Adaptive network solutions provider

Ciena Corporation NYSE: CIEN stock is finally breaking out of its 14-year trading range as the former

high-flier reawakens on 5G tailwinds. Older traders and investors will remember when shares were trading in the $400s as one of the early momentum stocks during the year 2000 internet bubble era. Shares exploded to triple digits on the hype of the internet and crashed into the single digits during the 2009

financial meltdown. It’s taken over a decade for the markets to regain faith in the stock. With strong tailwinds emanating from the insatiable demand for bandwidth and the

5G rollout, the Company stands to bolster growth

re-opening trends accelerate with greater

COVID vaccination penetration. Shares were rattled on the Q3 2021 earnings reaction but have since recovered as industry contractions may be behind them. Prudent investors looking a survivor with solid financials that will benefit from the growing demand for bandwidth can watch shares for opportunistic pullback levels to scale into a position.

Q1 Fiscal 2021 Earnings Release

On Feb. 9, 2021, Cisco reported its fiscal Q2 2021 results for the quarter ending January 2021. The Company reported earnings-per-share (EPS) of $0.52 versus consensus analyst estimates for $0.45, a $0.07 beat. Revenues fell (-9.1%) year-over-year (YoY) to $757.1 million, beating analyst estimates for $750.21 million. The Company noted that no single customer represented more than 10% of total revenues. Inventories total $389.7 million. Product inventory turns were 3.2. The global revenue mix was 65.6% from the Americas, 20.5% from Europe, Middle East, and Africa (EMEA), and 13.9% from the Asia Pacific region. Adjusted gross margins improved to 48% compared to 45.1%, a 290 basis point YoY improvement. The Company ended the quarter with $1.3 billion in cash and investments.

Q2 Fiscal 2021 Guidance

Ciena expects flat Q2 fiscal 2021 revenues and reaffirmed full-year 2021 revenue guidance expecting annual sales growth to grow upwards of 3%. The Company expects Q2 2021 revenues in the range of $810 million to $840 million compared to $829 million consensus analyst estimates.

Conference Call Takeaways

Ciena CEO Gary Smith set the tone, “In just over nine months of commercial availability, we’ve shipped WaveLogic 5E coherent modems to more than 75 customers around the globe, all of whom are actively deploying the technology in their networks. In fact, the adoption rate of WaveLogic 5E Extreme is impressive. Base on available data, it has been faster than the combined ramp of all competitive 600G solutions that are in the market today.” The Company secured its first private 5G network using 5164 routing for in-building XO aggregation. Revenues grew 10% YoY for its Blue Planet automation software as its customer base grew to more than 200 worldwide. CEO Smith noted, “With customer engagements continuing to expand, it is very clear that Blue Planet can disrupt the status quo and deliver a software-driven approach to digital transformation and service management and delivery.”

Growth Segments

Non-telco business made up 40% of Q1 revenues. Web-scale revenues rose 25% YoY and represented over 20% of total Q1 revenues as Ciena is the leader in web-scale. The EMEA region saw the most growth with 20% YoY noting the strong recovery in India. CEO Smith summed it up, “Digital transformation has also grown in importance for our largest customers. From 5G to content delivery to cloud applications, customers are directing CapEx towards automating and streamlining how they deliver new services to reduce operational inefficiency and their back-office operations.”

Combined Tailwinds

The COVID-19 pandemic has accelerated the need for digital transformation and scaling up of bandwidth capacity. This trend will continues even beyond the pandemic thanks to the combined tailwinds of 5G, streaming and infrastructure buildout. The Biden administration’s focus on building up the nation’s domestic supply chain also applies to galvanizing internet infrastructure for stability, bandwidth, connectivity, and access. This parallels the Company’s efforts with its digital inclusion commitment, “which promotes digital inclusion through greater connectivity, access to technology, digital skilling with a goal of expanding opportunities for 100,000 underserved students in our global communities.”

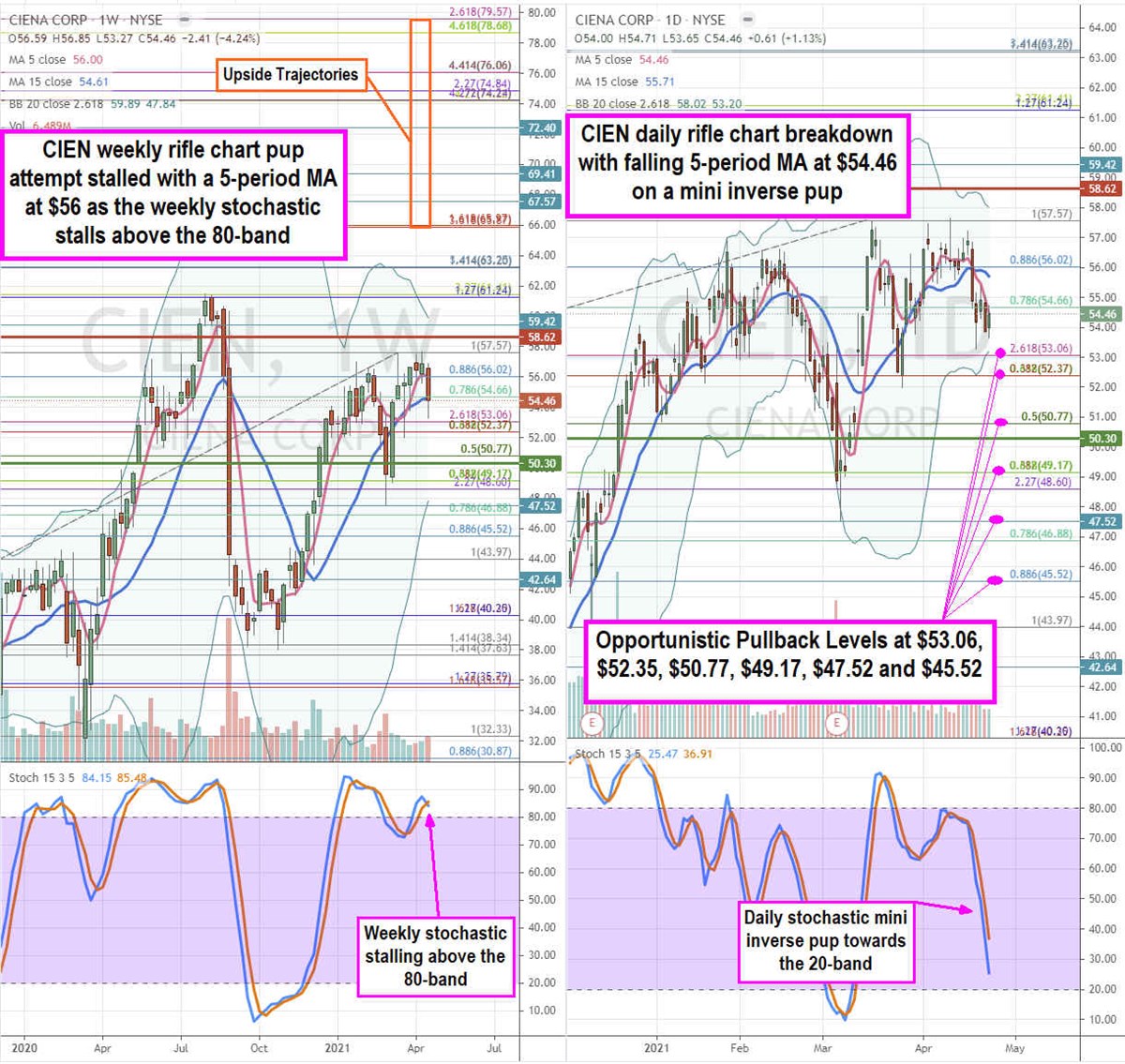

CIEN Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for CIEN stock. The weekly rifle chart formed a failing pup breakout as shares fell below the 5-period moving average (MA) support at the $56.03 Fibonacci (fib) level. The weekly stochastic peaked at the 90-band and waiting to either cross down through the 80-band and sell-off or form a mini pup to bounce. The daily rifle chart formed a market structure low (MSL) buy trigger on the $50.30 breakout powered by the full stochastic oscillation. The weekly market structure high (MSH) sell triggered formed when $58.62 broke down. The daily rifle chart downtrend has a falling 5-period MA at $54.46 with lower Bollinger Bands (BBs) at the $53.06 fib. The daily stochastic continues it oscillation down towards the 20-band. Prudent investors can used this downdraft to monitor for opportunistic pullback levels at the $53.06 fib, $52.35 fib, $49.17 fib, $47.52 fib, and the $45.52 fib. Upside trajectories range from the $65.87 fib up to the $79.57 fib level.

Before you consider Ciena, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ciena wasn't on the list.

While Ciena currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.