Hormel Guides Higher, Shares Follow Suit

Hormel (NYSE: HRL) is the first of the major consumer staples company’s to report results reflecting the expected rebound in the hospitality sector. The company’s results were driven by a massive rebound in F&B spending that has only just begun. The F&B rebound, coupled with the acquisition of Planter’s, has the company on track to sustain growth this year versus last year and at pre-pandemic levels. Hormel may be one of the most highly-valued consumer staples companies on the market today but it’s proven time and time again to be worth its valuation.

Hormel Blows Past The Consensus, Guides F2021 Higher

Hormel had a great quarter and one we think will lead to bigger gains in the quarters ahead. The $2.61 in net revenue is not only up 7.9% from last year but 6% sequentially, 11% over the past two years, and a full 800 basis points better than expected. The gains were driven by strength in most segments that was offset by expected weakness in U.S. consumer spending.

The U.S. retail segment came in flat from last year while all others showed gains. The U.S. Foodservice segment was strongest at up 28% followed by International at 11%. Breaking things down by category, refrigerated items rose by 17% offset by an 8% decline in grocery items and a 2% gain in Jennie-O Turkey sales.

Moving down the report, the company experienced some negative margin pressure due to rising commodity and other input costs but seems to be navigating the issue fairly well. The company’s operating margin shrank only 100 basis points over the past year to come in at 11.1% and above the consensus. On the bottom line, the FQ2 GAAP $0.42 is flat YOY but beat by a penny.

Turning to the guidance, the company is expecting the core business to remain steady over the next three quarters as sales shift away from consumer channels and toward F&B outlets. The new guidance is calling for revenue in the range of $10.2 to $10.8 billion versus the $10.12 expected by the analysts. That should drive EPS in the range of $1.70 to $1.82 which is also on the high side of the consensus. The Planter’s acquisition should close before the end of the fiscal year and will positively impact these results.

The Hormel Foods Dividend Is Appetizing

Hormel Foods doesn’t have the same value-to-yield as stock like Kraft-Heinz but that doesn’t make it a bad buy. The 2.15% dividend yield is well above the broad market average, incredibly safe, and growing. The company not only has ample cash flow and free cash flow to sustain a 22nd consecutive annual dividend increase but to keep doing each year, long into the future. The next increase isn’t due out until January 2022 but it should be in the range of 10% to 12% by our estimations.

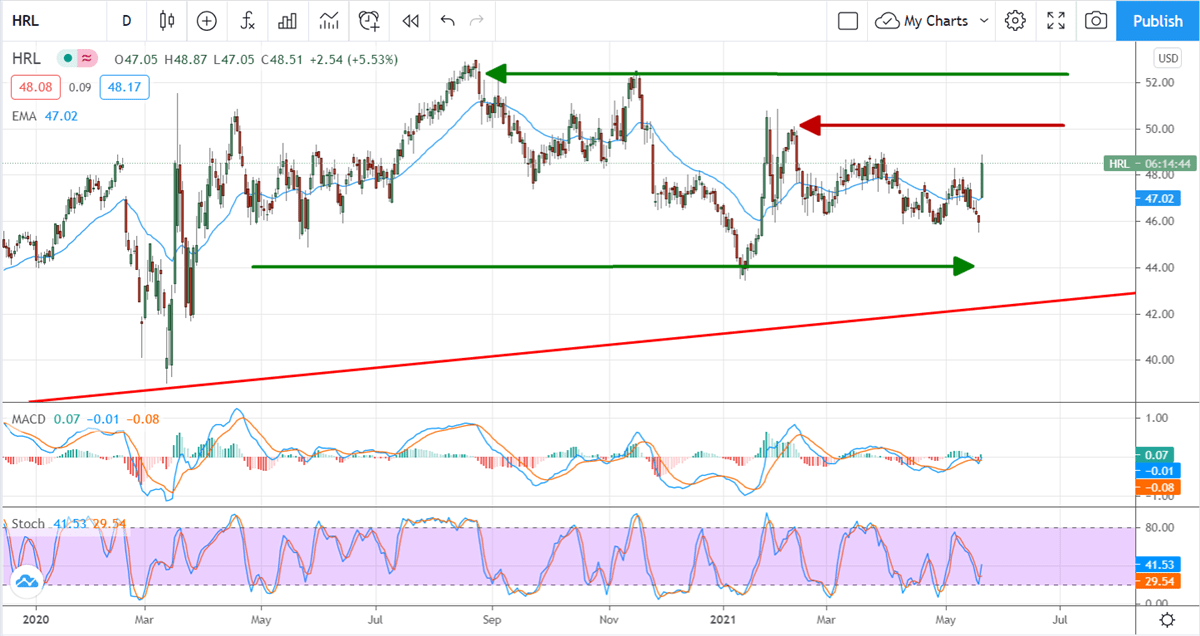

The Technical Outlook: Hormel Moves Higher Within Its Range

Unlike others in the Consumer Staples industry shares of Hormel have not staged a major rally over the last year. A better description is range bound trading market by periodic volatility. The Q2 news has shares moving higher and indicated higher but still only within that range. The top of the range is near the $52 level and may cap upward movement if resistance a the $50 level doesn’t do it first. While Hormel is a great buy with a great dividend and supported by F&B reopening so are other, less highly-valued, higher-yielding names in the group.

Before you consider Hormel Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hormel Foods wasn't on the list.

While Hormel Foods currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.