Delta Air Lines Today

DAL

Delta Air Lines

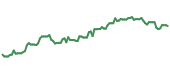

$60.93 +2.16 (+3.67%) As of 10/24/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $34.74

▼

$69.98 - Dividend Yield

- 1.23%

- P/E Ratio

- 8.58

- Price Target

- $71.53

The way the broader S&P 500 index has been headed lately (higher and higher) brings about a new narrative importance for markets to justify today’s valuations and the assumptions that need to become true if the entire market is set to keep going.

One of these narratives and assumptions is that earnings will keep expanding, as earnings per share (EPS) are mostly responsible for bringing valuation multiples higher, along with overall prices.

With this in mind, investors can (and should) focus on the stocks that show current EPS growth and, more importantly, keep reiterating the guidance that could allow them to meet and exceed current forecasts. This way, portfolios may be more aligned with what the market needs and what capital requires to outperform the broader indexes and industry groups.

This is exactly where Delta Air Lines Inc.NYSE: DAL comes into play, as the stock has broken out recently in terms of price action, especially when pegged against its competition in the transportation sector. The market’s treatment toward Delta Air Lines could be a byproduct of future expectations, some of which are as realistic as ever in bringing investors into new potential highs.

Why Delta Is Gaining Altitude

Over the past month alone, Delta Air Lines stock has delivered a net rally of up to 21.7%, outperforming all other peers and even the broader S&P 500 index.

Compared to American Airlines Group Inc.NASDAQ: AAL and United Airlines Holdings Inc.NASDAQ: UAL, Delta now sits at a wide enough margin to command new momentum buyers.

Beating its peers by as much as 20%, Delta Air Lines' momentum may signal investors of an even bigger development brewing. In fact, there is a very good reason for this price action, and just as good a chance that the upward momentum will continue in the coming months and quarters.

In its Q2 earnings report, Delta noted it delivered a record $15.5 billion in adjusted revenue and $2.10 in adjusted EPS, beating Wall Street’s expectations.

Delta Air Lines Dividend Payments

- Dividend Yield

- 1.23%

- Annual Dividend

- $0.75

- Dividend Increase Track Record

- 1 Year

- Dividend Payout Ratio

- 10.56%

- Next Dividend Payment

- Nov. 6

DAL Dividend HistoryEven more importantly, Delta reinstated its full-year guidance, projecting EPS between $5.25 and $6.25 and free cash flow of $3 to $4 billion.

This is a massive relief for investors, considering that most airlines have removed their guidance figures due to the volatile U.S. economy.

Management cited strong demand among its core premium leisure and business customers and noted that these consumers are resilient to broader economic uncertainty.

Delta’s financial strength was also demonstrated by a 25% increase in its quarterly dividend, now set at 19 cents per share.

The payout, scheduled for August 21, signals not only profitability but also a shareholder-friendly capital allocation strategy.

An Institutional Vote of Confidence

Delta Air Lines Stock Forecast Today

12-Month Stock Price Forecast:$71.5317.41% UpsideBuyBased on 21 Analyst Ratings | Current Price | $60.93 |

|---|

| High Forecast | $90.00 |

|---|

| Average Forecast | $71.53 |

|---|

| Low Forecast | $60.00 |

|---|

Delta Air Lines Stock Forecast DetailsInstitutional investors have taken notice.

Kingstone Capital Partners initiated a $386 million position in Delta stock in early July 2025, reinforcing the market's confidence in Delta’s trajectory. Meanwhile, UBS analyst A. Maheswari launched coverage with a bullish $72 price target. This view not only calls for a new 52-week high to be made (which might trigger even more institutional buying) but also implies a net rally of as much as 27% from where the stock can be bought today.

Seeing double-digit upside in an airline is not a common event in the market; however, Delta’s proposal for expanding EPS and free cash flow, along with a higher dividend payout, surely justifies the current setup for an asymmetrical return in this potential buy. This is something investors shouldn’t pass by.

Before you consider Delta Air Lines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Delta Air Lines wasn't on the list.

While Delta Air Lines currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.