Key Points

- The Chilean president Gabriel Boric has announced a plan to incentivize private capital investment in the country's lithium mining space, which may adversely affect some firms with exposure to Chilean mines.

- Albemarle stock has dropped by over 18% during Friday's session; however, looking at financials for 2022 and the five-year momentum buildup may suggest that the sell-off is a bit unjustified.

- Analysts are seeing a massive upside for the stock, which may not be as exposed to Chile as it may seem, with contract protection and less than half of lithium inventory coming from the country.

- Positive guidance from management and record levels of volume and capacity utilization showcase a reasonable opportunity for investors to take advantage of the dip.

- 5 stocks we like better than Albemarle

Certain mining stocks are falling after the Chilean government announced its plan to change the nation's stance toward the mining industry, rightfully worrying most investors. Chile has delivered it's long-awaited - and speculated decision on giving the state majority ownership in all new mining contracts within the country.

Chilean President Gabriel Boric stated that the decision is to raise private capital and take advantage of the opportunity that lithium presents to the country and its operators; taking control of the lithium narrative can effectively socialize the bounties of the lithium produced and exported by Chile.

Shares of Sociedad Quimica y Minera de Chile NYSE: SQM declined by as much as 18.5% during Friday's trading session following the government's announcement; the second company that operates in Chile and has outstanding active mining contracts expiring in 2030 is Albemarle NYSE: ALB whose stock also declined by more than 10% on Friday. Looking back at the latest financial results for Albemarle and the company's exposure to Chilean mining can give investors a helping hand throughout the challenging periods of unexpected third and more extensive standard deviations in the stock price decline.

Has the Business Changed?

Looking upon Albemarle's financials and the five-year record the company has posted can serve as an initial canvas upon which investors can paint the complete picture of what the news from Chile means. 2018-2022 has posted a revenue compounded average growth rate (CAGR) of 17%, with the most significant year-on-year increase being in 2022 for a massive 120% revenue.

Following revenue figures, the company enjoyed enriched margins across its income statement, aided by high capacity utilizations within the mining industry for the United States (posting an average above 90% in 2022, according to FED data) along with rallying lithium prices starting in the second half of 2020 and still sustained today.

Gross margins for Albemarle in 2018 stood at only 36%. While still signs of a healthy and thriving business, they are a shadow of 2022's gross margins of 42%. Similarly, stimulated by reductions in selling and administrative expenses as a percentage of revenues, thinner research and development budgets by the same metric, and the absence of non-recurring items such as 2021's $296 gain from a sale of a business unit, operating margins rose to 33.7% a complete 10%.

In addition, the benefits of higher efficiency and high demand for the battery metal trickled down to net margins, which were posted to be 16% higher than 2018's at 36.7%.

The company reported earnings per share of $22.84 for 2022, a magnificent achievement from 2021's $1.06 per share. However, despite a 2,052% increase in the diluted earnings per share figure, stockholders only enjoyed a 75% rally in the stock price for 2022, signaling that either some fears of a peak became present or some money was left on the table. Whichever the case may be, Albemarle investors are in for a first quarter 2023 announcement that may carry the entire momentum of 2022, as Albemarle's analyst ratings see a 68% upside from Friday's prices.

Assessing Risk

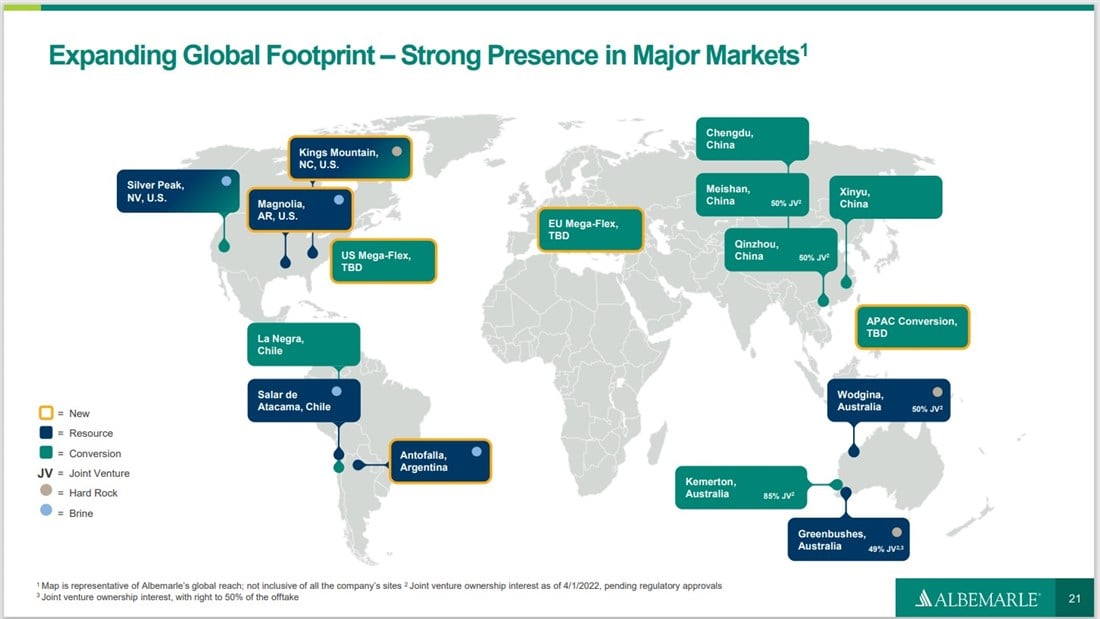

Chilean operations for Albemarle include their owned facility in La Negra, Chile, and Salar de Atacama, Chile, which are under contract to be reverted to government ownership once the company has sold all remaining contracted amounts; an end date to these facilities may come no later than 2043 if management decides to carry out the life of the agreement or decide to give up ownership earlier as the government places the option on the table. While any headlines of government intervention may seem scary and spook some market participants, Albemarle is protected by current contracts and any early talks of handing over ownership will likely be voluntary.

Now that the company is experiencing record levels of volume and demand, as measured by their inventory turnover ratios of 5.3x (historically 3.0x and below) coupled with capacity utilization rates of 124%, well above the industry average, Albemarle management may need to consider issuing more shares or even debt to finance facilities and equipment expansion to deliver on pent-up demand. Guidance for 2023 stands at 55-75% revenue growth carrying similar operating margins as 2022.

Based on the company's 10-K for 2022, capacity and volume from Chile only represents 29% of the overall Lithium operation, while the below map from their investor presentation stands to show increased diversity of resources. So perhaps analysts are within the realm of reality in supporting a brewing rally for the stock, as the scary news may soon be a thing of the past.

Before you consider Albemarle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albemarle wasn't on the list.

While Albemarle currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report