It also gives us time to invest in the markets and build a nest egg through compounding. Early retirement is possible, but you must develop the right mindset and plan meticulously. It will also require sacrifice, as learning to invest for early retirement usually means choosing which activities and trips to forgo to boost savings.

However, if you're interested in early retirement strategies, you've come to the right place. In this article, we'll discuss how to invest for early retirement, including concepts like FIRE, how to plan for early retirement and the types of investments you'll need to make to ensure you don't run out of money.

What is Early Retirement, Exactly?

The most commonly quoted retirement age is 65, but Americans can actually begin collecting Social Security at age 62. As lifespans lengthen, many people enjoy working well into their 70s and can still expect multiple decades of life in a post-career status.

The definition of early retirement will vary depending on the retiree. Still, anyone looking to retire in their 40s or early 50s will run into complications that older folks won't contend with — namely Medicare, Social Security and the ability to tap tax-advantaged retirement accounts without penalty. Learning how to retire early takes planning, which is why the FIRE retirement movement has gained notoriety.

What is FIRE?

FIRE stands for "Financial Independence, Retire Early." It's a lifestyle trend dating back to the early 1990s, when it appeared in the book "Your Money or Your Life" by Vicki Robin and Joe Dominguez. Participants in the FIRE movement devote themselves to a frugal lifestyle to become less reliant on work to provide necessary income. Instead, they save meticulously, develop a strict budget and reduce their dependence on work to fund their lifestyle. FIRE isn't for everyone, and participants often forgo leisure activities like traveling to save 60% to 70% of their income.

The 4% Rule

The 4% rule comes from financial advisor William Bengen, who researched various portfolio combinations in the 1990s and found that a 4% withdrawal rate allows most retirees to keep their portfolios intact for 30 years (or more). In the first year of retirement, the saver would withdraw 4% of the portfolio's value, followed by another 4% plus the inflation rate in year two, and so on.

In other words, if you have a $2 million retirement portfolio, you'd withdraw $80,000 in the first year of retirement. If inflation was 4% in year two, you'd withdraw $83,200 (since $3,200 is 4% of $80,000). If you're investing to retire early, the 4% rule is a helpful concept to learn.

How to Know You Can Retire Early

The retirement planning calculations will vary depending on lifestyle and age. For example, the plan for retiring in your 50s is different than the one for retiring in your 40s. If you want to retire at age 40, you'd likely need to prepare for 50 years of retirement living (depending on your health and family history). The Social Security Administration estimates that on average, 33% of retirees will make it to their 90th birthday — that's a long time to make your nest egg last!

If you want to know if you can retire early, you'll need to come up with a retirement number. This number should include the length of your expected retirement and the amount you plan to spend annually over this timeframe. In the example above, a retiree looking to have their money last 30 years with $80,000 in annual withdraws (before inflation) will need a $2 million portfolio. You must reduce your annual withdrawal rate to make a $2 million portfolio last 40 years. Because the math changes depending on a retiree's goals, the best retirement investments will vary from person to person. If you want some tools to get started, use MarketBeat's Retirement Calculator and play around with a few figures.

Learn more: How to Invest for Retirement at Age 60, How to Invest for Retirement at Age 50 and How to Invest for Retirement at Age 40.

How to Retire Early

So how to invest to retire early? One of the benefits of employment is the ability to use your human capital to make up for any turbulence in the capital markets. But once you've retired, you'll need to navigate the ups and downs of the market without the safety net of a paycheck. Managing funds for early retirement is different than a traditional retirement plan, especially since you won't have access to penalty-free withdrawals from Roth IRA and 401(k) accounts until age 59 1/2.

Step 1: Determine your average annual retirement spending.

What type of life are you planning to live in retirement? A lifestyle of traveling the world and taking adventures will require more annual income than a quiet life at home with a few beach trips in the summer. Projecting your annual spending rate gives you a target for a portfolio balance. Once you reach this balance, you can retire early with the security of knowing your spending needs will be met.

Step 2: Plan for the period before you can take Social Security and Medicare.

Health insurance often ties to employment, so early retirees must fill the gap before being eligible for Medicare. Early retirees usually need to pay for their insurance until Medicare kicks in, an expense you must plan for. Additionally, early retirees only have access to Social Security at age 62, and penalty-free retirement account withdrawals must wait until age 59 1/2. If you retire at 45 or 50, you'll likely need to pull money from taxable investment accounts or bank savings for a decade-plus.

Step 3: Invest in assets that can help achieve your goals.

Risk tolerance varies from person to person. Some retirees prefer a portfolio of bonds and fixed-income products, while others don't mind having growth stocks in the mix. Regardless of your risk tolerance, you'll need a portfolio that grows over time. Determining the right asset allocation is crucial to achieving your goals. The asset allocation early retirement mix often uses strategies like the three-bucket technique, where you keep short-term funds in cash, medium-term funds in bonds or dividend stocks and long-term funds in growth assets.

Step 4: Stick to your plan and prepare for the unexpected.

Once you've built an early retirement plan, you'll need the resolve to stick with it. Your money must last a long time, so keep frivolous spending to a minimum. Many early retirees want to return to work because the frugality of their lifestyle defeats the purpose of retiring. You'll also need to prepare for unexpected expenses like accidents, home repairs and health problems. A lengthy hospital stay can quickly deplete retirement savings, so ensure your annual spending plan has some wiggle room for emergencies.

7 Best Investments for Early Retirement

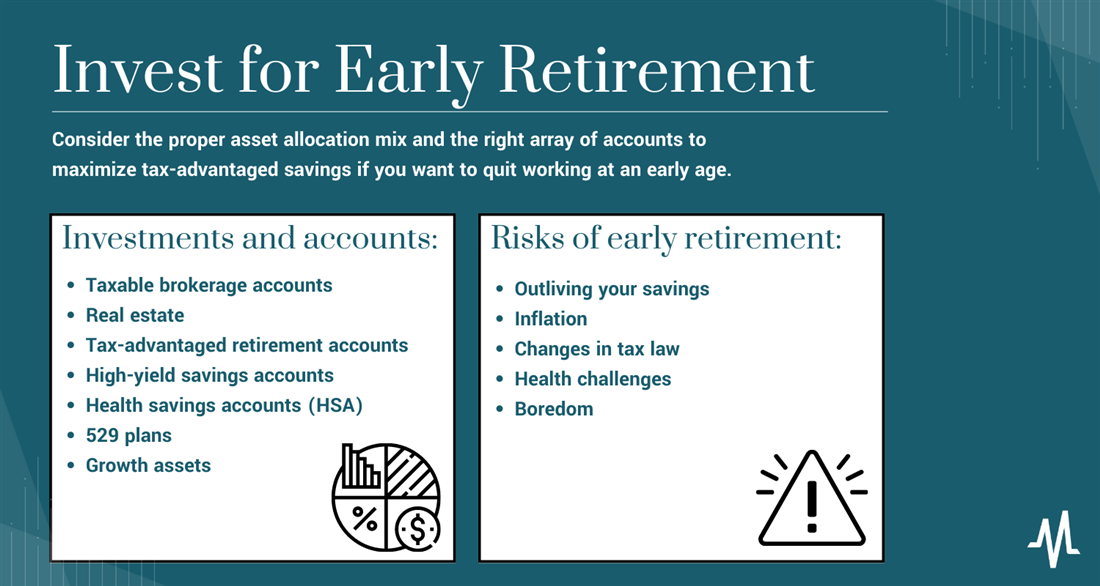

What are the best investments to retire early? Consider the proper asset allocation mix and the right array of accounts to maximize tax-advantaged savings. Here are seven investments and accounts to consider if you want to quit working at an early age.

1. Taxable Brokerage Account

Since you can't touch retirement accounts like 401(k)s and Roth IRAs until age 59 1/2, early retirees need another source to park investments. The best solution for that is usually just a traditional taxable brokerage account. Since you'll tap a taxable brokerage account first, it's generally considered a good idea to put less risky assets here and save the riskier investments for a Roth IRA or 401(k).

2. Real Estate

Real estate serves two purposes for retirees: an appreciating asset and a place to live. Many retirees use the proceeds from a primary home sale to bolster retirement accounts and downsize their living situation. Real estate adds diversification to a nest egg, but a house also carries costs that investments like stocks and bonds don't.

3. Tax-Advantaged Retirement Accounts

A traditional 401(k) account gives investors $19,500 in annual tax-deferred retirement savings. Roth and traditional IRAs offer another $6,000 in yearly tax-advantaged savings. These accounts typically comprise the bulk of a retiree's nest egg, but you can't tap them without penalty until age 59 1/2. Since early retirees must wait to access these funds, an aggressive asset allocation makes more sense here than in the taxable account.

4. High-Yield Savings Accounts

High-yield savings accounts frequently offer 3% to 4% rates, which generally lags the return of stocks and bonds but still helps preserve some purchasing power. High-yield savings are beneficial because you can withdraw them quickly in emergencies, and many even offer check and ATM services.

5. Health Savings Account (HSA)

If you've maxed out your tax-advantaged retirement accounts, an HSA is another option for tax-deferred savings. HSAs allow annual contributions of $3,650 for self-insured individuals and $7,300 for those with family plans. Withdraws are also tax-free if you use the proceeds for qualified medical expenses. To use an HSA, you must have an eligible health insurance plan and not enroll in Medicare.

6. 529 Plans

If you have children who plan to attend college, a 529 plan is another way to find tax-advantaged savings. 529s have no contribution limit, but withdrawals must go toward qualified education expenses, such as college tuition or private K-12 schooling. Certain education expenses have a $10,000 annual withdrawal limit, but each state offers different plans with different rules and investment options.

7. Growth Assets

Here's one that differs drastically from the blueprint for traditional retirees. When preparing for retirement in your 50s or 60s, the goal is to drop exposure to assets like growth stocks to lower the overall portfolio's risk. But if you want to retire early, you likely can't just sit on your nest egg at age 40 — you'll need it to keep expanding. This doesn't mean barrelling 100% into tech stocks, but you can't altogether remove market risk and expect your assets to keep pace with the cost of living.

Risks of Early Retirement

Retiring early has plenty of risks to consider as well. Here are five big ones to keep in mind when constructing your plan:

- Outliving your savings: Every retiree's biggest fear is running out of age in old age. Social Security and Medicare help, but you'll need a nest egg to draw from to live your desired lifestyle.

- Inflation: Loss of purchasing power is another threat to retirement savings. You can manage consistent moderate inflation, but inflation spikes (like in the last few years) can force unexpected changes in your spending plan.

- Changes in tax law: What tax brackets change? What if the government alters rules regarding Roth IRA withdrawals? Tax law changes can hamstring retirees, and there's little an early retiree can do to anticipate changes that may not come for decades.

- Health challenges: Other than perhaps housing, healthcare will be the biggest expense for most retirees. Even the most active and health-conscious individuals will feel the effects of aging at some point, and not preparing for health issues in retirement is a good way to exhaust your funds quickly.

- Boredom: What are you going to do all day? If your spouse, family and friends aren't following you into early retirement, you'll face much solitary time. Do you have enough hobbies and activities to keep yourself from getting bored? Inactivity can also lead to several health issues, so retirees must stay sharp physically and mentally.

Early Retirement: Sometimes The Dream Doesn't Match Reality

Early retirement may sound like a dream scenario, but everyone's experience will differ. If you find your career compelling and meaningful, early retirement could snatch away that sense of purpose. However, if you truly want to put the working world behind at an early age, you'll need a well-devised plan and the mindset to preserve your capital. Just know that this lifestyle is certainly not for everyone.

FAQs

Here are some commonly asked questions about investing for early retirement to help you plan, whether you want to learn how to retire in your 50s or learn about asset allocation early retirement tips.

How much money do I need to invest to retire early?

Your investment number will vary depending on your lifestyle and goals. First, you'll want to estimate how much you'll spend annually in retirement. Then calculate how long you expect to live in retirement and determine how much to save for that timeframe.

How much do I need to invest to retire at 55?

Again, it depends on your lifestyle and goals in retirement. A $2 million portfolio will be plenty for some 55-year-olds but not for others. You'll need to make the calculations based on your own retirement desires.

Does the 4% rule work for early retirement?

The 4% rule can work for early retirement, but remember that early retirees need their money to last at least a decade longer (or more) than someone who retires around the traditional age of 65. If you need help determining how to plan for a 4% withdrawal, an investment advisor can help you determine the best investments retirement advisors recommend.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...