The nation’s second-largest drugstore operator

CVS Health NYSE: CVS stock got rug pulled on the rollout of

Amazon Pharmacy NASDAQ: AMZN. Shares of the

pandemic benefactor had incredible momentum in the days leading up the announcement but are now underperforming the benchmark

S&P 500 index NYSEARCA: SPYtrading well below its February highs. The recent price collapse has brought the price-earnings (P/E) down to 11, making it a value play for bargain hunters. The Company had announced plans to hire an additional 15,000 employees in Q4. As COVID-19

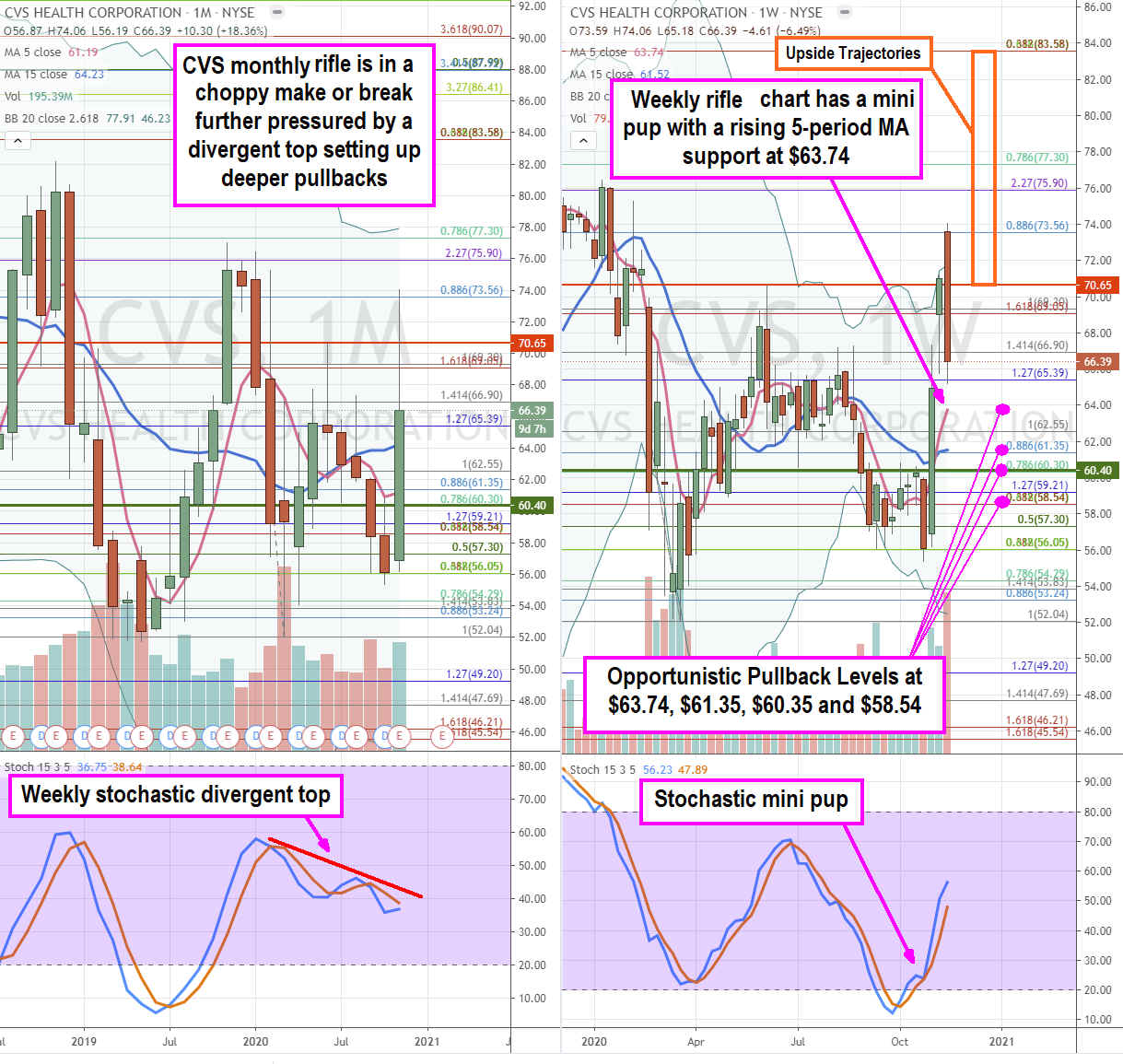

vaccines near FDA approval, CVS could play a pivotal role as a mass distributor just as it has been for COVID-19 testing. Shares may provide deeper price discounts based on the weekly divergent top stochastic formation for prudent investors looking for opportunistic pullback entries.

Q3 FY 2020 Earnings Release

On Nov. 6, 2020, CVS Health released its fiscal third-quarter 2020 results for the quarter ending September 2020. The Company reported an earnings-per-share (EPS) profit of $1.66 excluding non-recurring items versus consensus analyst estimates for a profit of $1.34, a $0.32 beat. Revenues grew 3.5% year-over-year (YoY) to $67.05 billion, beating analyst estimates for $66.54 billion. The Company also announced the appointment of Karen S. Lynch as the new CEO effective Feb. 1, 2021. Lynch is currently the Executive Vice President of CVS Health and Aetna. CVS raised its full-year 2020 EPS guidance to a range of $7.35 to $7.42, up from $7.14 to $7.27 versus $7.23 analyst consensus estimates.

Conference Call Takeaways

CVS Health CEO, Larry Merlo, highlighted the Company’s multi-channel health services model delivering care to customers wherever and whenever. The Company serves over 100 million members across all its businesses. This creates powerful leverage as well as distribution potential for healthcare services. The next-gen Transform Diabetes Care program, “brings together our advanced data analytics with our clinical, brick-and-mortar and digital assets to provide a comprehensive solution that is personalized, predictive, and prioritized.” As of Jan. 1, the program had one million members with access to the program. The Company introduced a reduced and zero copay Minute Clinic benefit including E-Clinic virtual care for Medicare Advantage plans in 2021.

Vertically Integrated Healthcare

CVS is the nation’s largest pharmacy benefits manager (PBM) responsible for nearly 50% of its top line, of which 33% is derived from its retail pharmacy business. The Amazon Pharmacy rollout may put some margin pressure on its retail pharmacy but should be offset by its organic growth. The acquisition of Aetna health insurance is transforming CVS into a complete vertically integrated powerhouse utilizing its brick and mortar stores to become healthcare distribution points as evidenced by COVID-19 testing (six million tests provided across 4,000 locations representing 70% of retail testing) and very likely for the distribution of COVID-19 vaccines.

Pandemic Benefactor

The Minute Clinics are already serving as viable routine and urgent care destinations for local communities. The synergies are the core engine for the HealthHubs initiative comprised of wellness and health clinics. With 205 HealthHubs currently, the Company plans to grow to 1,500 locations by year’s end 2021. The Health Advisor service data indicates a 12% reduction in unnecessary emergency room visits. About 70% of COVID-19 tested participants at CVS Pharmacy and 40% of the Return Ready B2B clients were not previous CVS health customers. This has become an indirect form of customer acquisition due to the pandemic further underscoring the Company as a pandemic benefactor for the long-term. Prudent investors looking for exposure in this value play should watch for opportunistic price pullback levels.

CVS Opportunistic Pullback Levels

Using the rifle charts on the monthly and weekly time frames enables a broader view of the playing field. The monthly rifle chart is in a make or break with a tightening range but a divergent top stochastic as the 5-period moving avg (MA) crosses over the 15-period MA again. The monthly market structure low (MSL) triggered above the $60.40 Fibonacci (fib) level. The weekly rifle chart formed a bullish mini pup as shares launched through its upper Bollinger Bands at $71.74 before the Amazon Pharmacy news caused shares to plunge. Further pullbacks for a tightening towards its weekly 5-period MA can be expected. Prudent investors can watch for opportunistic pullback levels at the $63.74 weekly 5-period MA, $61.35 fib, $60.35 fib and the $58.54 fib. The upside trajectories range from the $70.65 daily MSH to $77.91 monthly upper BBs to the $83.58 fib.

Before you consider CVS Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CVS Health wasn't on the list.

While CVS Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.