g class="alignleft" src="https://www.marketbeat.com/logos/articles/small_Depositphotos_386927726_s-2019.jpg" alt="J.B. Hunt Transport Services Is Driving To New All-Time Highs" width="400" height="266">

The Rebound In Trucking Is On

The J.B. Hunt Transportation Services (

NASDAQ: JBHT) Q1 results prove the rebound in trucking is on. The industry has been in high demand over the last year but struggled to

gain momentum until only very recently. The Q1 results are not only better than expected but point to solid demand and business expansion for this company in 2021. The key takeaways for us are the business is growing, the business is accelerating, and shares are breaking out to new highs because of it. Add in the dividend, its health, and the outlook for dividend growth and we think this stock could see 20% upside by the end of the year, if not sooner.

J.B. Hunt Drives Through The Consensus Targets

To say the analysts haven't been paying attention to this stock would be misleading at best. The community has been getting more and

more bullish on J.B. Hunt and trucking over the past few months, the problem is they've been overly cautious. The $2.62 billion in revenue reported by the company is not only

up 14.9% from last year it beat the consensus by 430 basis points. And this is on top of a difficult comp in the prior year, a quarter in which revenue grew 9% YOY which puts the gains in a whole new light. This company is accelerating its revenue sequentially and YOY with the economy on the verge of widespread reopening. As a trucking company and leading indicator of the economy, we take that as a very good sign and the results may have been better if not for the impact of weather.

On a segment basis, all segments saw growth. The Intermodal segment was the weakest with 2% YOY growth but it was also the worst hurt by the weather. Intermodal results were driven by a 5% increase in revenue per load offset by a 3% decline in loads. Intermodal is about 50% of the business and the core of revenue. The Dedicated Contract Services business, 36% of revenue, grew 7% on a 6% gain in efficiency and a 1% gain in fleet size. We read into this "more drivers" and take it as a very good sign of business growth because the shortage of drivers was the #1 factor holding the company back last year.

Moving on to

the growth segments which together account for the remaining 24% of revenue, growth was much stronger. The Final Mile Services business grew the weakest at 31% but these gains are definitely sticky. They are due to increases in contract obligations that are expected to keep the company busy (read "eCommerce fulfillment"). The Trucking and Integrated Capacity Solutions grew 43% and 56% respectively on strong demand in the J.B. Hunt MarketPlace. Total revenue through the MarketPlace grew 50% YOY.

The bottom line results are just as good if impacted by the pandemic, rising wages, recruitment costs, higher insurance premiums, IT Upgrades, and new systems (like the MarketPlace). Operating income increased 34% over last year to drive a 40% increase in profit margin. The GAAP EPS of $1.37 is not only up 40% from last year it beat the consensus by 17%.

The J.B. Hunt Dividend Is On Track For Growth

J.B. Hunt just

increased its dividend with the last payout so it may be a little while before the next one comes. That's good, though, because it will give the company ample time to outperform the consensus, grow its business, reap the rewards of economic reopening, and get itself set up to make a larger than average increase in early 2021. The company raised its payout by a mere penny per quarter over the past two years bringing the 5-year CAGR down to only 5%. Based on the Q1 results, the outlook for this year, the 18% payout ratio, balance sheet, and FCF the company could easily bump it up by $0.02 per quarter as it has done in the past. That would be worth about 7% of the current payout and bring the yield up to 0.7% from the current 0.65%.

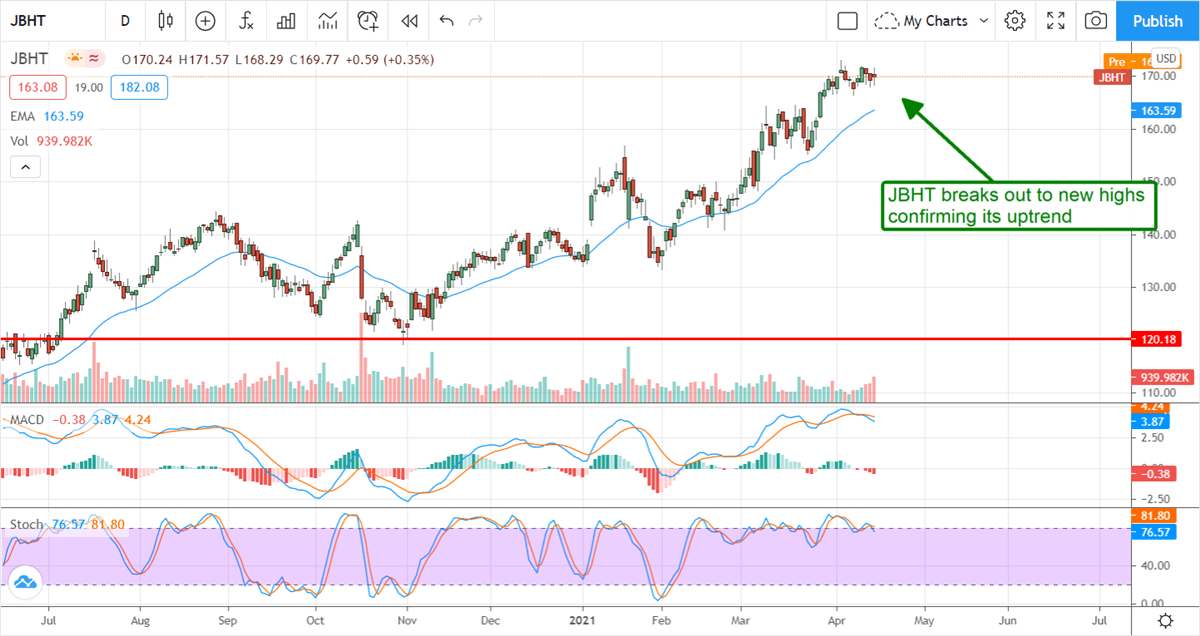

The Technical Outlook: J.B. Hunt Breaks Out To New Highs

Shares of J.B. Hunt are up about 2.0% in the pre-market and trading at a new all-time high. At this level, the stock is breaking out of a consolidation range and confirming the uptrend that began in late October 2020. With a break out in play, we see this stock moving higher by the end of the year and gaining as much as $34 or more.

Before you consider J.B. Hunt Transport Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and J.B. Hunt Transport Services wasn't on the list.

While J.B. Hunt Transport Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.