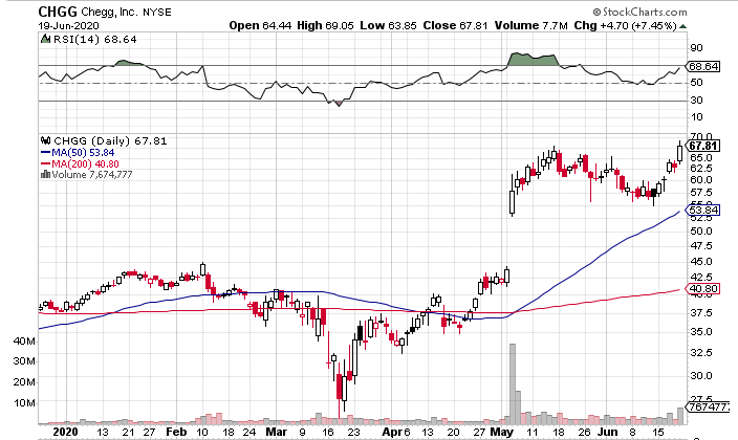

On Friday, Chegg NYSE: CHGG made yet another new high on big volume. This high came after a six-week consolidation between $55 and $65 a share, which followed a massive increase on Q1 2020 earnings.

On May 5th, Chegg increased more than 25% to new highs on massive volume, as investors loved what they saw in Q1. That breakout sent the stock above $55 per share, after shares had spent the better part of the past two years range-bound between $25 and $45.

Chegg, an education platform, has been one of the biggest winners of the coronavirus pandemic. The company should continue to thrive for as long as the pandemic lasts.

But how will it fare after things return completely back to normal? And is its high valuation of around 60x projected 2020 earnings cause for concern or justifiable?

Learn From Home

The pandemic has forced many companies to institute work from home policies. But what has gotten less press is the move to learn from home. Schools can’t just shudder their doors and hope for a vaccine, so they’ve been finding ways to continue virtually.

Chegg, with its online learning solutions, has helped universities and students more than ever during the “new-normal.” Chegg offers tutoring services, textbook rentals, and subscriptions (Study and Study Pack) that make the learning process more efficient for students.

The subscriptions, which are $14.95 and $19.95 per month, are responsible for around 75% of Chegg’s revenue. Let’s look into the subscription segment and touch on the other segments.

Offerings

As of the end of Q1, Chegg had 2.9 million subscribers, which is a 35% yoy increase. The service is seen by many as an amazing value and Chegg may be able to raise prices in the next couple of years without losing many subscribers.

As mentioned earlier, Chegg also offers tutoring services. Here, they also offer great value, as the company sources tutors from all over the word; the tutors often charge lower rates but are well-qualified. Chegg’s tutoring rates often come in at 1/3 of Wyzant’s, a major competitor that mostly uses tutors based in the US.

Chegg’s textbook rental and purchase business is another segment with good long-term potential. It has a lot of competition, particularly from Amazon NASDAQ: AMZN, but Chegg’s education specialization may give it the upper-hand long-term.

Competitors can’t match Chegg’s broad and complementary set of solutions, available for attractive prices.

Long-Term Upside

Chegg has experienced strong growth over the past few years. In Q1 2020, the company saw yoy revenue growth of 35.1%. That followed 26.6% yoy growth in Q1 2019 and 22.9% yoy growth in Q1 2018. Revenue growth is always nice to see – accelerating revenue growth lets you know you could be looking at something special.

And while Chegg currently does most of its business in the US, it looks primed for international expansion. The company’s focus on STEM and business will be extremely useful in foreign markets, as these subjects have become universally important due to globalization.

CFO Andy Brown had this to say on the Q1 earnings call:

“The first two months of the quarter started strong with subscriber growth at 33%. And the acceleration of growth since mid-March added an additional two points in the quarter, increasing growth to 35%. This continued acceleration is having a profound impact on Q2. As we now expect Q2 subscriber growth to be greater than 45%.”

So everything looks great now, but what about post-COVID?

There was already a learn-from-home trend prior to the onset of the pandemic. The virus may have just sped up the inevitable. It’s also unlikely that students and universities will discard all of this learn-from-home technology after in-person learning is possible without restrictions. What’s most likely to happen is that universities and students will selectively deploy the technology.

Look for Chegg’s already thriving business to see a sustainable boost.

Is Chegg a Buy?

The technicals look great on Chegg. The all-time high means the shares have no price resistance and the pattern of high volume increases and lighter volume consolidations is bullish.

The only reason to hesitate with Chegg is the valuation. 60x projected 2020 earnings isn’t cheap.

But Chegg has so many sources of upside. To recap:

- Subscriber growth

- Pricing power

- Tutoring and textbook services

- Sustainable adoption of learn-from-home technologies

- International expansion

Chegg’s revenue and earnings have a lot of room to increase over the next few years. Shares may look cheap at current levels in the near future. When you factor in the stellar price action, now is as good a time as ever to get in.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report