Long-term care and mortgage Insurer

Genworth Financial NYSE: GNW stock has been trapped in a tight trading range for the past four years under the proposed $5.43 acquisition deal by China Oceanwide (COW). After 17 extensions, Genworth officially announced the termination of the merger agreement on April 6, 2021 and provided strategic alternative plans to trim down debt and potentially spin-off a piece its lucrative U.S. mortgage insurance business via IPO. Shares initially sold off in this announcement, until the market digested the potential for unlocking shareholder value without a merger price cap chained to the shares. The

U.S. housing market has been white hot with demand vastly outpacing supply fueled by rising raw

materials costs and

pandemic triggered migration to single family homes. The mortgage business and subsequently mortgage insurance business is just as strong fueled by low

interest rates. With the COW deal behind them, shares of Genworth should buoyant rise in line with its peers. Prudent investors looking for a discounted play on the continued growth of the housing market can monitor shares of Genworth Financial for opportunistic pullback levels.

Q4 2020 Earnings Release

On Feb. 16, 2021, Genworth released Q4 2020 results for the quarter ending in December 2020. The Company reported earnings per share (EPS) of $0.34 excluding non-recurring items, beating consensus analyst estimates of $1.29, by $0.01. Revenues rose 11% year-over-year (YoY) to $2.26 billion, beating analyst estimates for $2.06 billion. U.S. Mortgage Insurance (subsidiary MI) full-year 2020 adjusted operating income was $381 million. Continued to progress toward long-term-care (LTC) Multi-Year Rate Action Plan (MYRAP) with $344 million incremental annual rate increase was approved in 2020 with an estimated net present value of approximately $2 billion. As of Dec. 31, 2020, the Company holding cash and liquid assets were $1.1 billion with $71 million in restricted cash. The Company paid off its February 2021 debt of $338 million.

Conference Call Takeaways

Genworth Financial CEO, Tom McIerney, set the tone, “First, as we discussed in January, we remain focused on preparing for a potential partial IPO of U.S. MI, subject to market conditions as well as satisfaction of various conditions and approvals. While we are not permitted to discuss details associated with this transaction due to applicate gun-jumping and related securities laws, I can tell you that we began our preparations for the IPO over a year ago as part of our contingency planning… our intent to pursue a partial U.S. MI, we received multiple expressions of interest from third parties and various transactions involving our U.S. MI business, including a sale of 100% of U.S. MI. The Board and management will consider these proposals, moving forward, as we continue to prepare for an IPO. Our priority in any transaction would be to maximize long-term shareholder value by unlocking value from U.S. MI and further insulating U.S. MI’s ratings.” The Company will align its U.S. Life business structure currently serving 3 million customers and committed to improving its U.S. long-term care insurance model. There are no plans to infuse any more capital in that segment as it can sustain itself on the $2.3 billion on consolidated statutory capital.

Share Price Driver

The Company has a $660 million 7.75% unsecured note principal payment due September 2021. The Company is eyeing a partial IPO of its U.S. MI business which has achieved a 27% adjusted income compound annual growth rate (CAGR) since 2014. The Company has improved since the original merger agreement four years ago as it shored up its balance sheet and paid down debt. As the merger agreement is terminated, the move towards an IPO spinoff of its U.S. MI division is a driver for the stock sooner rather than later with its debt payment coming due. Prudent investors seeking exposure can watch for opportunistic pullback levels to scale into a position.

GNW Opportunistic Pullback Levels

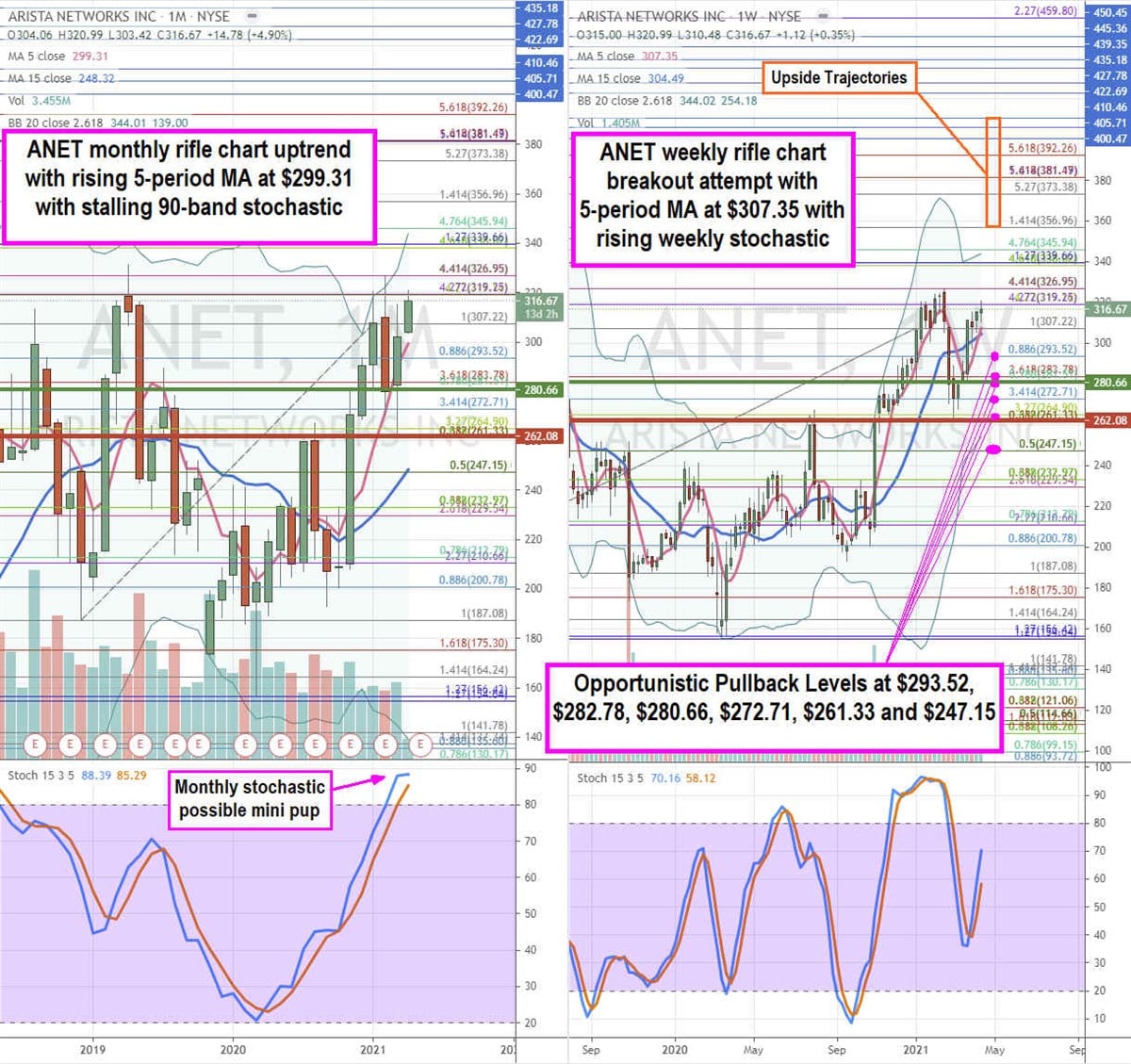

Using the rifle charts on monthly and weekly time frames provides a broader view of the landscape for GNW stock. The monthly rifle chart is in a make or break set-up as the falling 5-period moving average (MA) sits at $3.34 with a falling monthly stochastic as shares attempt to hold above the $3.54 Fibonacci (fib) level. The monthly market structure low (MSL) buy triggered on the breakout through $3.32. The weekly market structure high (MSH) sell triggered when $4.16 broke. The weekly rifle chart is also in a make or break trying to breakout above the weekly 5-period MA at $3.48 as the weekly stochastic crosses back up. The $3.68 is a key fib breakout level. Prudent investors can monitor opportunistic pullback levels at the $3.48 fib, $3.32 monthly MSL trigger, $3.17 fib, $2.75 fib, $2.60 fib, and the $2.26 fib. Upside trajectories range from the $4.54 fib upwards to the $7.37 fib level. Keep an eye on peer mortgage insurers MTG, NMIH, ESNT, and RDN, as the group tends to move together.

Before you consider Genworth Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genworth Financial wasn't on the list.

While Genworth Financial currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.