Movado Group Exceeds All Expectations

Movado Group Incorporated NYSE: MOV is a great example of what we've come to love in the post-pandemic market. The company is a manufacturer and retailer of quality and high-end watches, and one whose business has bounced back from the pandemic slump with strength. Three of the four elements driving the company’s success are its brand, its capital management, and its leverage of e-commerce. Other companies, like Shoe Carnival NASDAQ: SCVL, are also leveraging e-commerce and producing sustained growth above and beyond the analyst forecasts. The 4th element driving the company's business, and this is true for Shoe Carnival as well, is its use of Salesforce.com NYSE: CRM CRM Analytics to track and engage with its customers.

“Our overall performance was driven by design innovation across our brands supported by powerful marketing programs,” says CEO Efraim Grinberg.

Movado Group Returns To Growth

Movado groups fiscal second-quarter 2022 earnings report is one of the best the company has ever given. The $173.87 million in net revenue is up 96.4% from last year and beat the consensus by 2400 basis points. Revenue was up 10% in the two years stack with US comps up 28% offset by a -3.9% decline in the international market. The international market is bouncing back in the wake of the pandemic and should help drive revenue strength in the coming quarter and second half of the year. Notably, the company says that sales growth was underpinned by eCommerce in both the Movado-owned channels and in their customer’s e-commerce channels. In total, eCommerce is up 70% with strength seen in the wholesale channels as well.

Moving down the report, the company experienced a 540 basis point improvement in gross margins that helped drive a significant beat on the bottom line. At the operating level, the company reversed a loss in the previous year to post Q2 GAAP earnings of $0.82. This compares to a loss of -$0.06 in the previous year and the consensus expectation for $0.33 this year. Looking forward, the company is expecting revenue strength to continue and has guided the full-year higher. The catch is that the $680 million to $695 million in expected revenue is short of the consensus $720 and pre-COVID business levels.

In our view, the guidance is very cautious even though it expects a marked improvement in second-half revenue. The second half of the year includes the holiday season which is seasonally the strongest period of the year. Assuming the company is able to only match its pre-COVID revenue level it will still exceed the consensus by at least 800 basis points. We think that's a low estimate too.

Movado Group May Increase The Dividend Soon

MarketBeat’s dividend history for Movado group shows an erratic history of dividend increases including a dividend suspension during the pandemic. That said, the erratic nature, including the suspension, is evidence of the company's efforts to preserve capital and maintain the fortress balance sheet. The takeaway for investors is that both revenue and free cash flow have improved and are expected to improve again/ This is helping the company build its cash reserves, pay the dividend and buy back shares. At the current payout, the dividend is worth about 2.2% and is less than 25% of the earnings outlook. If there was ever a company with a high probability of dividend increase, it's this one. Movado Group has $15 million left under the current repurchase program.

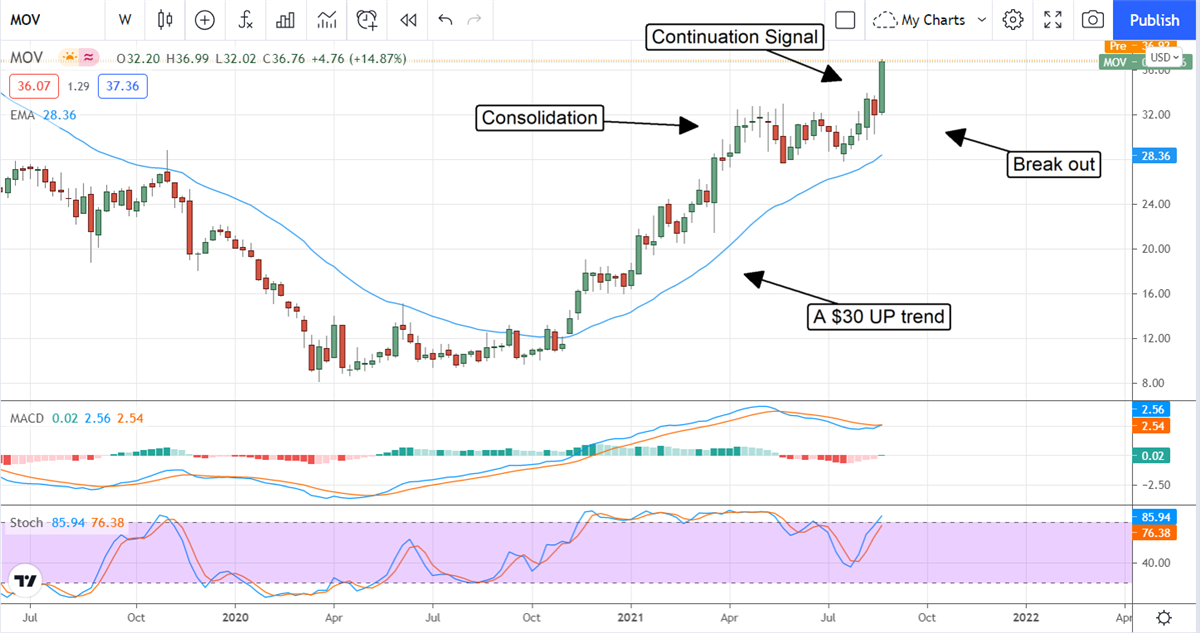

The Technical Outlook: Movado Group Moves Up Like Clockwork

Shares of Movado Group have been moving steadily higher since hitting the pandemic bottom. Most recently, price action has broken out of an important consolidation range and followed that up with a continuation signal. The signal is worth about $20 of upside which puts our target at $50 or about 35% of upside.

Before you consider Movado Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Movado Group wasn't on the list.

While Movado Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.