Pop culture toys and collectibles maker

Funko, Inc. NASDAQ: FNKO stock IPO’ed at $8 in November 2017 and surged as high as $31.12 and fell as low as $3.12 during the COVID-19 pandemic April 2020. The recent recovery in the

S&P 500 NYSEARCA: SPY has lifted shares back to the $7.22

Fibonacci (fib) level. As the restart narrative takes shape, share of FNKO have potential for more upside for nimble traders and investors taking advantage of opportunistic pullbacks during the market normalization phase ahead of the next earnings season.

Funko Pop and Comic Collectibles Market

Funko pops are inextricably linked with the comic book collector’s market as their most popular and valuable pops are comic related. They have a growing underground following with rare pops selling for over $9,000. The vertically integrated Company stays on the edge of pop culture and can create and manufacture pops at the drop of a hat, when factory supply chains are fully operational. The COVID-19 crisis lead to the shutdown of production as well as a large chunk of their distribution channels. However, the aftermarket for pops didn’t fall much as feared. The same can be said about the comic book aftermarket despite the shutdown of printing and distribution channels like Diamond Publishing, which had a monopoly on distribution. This can be attributed to the stay-at-home mandates which gave bored collectors more opportunities to bid up prices and hunt for sought after key comics and Funko pop’s while stuck at home. While both industries benefit little from aftermarket activity, it does build “pent-up” demand for new products when production capacity resumes. Funko pop sales climb in anticipation of major content productions and events. The largest being the Marvel Cinematic Universe (MCU) and Disney+ NYSE: DIS slate of Phase IV movie and exclusive streaming projects, which were delayed during COVID-19.

Marvel Phase IV

The highly anticipated resumption of the MCU projects has also help fuel Disney shares higher in recent weeks. The Marvel Phase 3 movies concluded with Avengers Infinity Wars: End Game resulting in the highest grossing film of all-time generating $2.8 billion in worldwide box office in 2019. Incidentally, FNKO shares also peaked near $28 during the same time. The glut of releases combined with the COVID-19 triggered production shutdowns caused a perfect storm of falling collectibles prices, content vacuum, stock market collapse and demand shock to Hulk smash FNKO shares to all-time lows in 2020.

Hunting for Opportunity

Funko pops are a peculiar item that appeals to consumers and collectors on may levels. Since they are pop culture toys, they carry an iconic theme that consumers embrace as sign of the times during a period. The production of valuable variant molds spur the ‘treasure hunting’ appeal as any ‘mystery’ order could result in a random windfall. There is the speculation appeal of buying up pops in anticipation of surging demand and subsequent value appreciation, just like stocks. The latter is where the Company benefits the most. Like stocks, speculators tend to buy multiples of hot pops, not just one. At $10-$15 apiece, it’s not uncommon to see someone walking out with 10 Funko pops of a particular character. This is where the “pent-up” demand combined with the resumption of MCU Phase IV could result in an upside demand surprise in the earnings releases moving forward. Prudent investors may considering positioning at opportunistic entry pullbacks levels ahead of full production capacity resumption.

Opportunistic Entry Levels

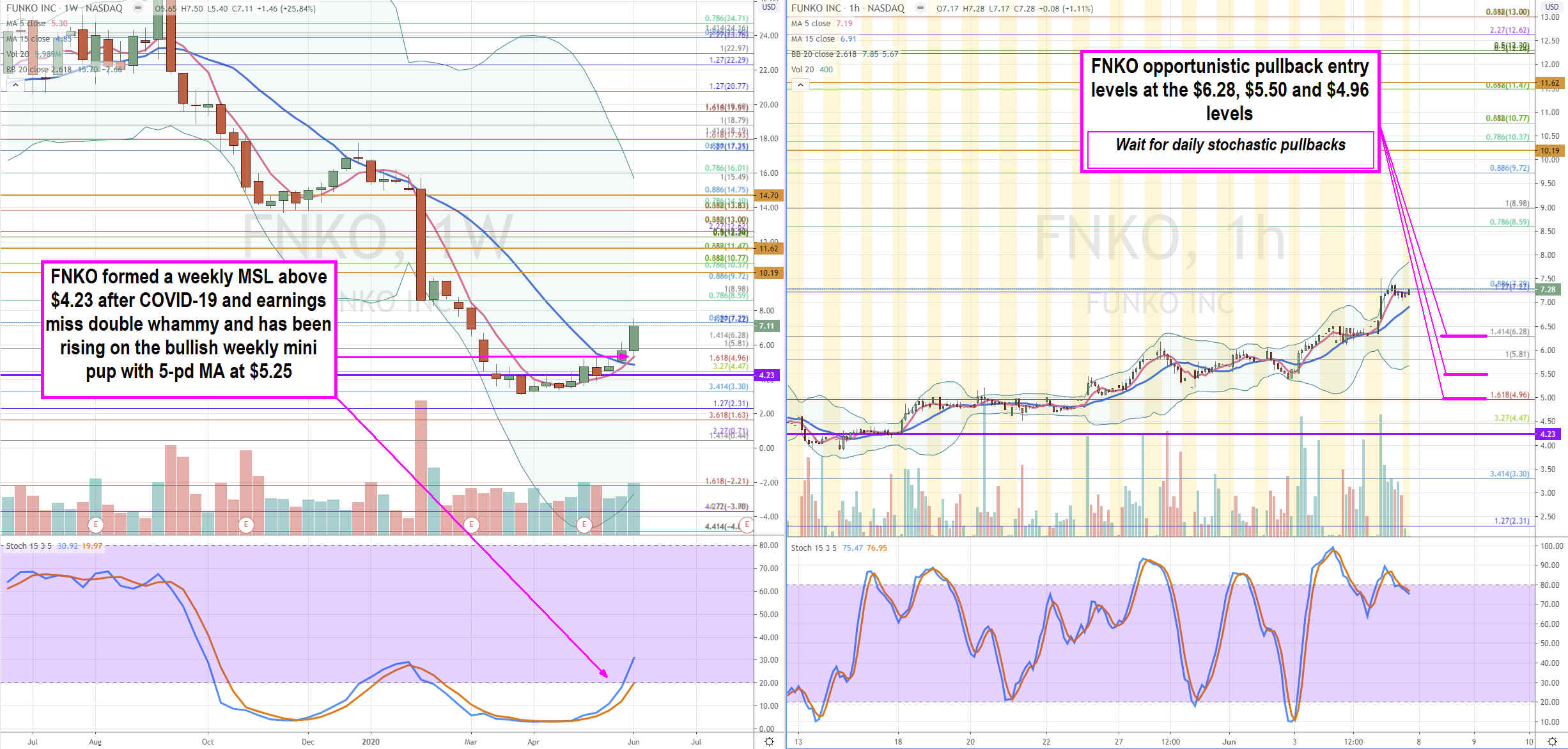

Using the rifle charts on a monthly, weekly and daily time frame provides a broader view of the landscape for FNKO stock. The weekly rifle chart triggered a market structure low (MSL) above $4.23. The weekly stochastic triggered bullish mini pup that spiked shares on the 20-band crossover causing a surge to the $7.28 fib. Rather than chasing an entry, it’s prudent with wait for pullbacks on the daily stochastic for a reversion to opportunistic pullbacks at these key levels: $6.28 fib, $5.50 weekly 5-period MA and $4.96 fib. Nimble traders can trade the fib inflection points on the chart. Longer-term investors can look to scale in with a pyramid style allocation model (light to heavy as prices fall) to average in a solid position at better prices. Risk tolerant investors with level 4 options permissions can also sell put near the opportunistic price levels with the intention of being assigned shares at the strike prices. If the weekly mini pup plays out as anticipated, then FNKO shares have upside towards the $10.19, $11.62 and $14.70 targets.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.