Long-term care and mortgage Insurer

Genworth Financial NYSE: GNW stock has been in a sharp downtrend along with the rest of the peers stocks in the mortgage insurance sector. The U.S. mortgage insurance business division named Enact was originally scheduled to IPO in the $22 to $24 price range but was put on hold due to market conditions. This sent shares lower in May but soon recovered over $4. It has been in a steady decline for the past several weeks despite benchmark indices making new highs. This is reflective of the lack of breadth in the U.S. equity markets that gauge market performance on the S&P 500 and Nasdaq 100 indexes, which is very misleading. That’s for another article. The fundamentals still remain strong for Genworth and any updates on the scheduling of the Enact IPO should immediately boost share prices. The housing market remains strong and

consumers still have

pent-up demand, if not stronger as

materials costs have been normalizing. The U.S. Federal Reserve still doesn’t plan rate

interest rate hikes until 2023, but inflation is also another reality that may cause the Fed to react sooner than anticipated. Management may have been premature in delaying the IPO but following through on it is still a reality. Prudent investors can watch for opportunistic pullbacks to gain exposure ahead of the spin-off.

Q1 2021 Earnings Release

On April 29, 2021, Genworth released Q1 2021 results for the quarter ending in March 2021. The Company reported earnings per share (EPS) of $0.33 excluding non-recurring items, beating consensus analyst estimates of $0.23, by $0.10. Revenues fell (-0.02%) year-over-year (YoY) to $1.99 billion, beating analyst estimates for $1.96 billion. The Company completed the sale of its Genworth Mortgage Insurance Australia Limited for net proceeds of $123 million. USMI had adjusted operating income of $126, up 33%. New delinquencies continue to decline, down 16%. Genworth CEO Tom McInerney stated, “We have remained nimble and taken decisive actions to ensure Genworth is well-positioned to create value for our stakeholders into the future. Given our current holding company cash position, the actions we've already taken with our strategic plan, capital raising efforts and our expected cash flow profile, I am confident in Genworth's ability to meet the debt obligations over the next several years. We have the right strategy in place and the right team to lead our execution of this strategy, along with guidance from our new independent directors Jill R. Goodman, Howard D. Mills, III and Ramsey D. Smith, whom we are delighted to welcome to our Board of Directors.”

Conference Call Takeaways

CEO McIerney set the tone regarding the long-term care (LTC) business, “We are taking a three-pronged approach to maximize the value of our LTC business, and to monetize our deep expertise in this area. First and most importantly, we are continuing to mitigate our downside through our LTC multi-year rate action plan and reduce benefit options. Both of those will continue to reduce our risks. We have made exceptional progress on this effort through the end of the first quarter, achieving over $15 billion in net present value from LTC premium increases and benefit reductions, since 2012. Second, we are also exploring opportunities to partner with well-regarded third parties to launch a new long-term care insurance business in the United States.” He continued, “There is a huge need for long-term care solutions in the U.S., with 54 million Americans aged 65 and older at the end of 2019. And with that number expected to increase to 95 million by 2060. There are very few players in the LTC insurance market today due to severe financial challenges arising from legacy LTC business. We are evaluating opportunities to monetize our LTC expertise and own intellectual property in partnership with strong third parties to develop a number of new LTC products and services.” He didn’t talk much about the USMI IPO.

Delayed IPO

On May 12, 2021, Genworth announced it was delaying the USMI IPO due to market volatility. The Company will continue to monitor market conditions before pricing Enact’s IPO. The proposed IPO would spin-off 22.6 million shares and continue to own 83.7% of the Company. Enact sells private mortgage insurance to homeowners when they purchase homes with less than 20% down payments.

GNW Opportunistic Pullback Levels

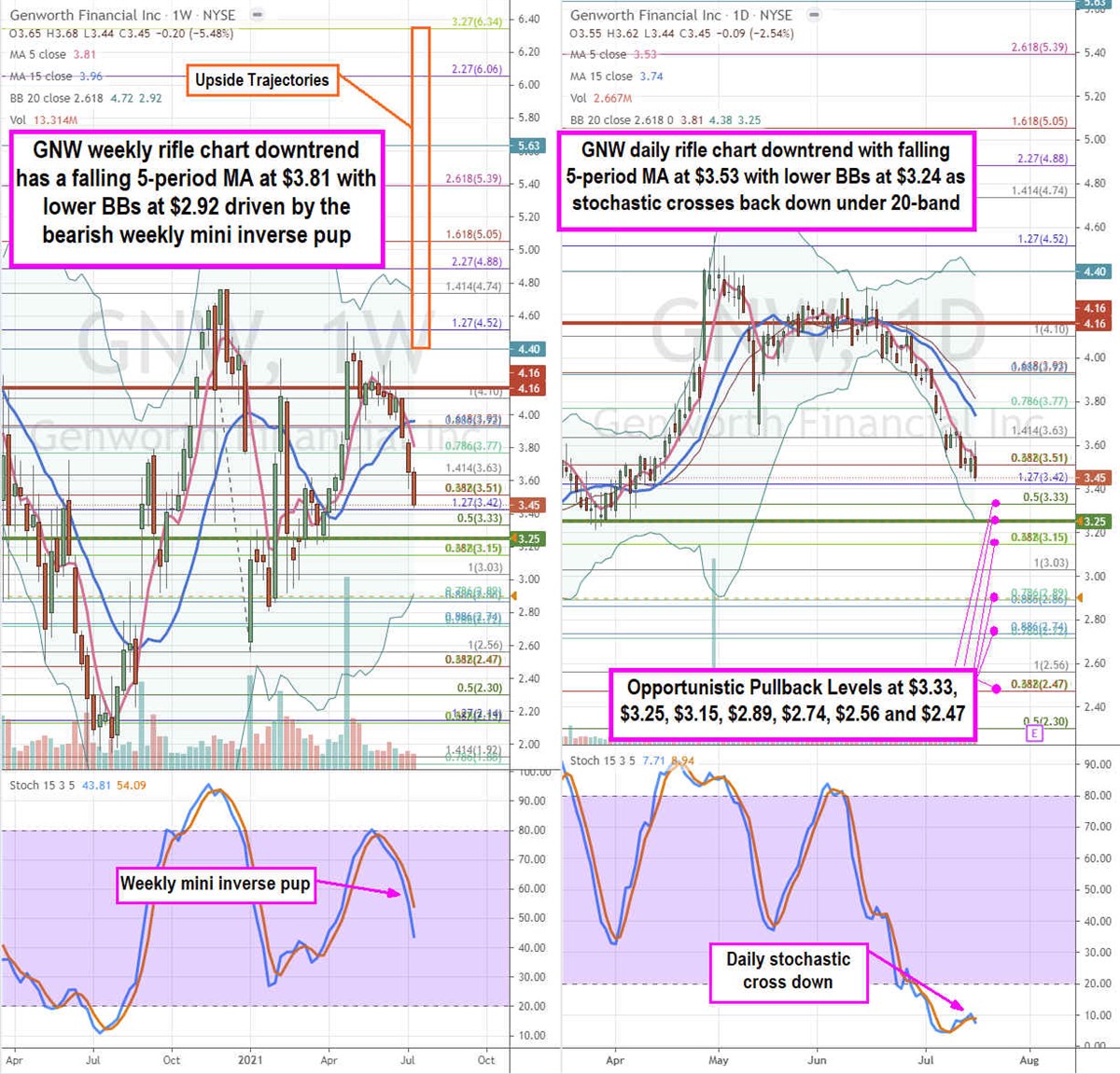

Using the rifle charts on weekly and daily time frames provides a precise view of the landscape for GNW stock. The weekly rifle chart is in a sharp downtrend with a falling 5-period moving average (MA) resistance near the $3.77 Fibonacci (fib) level. The weekly formed a market structure high (MSH) sell trigger on the breakdown below $4.16. The weekly stochastic has a bearish mini inverse pup targeting the lower Bollinger Bands (BBs) near the $2.89 fib. The weekly market structure low (MSL) buy triggered on the breakout above $3.25, which will be a key level for bulls to defend. The daily rifle chart has an extended downtrend with a falling 5-period MA at $3.53 and lower BBs overlapping the $3.25 weekly MSL trigger. Prudent investors can monitor for opportunistic pullback levels at the $3.33 fib, $3.25 weekly MSL trigger, $3.15 fib, $2.89 fib, $2.74 fib, $2.56 fib, and the $2.47 fib. Upside trajectories range from the $4.40 level up to the $6.34 fib level. Keep an eye on peer mortgage insurers MTG, NMIH, ESNT, and RDN as they tend to move together.

Before you consider Genworth Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genworth Financial wasn't on the list.

While Genworth Financial currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.