Wells Fargo Is The Lagging Stock In A Lagging Sector

Wells Fargo Is The Lagging Stock In A Lagging Sector

Wells Fargo (NYSE:WFC) has had a rough couple of years. Scandal after scandal set the stock up for a big fall when the pandemic struck and now it is trading at the lowest levels in a decade. The upshot is the company has been working on its problems all the while, finally ripping the band-aids off to cope with the pandemic, and is now set up for a solid recovery. Consensus targets for revenue growth are not robust but growth is expected, it’s the earnings outlook and its impact on the dividend (along with the deep value) that has my attention.

"Wells appears to be ripping off the Band-Aid on capital adequacy actions and loan loss reserve build — both of which we believe positions the bank well to face upcoming COVID-related stress," Evercore ISI analyst John Pancari wrote in a note after the 2nd quarter earnings release. In that release, the company slashed its dividend to preserve capital and used the money to boost its credit loss provisions more than the analysts had expected.

Wells Fargo Has A Mixed Q3, Credit Quality Improves

Topline revenue came in at $18.86 for Wells Fargo. This is down -14.4% from the previous year but nearly $1.0 billion or 550 basis points above the consensus. The GAAP EPS of $0.42 reverses the loss posted in the 2nd quarter but fell short of consensus by ($0.03). Despite the miss, the 3Q earnings have the YTD total above the full-year consensus so I suspect some analysts upgrades and revisions lurking around the corner anyway. On a segment basis, net interest income declined $2.3 billion or 19.6% while non-interest a more tepid $0.891 billion or 8.5%.

The provisions for credit losses is where things get interesting. Wells Fargo increased its provisions for credit losses by $769 million which is about half the consensus. The provisions were offset almost entirely by an uptick in credit losses that left the total provisions virtually unchanged at $20.5 billion. The silver lining is the total provisions for credit losses increased as a percentage of loans to 2.22% and is now double its level of a year ago. The takeaway is that Wells Fargo continues to be well-capitalized in regards to its cash and ability to withstand credit-losses and charge offs.

“As we look forward, the trajectory of the economic recovery remains unclear as the negative impact of COVID continues and further fiscal stimulus is uncertain, but we remain strong with our capital and liquidity levels well above regulatory minimums,” said Chief Executive Officer Charlie Scharf.

The red-flag is in the earnings but there is a mitigating factor. Competitor JP Morgan Chase & Co. similarly increased its credit loss reserves but was able to beat consensus for EPS by a wide margin. The difference is that JP Morgan has not been dealing with restructuring and legacy issues the way that Wells has. Taking into account the $718 million in severance costs the company incurred, the GAAP EPS could have been as much as 35% higher. Looking forward, the analysts are expecting Wells earrings to grow in the range of 500% in fiscal 2021.

Wells Pays A Dividend, It’s Going To Grow

Wells Fargo pays a dividend but investors should be careful in how they look at it. The first glance I got said the yield was over 6.6% but that is on a trailing twelve-month basis. Based on the 2nd quarter distribution cut, the forward 12-month outlook is closer to 1.6% but there is a high-expectation of growth. The company’s earnings power relative to revenue will expand exponentially next year and position it to increase the payment if not bring it back up to where it was.

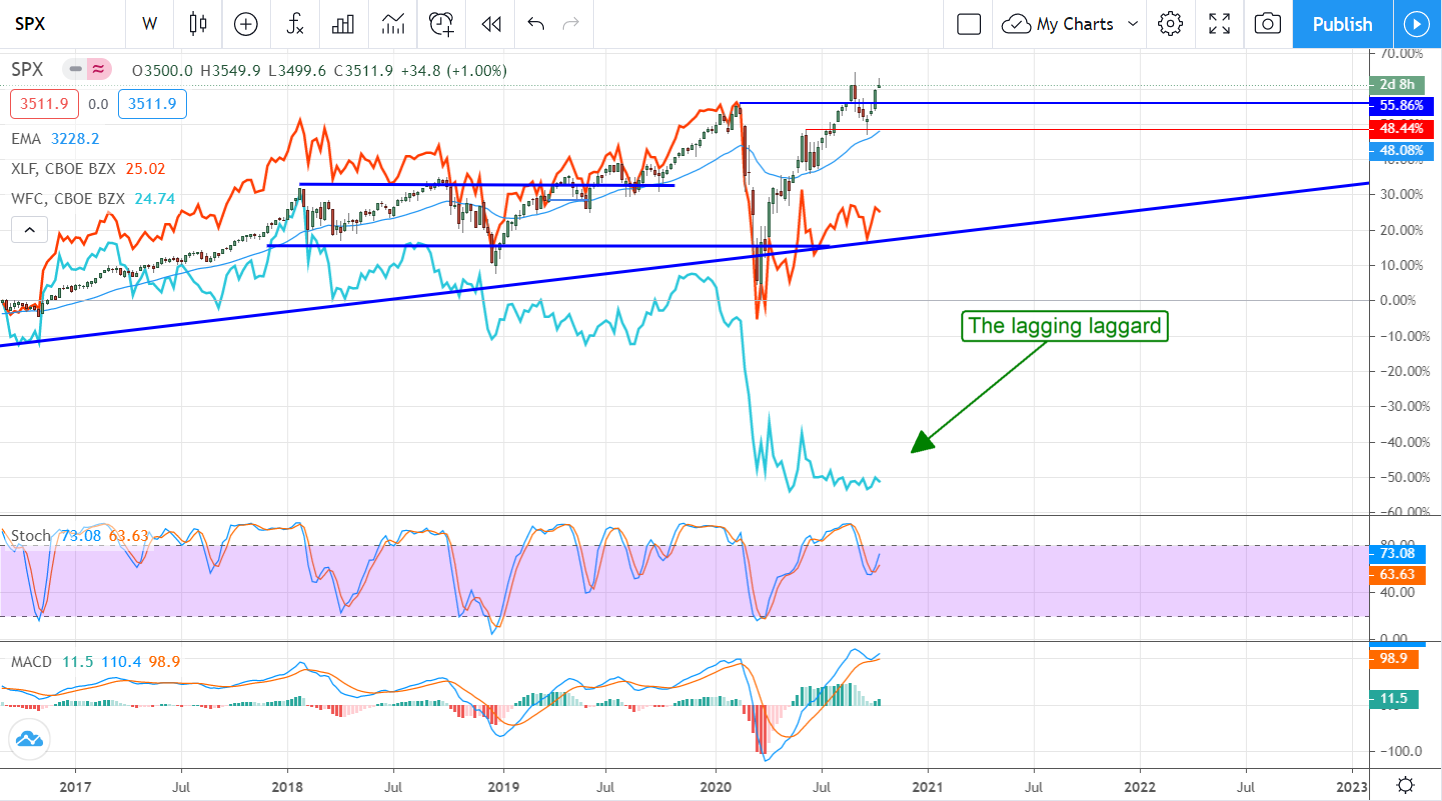

In terms of value, the stock is trading at a very high multiple relative to this year’s earnings but that is another bit of misinformation. Looking forward, the P/E drops to a low 11X earnings which bring it back in line with its peers. If the outlook for earnings next year is as off as they are for this the valuation is even lower and that can be seen in the chart. Not only has the financial sector been lagging the broader market during the rebound but Wells Fargo has also been lagging the financials. I think it’s ready to start catching up with its peers.

Before you consider Wells Fargo & Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wells Fargo & Company wasn't on the list.

While Wells Fargo & Company currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.