An interesting shift in allocation and performance has occurred over the last month, with the energy sector catching up to the overall market. Over the last month, the Energy Select Sector SPDR Fund NYSE: XLE has gained almost 9%, while the overall market, SPDR S&P 500 ETF Trust NYSE: SPY, has gained about 1.5%. Year-to-date, the XLE is still lagging behind the SPY, with XLE up just over 1% and the SPY up almost 17%.

In the above chart, the shift in momentum from the start of July can be seen. Notice the outperformance and relative strength displayed in XLE versus SPY(yellow line). During the period, beginning July 1, the XLE has surged over 9% higher while the SPY is up close to 1%. If you would like to conduct a similar comparison study, click the plus symbol on any chart.

Given the recent relative strength displayed in the energy sector, now might be a good time to gain exposure to the sector. Three names, in particular, stand out.

Three Energy Stocks To Consider

1) Energy Select Sector SPDR Fund NYSE: XLE is an ETF that seeks to provide investment results that generally correspond to the price and yield performance of the Energy Select Sector Index (the Index). The Index includes companies from the following industries oil, gas and consumable fuels, and energy equipment and services.

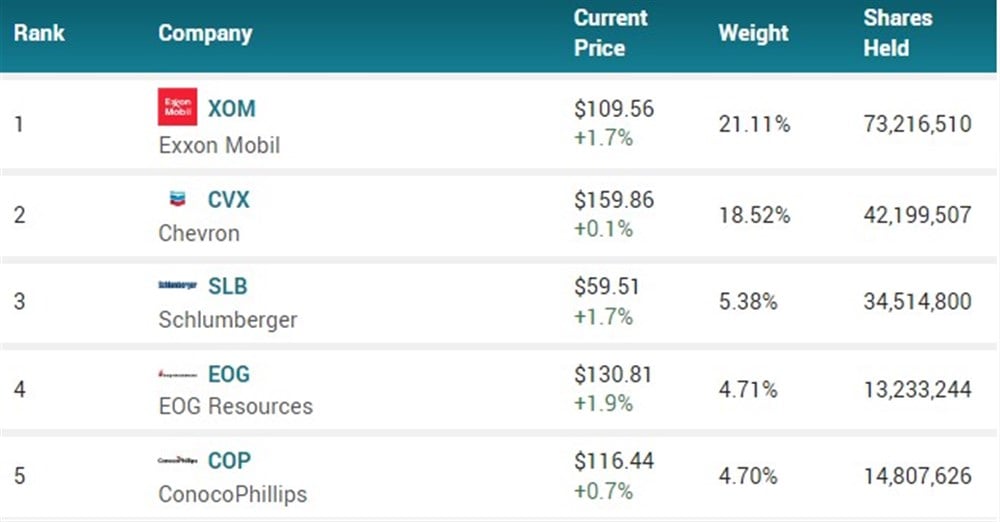

Top Five Holdings Of XLE

The XLE has a 3.63% dividend yield, net expense ratio of 0.10%, and a market capitalization of $36.89 billion. Thanks to recent positive momentum, resulting in shares of XLE climbing almost 9% over the last month, the ETF is now up 1.36% year-to-date. XLE is trading near two critical areas of resistance, $90 and $92. Investors should pay close attention to the price action around these key levels, as a breakout over these levels might indicate a meaningful shift in momentum.

2) Chevron NYSE: CVX is the second largest holding of the XLE ETF, weighing 18.52%. The stock has strong dividend growth and an attractive dividend yield of 3.76%. CVX currently has a P/E of 10.20, and an RSI of 56, indicating that the stock might be in value territory.

Although the stock is up about 3% over the last year, year-to-date shares are down 10.40%. While the stock is potentially trading at a discount, investors may want to wait for further confirmation before picking up shares. A move over short-term resistance at $164, and a reclaim of the 200-day SMA near $168, could serve as confirmation and signal a momentum shift.

3) Schlumberger NYSE: SLB is the third largest holding of the XLE ETF, with a current weighting of 5.38%. The stock has a dividend yield of 1.7% and a P/E of 21.50. SLB’s current market capitalization is $83.71 billion.

Shareholders of SLB will undoubtedly be happy, with the stock up almost 69% over the past year and 28% over the last three months. After its impressive performance and relative strength in the sector, one might believe that SLB could be overvalued in the short term. However, that is not the case with a current RSI of 66.9

Analysts agree that SLB could see further upside, with a consensus price target of $65.13, predicting almost 11% upside. Based on the seventeen analyst ratings, SLB has a Moderate Buy rating, with sixteen ratings as a Buy and only one as a Hold.

Before you consider Schlumberger, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Schlumberger wasn't on the list.

While Schlumberger currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.