Economics 101 ascertains that raising prices tends to drive down demand unless you fall under the elastic principle like alcohol, cigarettes, drugs, and Conagra Brands, Inc. NYSE: CAG consumer staples products. Some popular brands you will recognize include Slim Jim meat snacks, Orville Redenbacher’s and Jiffy Pop popcorn, Vlasic pickles, Banquet frozen meals, Swiss Miss hot cocoa, Hebrew National hot dogs, Chef Boyardee, Hungry-Man frozen dinners, Wish-Bone salad dressings.

Raising prices has enabled the Company to bolster its gross margins to 28% and adjusted operating margins back to the 15%-17% range from the 12% range. Organic growth rose to 8.6% from 5% in fiscal Q3 2022.

Higher prices had a modest impact on volumes, but margins improved dramatically. As a result, shares are up 2.7% year-to-date (YTD), outperforming popular consumer staples brands like The Coca-Cola Company NYSE: KO and PepsiCo Inc. NYSE: PEP.

Sharp Rebound

After lowering guidance for fiscal 2022 earnings, the Company has rebounded with fury as they smoked and raised guidance for fiscal 2023. This was mainly due to the inflation-driven pricing actions the Company implemented to counter the cost inflation it experienced in its refrigerated, frozen, and snacks business in the fiscal Q3 2022.

As a consumer staples provider, customer demand remained strong despite the raised prices, which complements the elasticity of its brands versus other consumer staples players like Hormel Foods Corp. NYSE: HRL, whose operating margins hover around 10.5% amid lowered forecasts for 2023.

What Goes Up Pulls Everything Else Up

On Jan. 5, 2023, Conagra released its second-quarter 2023 results for November 2022. The Company reported an adjusted earnings-per-share (EPS) profit of $0.81, excluding non-recurring items beating consensus analyst estimates for a $0.66 by $0.15. In addition, revenues grew by 8.3% year-over-year (YOY) to $3.31 billion, beating analyst estimates of $3.28 billion.

Organic net sales are expected to grow 7% to 8% compared to fiscal 2022. Adjusted operating margin increased to 17%. Breakfast sausage sales increased 26.8% YoY; microwave popcorn grew 21%; seeds grew 18%; meat snacks 14.6%; hot cocoa 14.3%; and single-serve meals rose 10.2% YoY.

A Big Pat on the Back

Conagra Brands CEO Sean Connolly commented, “Our second quarter results reflect the ongoing strength of our brands and successful execution of the Conagra Way playbook as evidenced by our robust top-line growth, margin recovery, and earnings results.

Our decisive actions to offset inflation and improved service levels and productivity allowed us to successfully navigate ongoing inflationary pressures and industry-wide supply chain challenges as each segment delivered adjusted operating margin expansion in the quarter."

Raising the Bar

Conagra raised its fiscal full-year 2023 EPS guidance between $2.60 to $2.70 from prior guidance of $2.38 to $2.48 versus $2.47 consensus analyst estimates. CEO Connelly added, "We are raising our fiscal 2023 guidance on all metrics - organic net sales growth, adjusted operating margin, and adjusted earnings per share due to continued positive business momentum and our strong first half performance.”

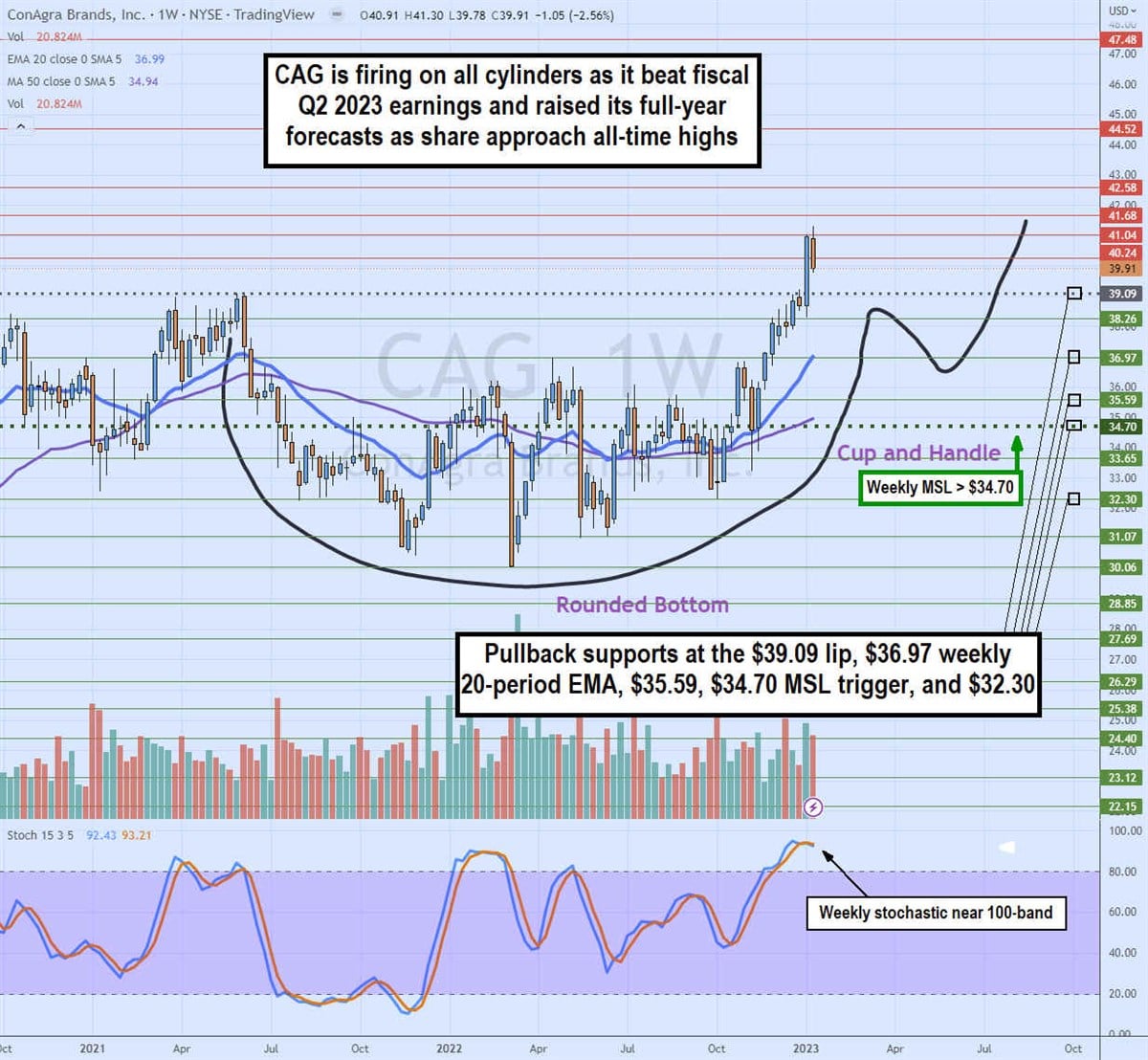

Weekly Rounded Bottom and Cup and Handle Breakout

CAG weekly candlestick chart shows a rounded bottom formed after peaking at $39.09 in April 2021. The $30.06 was the bottom-of-the-range hit in January 2022, and the stock eventually started to make higher lows on pullbacks until the weekly market structure low (MSL) buy triggered the breakout through $34.70.

Shares recovered to the $39.09 prior peak and lip of the cup in January 2023. Eventually, shares spiked through the lip as they approached an all-time high of $41.68.

A pullback under the lip would form the handle after it bounces back up through the lip. The weekly 20-period exponential moving average (EMA) is uptrending with support at $36.99, followed by the 50-period MA at $34.94 support. Pullback supports sit at the $39.09 cup lip, $36.97 weekly 20-period EMA support, $35.59, $34.70 MSL trigger, and $32.20.

Before you consider Conagra Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Conagra Brands wasn't on the list.

While Conagra Brands currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.