rebound is already underway and gaining momentum. The data shows the rebound is also stronger than expected. The risk for markets now is that each and every data point from this moment forward will be the same and convert into EPS for S&P 500 companies. That has us set up for upward revisions and if there is one thing that can move a market reliably over time it is upward revisions to the EPS outlook.

Among today’s market leaders is Apple (AAPL). Apple just got another round of thumbs-up from the analyst’s community that include 2 upgrades and 4 price target hikes. The high-water market suggests about 25% upside for this stock and the sentiment is shared by most FAANG stocks. Google (GOOG) is only one not receiving analyst love at this time but that is sure to change.

The Technical Outlook Is … Stunning

The technical outlook for the SPX is stunning to say the least. If you think of the market as an elastic beast driven by sentiment, and the correction we saw last March as overshooting its mark, the SPX is set up to rocket higher.

On a purely technical basis, the correction in March resulted in a trend following bounce that we are able to make some projections from. Using the weekly charts, the rebound from March’s lows looks like a pretty strong rally with its own little correction. Assuming the correction is a consolidation and continuation pattern (the candles are bouncing nicely from the 150 day EMA) the next leg of the rally could reach as high as 3900. To get this target, subtract the March low from the June high and add it to the EMA. I used opening and closing prices, not the shadow tips, to keep my projections on the conservative side.

Because it looks like the top of a long-term secular trading range is in play, and that top may be exceeded, we can use the trading range itself as a means of projecting. The trading range is about 1000 S&P points tall, when the market breaks out of the trading range and confirms new support the next target is the top of the range plus 1000 or 4400. The caveat is that these targets aren’t going to be reached in a straight line. It’s going to take time and there will be resistance along the way.

The first major target for resistance is the top of the range. I would expect to see profit-taking when the S&P 500 reaches this point. When it happens it is going to result in a nice buying opportunity. The question will then be, how good of an opportunity will it present? If the data points to accelerating economic momentum it might not be much of an opportunity at all, more like a quick pause on the march to new highs.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.