It’s been a wild ride for

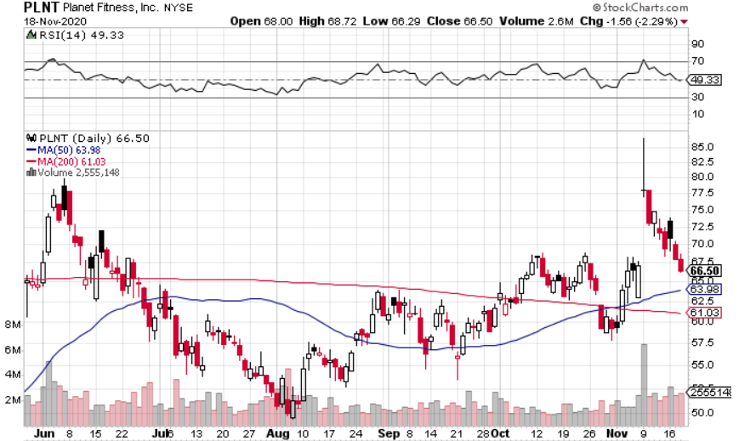

Planet Fitness NYSE: PLNT shareholders over the past two weeks. The gym chain reported earnings on Thursday, November 5, after the bell. Shares opened down 5.3% the next day, but quickly recovered, closing up nearly 1%.

On Monday, November 9, the price action got even crazier. Shares were up as much as 28.7% after the vaccine news came out, but gave back some of those gains, closing up 16.2%.

Peloton NASDAQ: PTON had been eating Planet Fitness’ lunch for much of 2020, but on that day, Planet Fitness flipped the script: Peloton shares cratered by more than 20% on November 9. Peloton shares have pared those losses a bit, but still sit 16.7% below where they closed on November 6.

Planet Fitness, on the other hand, has given back all of its November 9 gains. PLNT shares are currently 1% lower than they were right before the vaccine news came out.

When shares were up nearly 30% on November 9, I thought the rally was overdone. But it’s nonsensical for shares to be trading at roughly the same levels as they were pre-vaccine. Planet Fitness, after all, is set to benefit from a vaccine as much as just about any company. And now there may be a second vaccine on the way. Only increasing the chances that we will, in fact, be able to return to our old ways of life sooner rather than later.

Two months ago, I gave 5 reasons why Planet Fitness is set for a post-COVID boom. To recap:

- Existing franchisees have given Planet Fitness important votes of confidence.

- Comps were amazing pre-COVID – 53 straight quarters of positive same-stores sales growth.

- Planet Fitness is planning to double its number of locations from 2,000 to 4,000+.

- Low-cost membership makes it easy for people to come back.

- The valuation is attractive.

That piece was written prior to the release of Planet Fitness’ Q3 earnings. On the earnings call, Planet Fitness went into detail on something else that makes me optimistic about the company’s future.

Monetizing the Mobile App

Planet Fitness’ mobile app has the potential to really move the needle for the gym chain. Adoption of the app “remains at an all-time high.” Furthermore, “nearly 30% of the total membership base has adopted the mobile app.”

And its not just members that are downloading the app. A “meaningful percentage” of the users are nonmembers. The end game for Planet Fitness is to get these nonmembers to purchase a standard membership.

But the potential also exists for a paid digital membership, which Planet Fitness is currently in the process of testing. The membership would cost $5.99 a month, and would include digital fitness classes. Planet Fitness made it clear that it will “always offer free content via our mobile app,” which I think is the best course of action. Free app users are valuable leads and shouldn’t be given the choice between paying and going.

What really excites me though, is the potential for a digital bundle. A Planet Fitness membership only costs $10 a month. I’m guessing that there’s a good number of people that would be willing to spend, say, $13.99 to bundle the in-person and digital memberships. The extra $3.99 a month might not sound like much, but that’s around 40% more revenue (from those that buy the bundle).

Are “Pent-Up Cancels” an Issue?

On the Q3 call, Planet Fitness noted that it saw “a clear pattern of pent-up cancels upon reopening and resumption of billing.”

At the end of Q2, Planet Fitness had 15.2 million members. By the end of Q3, that number had dropped to 14.1 million. Planet Fitness hadn’t been billing its members if their locations were closed. The re-openings and resumptions of billing led many to cancel their memberships.

The million-dollar question: Will these people come back post-pandemic?

I think most of them will. Yes, some will probably workout at home in the long-run, but I think that will be a small percentage. The thing is, I don’t think Planet Fitness members were responsible for Peloton’s rise. There’s a big jump from spending $10 a month to spending $1,895+ up-front AND $39 per-month.

The Verdict

I think that Planet Fitness should be trading at least 10-15% higher than it was prior to the vaccine news, as it’s truly a game-changer. The fact that PLNT shares are actually slightly lower provides a golden buying opportunity.

Before you consider Planet Fitness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Planet Fitness wasn't on the list.

While Planet Fitness currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.