It’s been easy to overlook eBay (NASDAQ: EBAY) over the past several years as Amazon (NASDAQ: AMZN)has taken over the e-commerce space. It has, at times, been a rocky road for Amazon’s less-glamorous competitor.

But on June 4th, eBay raised its Q2 guidance and added to the all-time high share price it set a few days prior.

While eBay isn’t going to compete with Amazon at what it does best - selling new items at a massive scale - the Amazon boom has ironically provided an opportunity that eBay is uniquely positioned to pounce on.

Returned Merchandise

The e-commerce revolution has led to much higher return rates. Customers can’t physically see or try-on what they’re buying. And with many online retailers, including Amazon, offering free and easy returns, customers don’t hesitate to send an item back.

“Shoppers return 5 to 10 percent of what they purchase in store but 15 to 40 percent of what they buy online,” David Sobie, co-founder, and CEO of Happy Returns told CNBC.

It’s hard to estimate the exact amount of returned merchandise, but the consensus is that it’s hundreds of billions of dollars per year and rising. This could soon be a trillion-dollar issue.

At the moment, solutions to this massive problem are fragmented and not ideal. Retailers often take massive losses on their returned inventory.

Optoro is one company that has stepped in to try to solve this problem. Optoro’s software solutions help companies handle the returned items that can’t be put back into inventory (a high percentage), and remarkets them.

So, how does eBay fit into all of this?

eBay’s platform was built on the idea of selling one-of-a-kind items, which makes it a natural fit for selling slightly (and uniquely) damaged merchandise. eBay’s user base is also conditioned to shop for and accept slightly damaged items - provided that it’s noted in the item description.

Furthermore, a big problem with returned merchandise is that a lot of it can go out of season quickly, either due to fashion trends or the time of the year. eBay’s widely used auction format gives sellers the option to quickly move merchandise.

Optoro already lists items on eBay and there have been rumors that they will form a strategic partnership or that eBay will buy the company outright. But regardless of how things pan out between eBay and Optoro, eBay stock has a potentially massive upside if it can gain market share in this rapidly growing new industry.

2020 Outlook

As touched on before, eBay has a strong 2020 outlook. Its recent announcement boosted Q2 revenue estimates to $2.75 billion to $2.8 billion, up from an April estimate of $2.38 billion to $2.48 billion. Non-GAAP Q2 earnings guidance was raised to $1.02 to $1.06 per share, up from an April prediction of 73 cents to 80 cents.

eBay added around six million buyers in April and May. Its business is performing better than the company expected during the coronavirus pandemic, with many people shopping online more with all of the additional time spent at home. While it would be a stretch to call eBay recession-proof, investors should be optimistic due to the company’s ability to thrive during such a difficult period.

In February, eBay finalized its deal to sell StubHub for around $4 billion in cash. eBay’s reasoning behind the sale was to focus more on its core business. eBay raised its planned 2020 stock buybacks to $4.5 billion shortly after the StubHub sale was completed.

Technicals

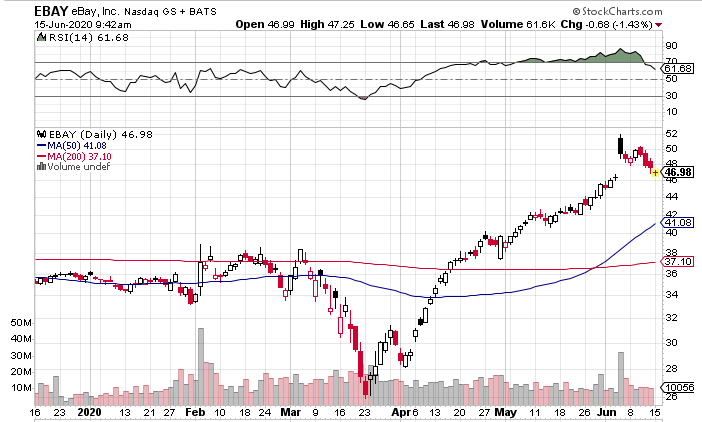

The stock market carnage of March didn’t spare eBay; the stock lost around a third of its value in a few weeks. But buoyed by the general market rebound and the outperformance of e-commerce, eBay’s share value has nearly doubled in less than three months off the lows, completing a V-shaped recovery.

After basing between around $25 and $40 for the better part of the past five years, eBay has broken out and surged to new all-time highs.

The stock just spent about a month in overbought territory on the RSI. So it shouldn’t be surprising that the stock cooled off a bit during the recent sell-off in the major indices. However, the pullback has been very mild - the continued relative strength is a reason for optimism.

It still looks extended on the chart, but a pullback to the low $40s would get it closer to the 50-day moving average and the breakout point; that range would represent a potential buying opportunity. Alternatively, a new base in the $45-50 range could give the stock time to digest its gains and set up for the next leg up.

Keep an Eye on eBay

eBay has an excellent long-term outlook due to the strength of its core business, ability to thrive during the ongoing coronavirus pandemic and potential upside in the returns space.

The stock looks extended in the near-term, but keep an eye on eBay over the next month to see if it provides an attractive entry point.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report