McDonald’s NYSE: MCD broke above $222 a share during yesterday’s trading session, setting intra-day all-time highs. Shares of the fast-food giant closed at $220.56, their second-highest all-time finish (MCD closed at $221.15 on August 9, 2019).

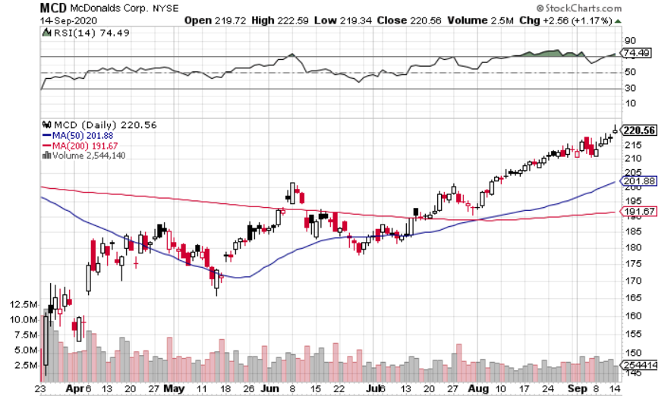

Let’s look at the chart and see if it’s saying buy now or wait and see:

On the one hand, McDonald’s has shown good relative strength recently, as most other stocks have corrected. The 50-day moving average crossed over the 200-day moving average a month-and-a-half ago, which is the sign of an emerging uptrend.

On the other hand, shares are in overbought territory and have been for much of the past month.

And most importantly, McDonald’s did not break out convincingly:

- It closed just below the all-time highs.

- Volume was light yesterday.

- Shares closed near the lows of the day’s range.

Not to mention, I would have liked to see McDonald’s consolidate around $215-220 for another week before breaking out.

Anything is possible, but McDonald’s seemingly doesn’t have the juice to make a nice move in the immediate future.

That said, this chart could quickly repair itself. It would just take another week or two of consolidating in the $215-225 range, followed by a convincing breakout to fresh all-time highs. At that point, it would be smooth sailing ahead – technically.

McDonald’s business faces more headwinds than its chart, but overall, the company is holding up well despite several pandemic-related challenges.

Comps Were Down in Q2 But Improved as Quarter Progressed

In Q2, McDonald’s same-store sales dipped 24% yoy globally and 8.7% yoy in the U.S. Analysts had expected same-store sales to decrease 20% yoy globally and 8% yoy in the U.S.

On the plus side, comps improved as the quarter progressed. Global comps were down 12% yoy in June, while U.S. comps decreased 2.3% yoy in June.

In July, comps have been slightly positive in the U.S. and down in the high-single-digits in International Operated Markets.

Beyond Meat NASDAQ: BYND Fizzling on the Grill?

The re-opening of restaurants has been largely responsible for the improvement, as McDonald’s had around 75% of its restaurants open at the beginning of the quarter, but now has nearly all of its restaurants open.

Drive-Thru Helped McDonald’s Outperform Its Peers

You never want to see revenue dip, but McDonald’s has actually significantly outperformed its peers.

With restaurant closures and social distancing requirements hurting dine-in, drive-thru has saved the day for McDonald’s.

Drive-thru accounted for nearly 90% of McDonald’s sales in Q2.

Even though delivery revenue has increased “significantly,” it still makes up less than 10% of sales in the U.S.

And it’s easy to see why:

McDonald’s has a low average check. A lot of people are spending $5 on their McDonald’s order, give or take, so it rarely makes sense to pay for delivery. Even with average checks increasing 30% in the U.S., it’s still not high enough to justify delivery in most cases.

Delivery will likely never be a major part of McDonald’s business – and that’s okay. Drive-thru isn’t a completely contactless experience, but it is much more so than dine-in. The high level of safety, combined with the fact that customers rarely have to drive far to get to a McDonald’s, means that drive-thru should help McDonald’s maintain most of its sales for as long as the pandemic lasts.

Breakfast Could be a Long-Term Challenge Though

With millions of people now working from home, McDonald’s breakfast revenue has decreased.

On the Q2 earnings call, CFO Kevin Ozan noted that, “Breakfast continues to be disproportionately impacted by disruptions to commuting routine.”

People are seemingly more willing to eat breakfast at home than other meals. A good percentage of people will return to the office post-pandemic, but work-from-home is here to stay in some capacity. That’s going to be a long-term headwind for McDonald’s breakfast sales.

Furthermore, this segment is starting to attract a lot of competition. On the Q2 earnings call, CEO Chris Kempczinski said, “Breakfast, as you know, prior to the pandemic was the only daypart that was growing, and so as a result, there were a lot of new competitors that were flooding into the breakfast daypart that certainly was one area of pressure for us.”

Wendy’s NASDAQ: WEN is one competitor that has created a successful breakfast segment this year.

McDonald’s Shares are a Bit Expensive

McDonald’s is trading at 38x next year’s earnings and 27x its projected earnings a year-out. That’s a little expensive, considering McDonald’s near-term headwinds.

The 2.26% dividend is nice, particularly since McDonald’s has been raising it for over 40 years, but it’s not going to make you rich.

All that said, McDonald’s has an incredible brand and business, and you really can’t go wrong betting on this company in the long-term.

If the chart shapes up, consider picking up some shares, and ride the trend for as long as it lasts.

Before you consider McDonald's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and McDonald's wasn't on the list.

While McDonald's currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report