Global cinema and real estate operator

Reading International NASDAQ: RDI stock has rallied as regional economic reopening momentum improves. The acceleration of

COVID vaccinations is driving optimism and improving sentiment in the

epicenter industries hardest hit by the

pandemic. The growing belief that pent-up demand among consumers will result in a surge of traffic and return to growth should be tempered with the reality that the return to normal will inevitably be a “new” normal. The world’s largest cinema operator

AMC Entertainment NYSE: AMC has gained major headlines as a

“meme” stock following on the coattails of the history-making

GameStop NYSE: GMEshort-squeeze. This has inadvertently drawn attention and momentum into boosting peers like

Cinemark NYSE: CNK and

IMAX NYSE: IMAX. While it has brought money flow into the peer stocks, it also invited volatility. Reading International remains an under the radar play that prudent investors can monitor for opportunistic pullbacks to consider gaining exposure as a reopening trade.

Q3 2020 Earnings Release

On Nov. 11, 2020, Reading International reported its Q3 2020 earnings for the quarter ended October 2020. The Company reported EPS loss of (-$0.88) compared to $0.04 for the same period in 2019. Worldwide revenues fell (-89%) year-over-year (YoY) to $10.2 million, compared to $70.4 million. Operating loss was (-$14.3 million) compared to operating income of $7.4 million in same period 2019. Adjusted EBITDA was a loss of (-$11.6 million) compared to $9.1 million. All theaters in New Zealand are open and operating without social distancing requirements. The majority of theaters are open in Australia with social distancing restrictions, with the exception of seven. In the U.S. 13 of 27 theaters are open with social distancing restrictions in place. Global real estate revenues fell (-45%) to $3 million for an operating loss of (-$800,000) primarily due to the closure of three Live Theatres in the U.S. as a result of COVID-19. During pre-COVID the Company used cash flow from its cinemas to build long-term real estate assets. During the pandemic, the Company is leveraging its real estate assets to provide “needed liquidity” for its cinemas. As of Sept. 30, 2020, the Company had total debt of $274.1 million against total book value of $673.4 million with cash and cash equivalents of $27.8 million. Cinemas in New Zealand and Australia are recovering quicker than the U.S. theaters.

Conference Call Takeaways

Reading International CEO, Ellen Cotter detailed, “While 91% of our revenues today come from the cinema business, between operating and development properties we have over 12.8 million square feet of real estate in the United States, Australia and New Zealand, which are reflected in our September 30, 2020 balance sheet showing total assets of $673.4 million. At the end of the third quarter, we did a complete asset impairment analysis and determined no reductions in the carrying values of our assets were required.” CEO Cotter noted they are seeing very encouraging attendance trends in Australia and New Zealand “even without a regular diet of tentpole films”. She underscored how consumers are happy to “pay a premium” to go to a theater. Currently, only 63% of its cinemas are open and operating with only two major studio film releases in Q3 2020. She summed it up, “Generally speaking, we believe we entered the COVID-19 period better prepared for a shock to the system than some of our cinema peers. While we have reviewed a number of cinema acquisition opportunities in the U.S. over the years, we declined to pay the high multiples being demanded by such assets and focused on improving existing operations in the U.S., Australia and New Zealand.” There is no default on any leases and the total deferred rent is $11 million with repayment terms ranging from 12 to 36 months.

Reopening and Real Estate

CEO Cotter pointed out the focus beefing up real estate assets, “Over the past five years, we acquired Cannon Park in Townsville, the Telstra building on the Auburn Redyard property and the office building adjacent to Newmarket Village. In the U.S., we have deferred or passed upon other potential projects to focus on Tammany Hall.” She considers Tammany Hall a long-term asset in one of the “best” locations in the U.S. It’s considered a substantial capital reserve for the Company with only $40 million in debt. The Company plans to launch its own streaming platform in Q4 2020 called Angelika Anywhere offering virtual cinema screening programs arranged with specialty distributors along with curbside delivery of select menu-items directly from their kitchens to enhance the at-home movie experience. The pent-up demand for theater reopening tailwinds and strong real estate assets make Reading International dual reopening play.

RDI Price Action Analysis

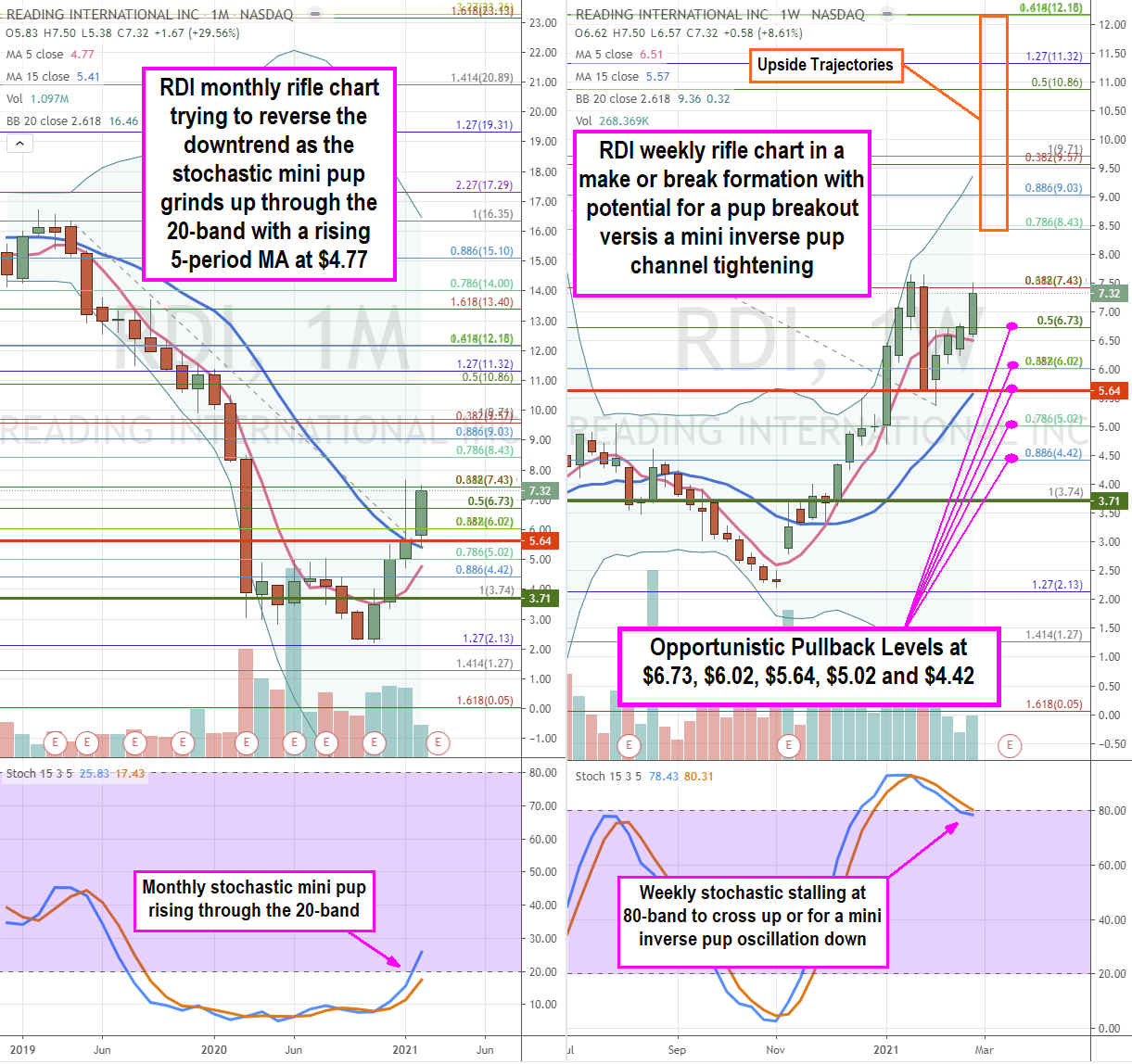

Using the rifle charts on the monthly and weekly time frames provides a broader view of the playing field for RDI shares. The monthly rifle chart is trying to reverse its downtrend as the rising 5-period moving average (MA) at $4.77 attempts to close the channel and crossover the 15-period MA at $5.41. This is powered by the monthly stochastic mini pup crossing up through the 20-band after 18-months below. The weekly rifle chart indicates a peak after three attempts to crack the $7.43 Fibonacci (fib) level. The weekly market structure low (MSL) buy triggered above $3.71, but also formed a weekly market structure high (MSH) sell trigger under $5.64. The weekly 5-period MA support is stalled at $6.51 as the 15-period MA continues to rise at $5.57. Prudent investors can watch for opportunistic pullback levels at the $6.73 fib, $6.02 fib, $5.02 fib, and the $4.42 fib. Upside trajectories range from the $8.43 fib up to the $12.18 fib. It’s prudent to also watch shares of peers AMC, CNK, and IMAX as these stocks tend to move as a group. It’s worth noting that volume can be thin so patience should be adhered to wait for a pullback rather than chase entries.

Before you consider Reading International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Reading International wasn't on the list.

While Reading International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.