Are you a REIT investor looking for diversification in your passive income streams? REITs are terrific vehicles for gaining exposure to the real estate market without going through the hassle of purchasing property. They're also imperfect assets with certain risks. A REIT alternative can mitigate some of these risks.

This article will share comparable alternatives to REITs and the risks involved with investing in these alternative assets.

Why Consider REIT Alternatives?

REIT stands for real estate investment trust, a fund that owns commercial or residential property in its portfolio. The rent or mortgage payments on these properties are where REITs derive their profits, which must be returned in large quantities to shareholders due to securities law.

To be considered a REIT, the company must meet the following qualifications:

- It must invest at least 75% of its capital in real estate, cash or cash-like assets (such as U.S. Treasuries).

- At least 75% of gross income must come from property-related businesses.

- At least 90% of a REIT’s taxable income must be repaid to shareholders as dividends.

REITs must also have a board of directors; at least 100 different people or entities must hold shares. A REIT is a company like any other, but these strict rules allow for certain tax benefits. Since most REITs return 100% of income as dividends, they frequently report no annual taxable income.

While these tax benefits may be good for the REIT as a company, they aren’t good for you as an investor. Dividend income from REITs is almost always considered ordinary income, meaning you pay the IRS at the standard rate, not the more beneficial capital gains rate. Since much of this industry’s return depends on dividend payouts and not share appreciation, REITs can create some inefficiencies in taxable brokerage accounts.

Alternative income REITs are available on private markets, but for most investors, you'll need to look to stock exchanges or crowdfunding to find assets similar to publicly traded REITs. Learn about five alternatives to REITs to add passive income to your portfolio.

How to Identify Great REIT Alternatives

Are REITs alternative investments themselves? Not in the traditional sense, but they have some unique consistencies that certain investors can appreciate. Since REITs must return 90% of profits to their shareholders, investors are used to consistent dividend income. Consider assets with a similar steady passive income stream when looking for REIT alternatives.

Many assets offer steady income payouts, but REIT investors likely want more upside than Treasuries or other fixed-income instruments can provide. And if you're looking for mortgage-backed securities (MBS), you might as well stick with public REITs.

For REIT alternatives, you want to consider assets with the potential for passive cash flow without excessive volatility. Market risk will always be in play when trading traditional securities on exchanges. Still, not every stock or ETF is as volatile as NVIDIA Corp NASDAQ: NVDA or Tesla Inc. NASDAQ: TSLA. The investments on our list offer consistent cash flow, low transaction costs and tempered volatility. Remember, all investments contain risk, and you'll need to understand the pros and cons of each of these REIT alternatives before investing.

5 Best REIT Alternatives

Take a look at the five best REIT alternatives below.

|

Strategy

|

Asset Class

|

Public/Private

|

Minimum

|

|

Dividend investing

|

Equities

|

Public

|

None

|

|

Homebuilder stocks and ETFs

|

Equities

|

Public

|

None

|

|

Farmland investing

|

Equity, Crowdfunding

|

Both

|

Varied

|

|

Real estate crowdfunding

|

Equity, Debt

|

Both

|

Varied

|

|

Private REITs

|

Varied

|

Both

|

$200,000

|

Dividend Investing

Dividends are often forgotten in investment returns because they don’t steal headlines like high-flying stock prices. But dividends from stable large-cap stocks and funds can simulate the steady income REITs provide while diversifying portfolios away from the real estate market.

You can usually find dividend stocks in less volatile market sectors like banks, industrials and consumer staples. Companies selling products with inelastic demand, like Proctor and Gamble Co. NYSE: PG, Walmart Inc. NYSE: WMT and Altria Group Inc. NYSE: MO, are often valuable assets in a dividend stock portfolio. Tobacco companies like Altria often pay high dividends to offset the negative connotations of their products to appeal to investors.

But you don't need to pick your dividend stock portfolio. There are many affordable dividend ETFs, such as the Vanguard Dividend Appreciation ETF NYSE: VIG, are available.

Like most Vanguard funds, VIG has a minuscule expense ratio (0.06%) and a vast portfolio of stocks spread across multiple U.S. stock sectors. The dividend yield of 1.82% is also higher than broad index funds like the SPDR S&P 500 ETF Trust NYSE: SPY.

Homebuilder ETFs and Stocks

Another alternative would be the companies constructing the homes and buildings, allowing REITs to collect their rent and mortgage payments. Companies like Toll Brothers Inc. NYSE: TOL are large-cap firms that design and construct residential and commercial properties.

Homebuilders frequently don't pay dividends on the level of REITs, depending more on stock price appreciation to reward investors (which has its pros and cons). But since homebuilders often don't move in lockstep with REITs, they can be good opportunities to diversify a portfolio while still having indirect exposure to real estate.

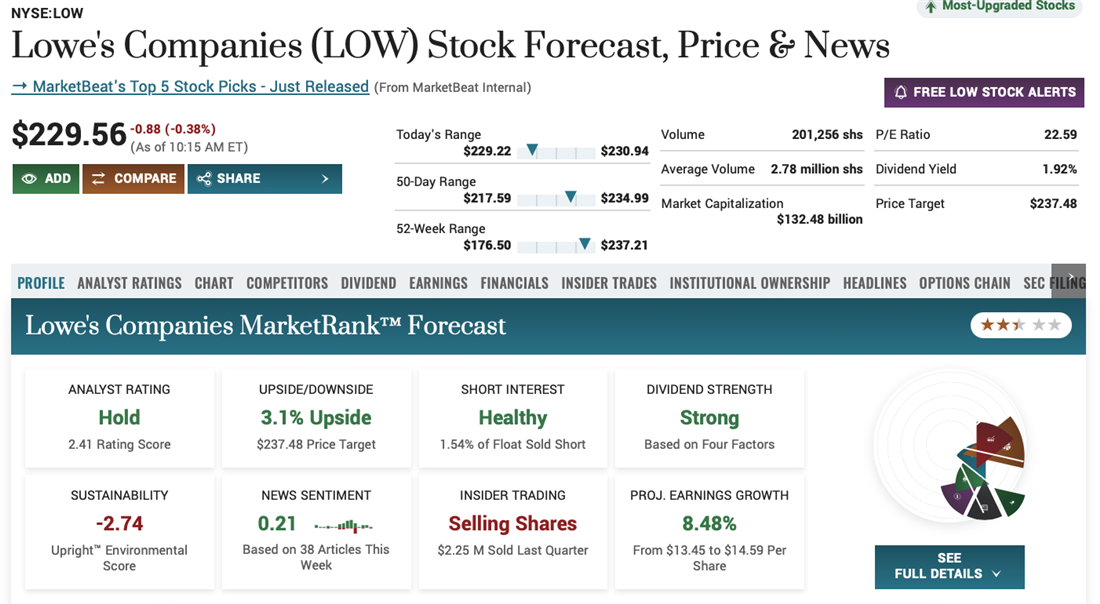

As with dividend investing strategies, homebuilders also have their own set of ETFs and mutual funds. One of the largest funds is the SPDR S&P Homebuilders ETF NYSE: XHB, which has over $1.3 billion in assets under management and a 0.35% expense rate. Construction companies like Toll Bros. are amongst its holdings, and it also has a strong base in HVAC companies like Lennox International Inc. NYSE: LI, Carrier Global Corp. NYSE: CARR and do-it-yourself retailers like Home Depot Inc. NYSE: HD and Lowe’s Companies NYSE: LOW.

Farmland Investing

Farmland Investing

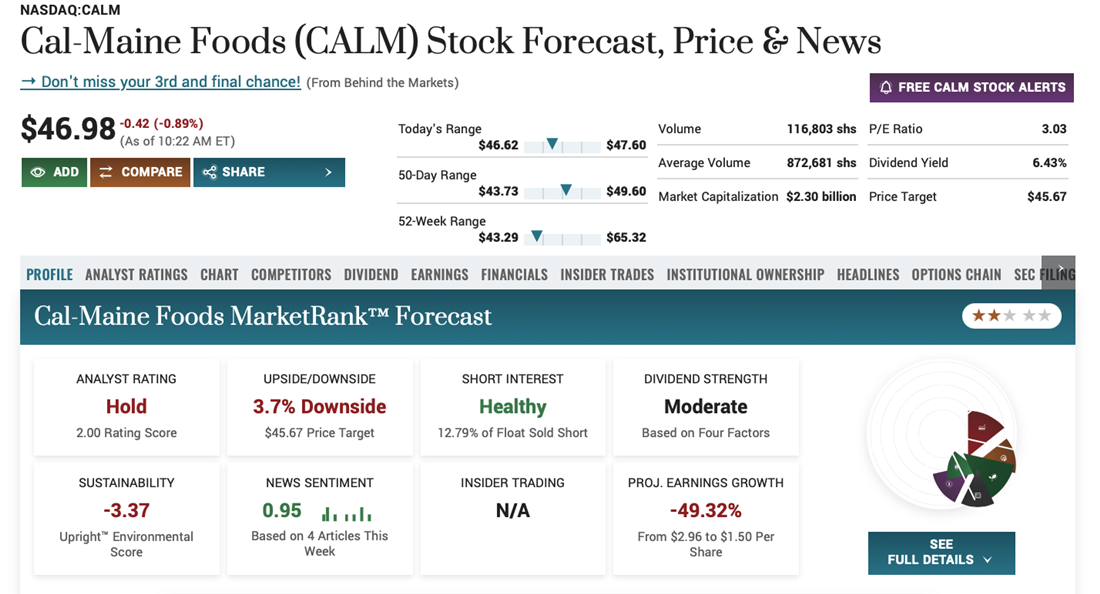

You don't need to raise chickens or grow corn to benefit from investing in farmland anymore. You don't even need to leave the comfort of public stock exchanges. Farmland stocks include food growers like Cal-Maine Foods Inc. NASDAQ: CALM and Nutrien Ltd. NYSE: NTR, equipment and product suppliers like Tractor Supply Co. NASDAQ: TSCO and agricultural ETFs.

Farmland ETFs come in two packages: agriculture funds that use commodities futures contracts, like the Invesco DB Agriculture Fund NYSE: DBA and those that invest in farmland stocks like the VanEck Agribusiness ETF NYSE: MOO, which has one of the best stock tickers on the New York Stock Exchange.

Another way to invest in farmland is through crowdfunding programs such as Harvest Returns, AcreTrader or FarmFundr. If you're a nonaccredited investor, you'll need to use Harvest Returns, which occasionally has 506(b) deals open to a limited number of retail investors. Deals on platforms like AcreTrader are only available to accredited investors.

Real Estate Crowdfunding

Real Estate Crowdfunding

One of the newer alternatives to REITs is the crowdfunding investment platform, which allows investors to purchase partial shares in individual properties and earn returns from both dividends (via rent and mortgage payments) and property value appreciation.

Fundrise is one of these crowdsourcing platforms, and it’s open to both accredited and nonaccredited investors. It works like this: Investors pool their money to purchase various properties in the United States, which Fundrise manages. As properties are leased and cash flows come in, investors receive quarterly dividends and potential share price appreciation. Fundrise charges an annual advisory fee of 0.15% on its investments, and the minimum to invest varies from deal to deal.

Yieldstreet is another crowdfunding platform with deals of varying size and scope. One helpful feature of Yieldstreet's platform is the ability to search deals by strategy (income vs. growth), minimum (usually around $10,000), physical location or property type. Deals range from single-family rentals to large industrial centers, and some are even eligible to be held in an individual retirement account (IRA), which can provide some serious tax benefits.

Private REITs

Publicly traded REITs are available to anyone with a brokerage account and the cash to purchase a single share, but private REITs are also available to accredited investors. However, this is only the land of accredited investors — no retail investors can purchase shares in private REITs.

What makes someone an accredited investor? For starters, you'll need to have earned at least $200,000 in taxable income in the last two years or $300,000 in income if you file jointly with a spouse, or have a personal net worth of at least $1 million, excluding your primary residence.

Why are accredited investor rules in place? It's not to keep retail from gaining an edge; it's because assets not marked-to-market (like private REITs) contain considered risk and have limited transparency. There’s a high rate of failure in private markets, and accredited investors can withstand substantial losses.

A private REIT still has to follow the rules of a public REIT, but the rest of the investment process and strategy can be opaque. For example, private REITs often have highly illiquid shares, meaning investors can only withdraw their capital in limited opportunities (if at all). Private REITs may also have conflicts of interest that may not be readily apparent.

Suppose you have accredited investor status and want to investigate the world of private REITs. In that case, you can start with a company like RealtyMogul, which offers two private REIT funds with different holdings and objectives (and minimums as low as $5,000).

Align Alternative Assets with Your Goals

A REIT is an acceptable investment vehicle for those who want real estate exposure without the hassle of property ownership or management.

Still, they also can be tax-inefficient and don't offer much stock price upside. Passive income through dividends can be part of a conservative investment strategy, especially for retirees on fixed budgets who care more about consistency than the upside.

However, if you're looking for REIT alternatives, you'll have no shortage of options. Some strategies like dividend investing can simulate the passive income payouts while offering a little more upside. Alternatively, you can invest in crowdfunding platforms and purchase actual shares of property deals for commercial, residential and even farmland real estate.

Of course, investing in alternatives to REITs also means learning about the risks and rewards of different classes of assets. Not all ETFs or crowdfunding deals will mesh with your investor goals, and you'll need to turn down those that don't fit your plan. Just because you have accredited investor status doesn't mean you should invest in exotic (but opaque) opportunities. Always know your timeline and risk tolerance before investing in any REIT alternative.

Methodology

The investment strategies vary based on asset class and strategy, but they all have at least two of the following four features in common with traditional REITs:

- Passive income potential: Dividend payments are an important part of a REIT investment. These assets all pay some form of a dividend to investors monthly, quarterly or annually.

- Direct or indirect exposure to real estate: Whether it's a homebuilder ETF, farmland supply company or crowdsourced multi-family deal, each of these strategies will have some correlation to the real estate industry.

- Low volatility: Passive income investors depend on stable prices for their plans. While real estate prices can be volatile occasionally, REITs tend to be less volatile than other market sectors. Since the investments on this list are more concerned with dividends than price appreciation, volatility should (in theory) remain below market averages.

- Minimal transaction costs: Most major brokerages have removed commissions, and REIT expense rates are low compared to other sector-specific funds. The investments laid out here all have a low cost of entry and fair fees in terms of expenses or advisory costs.

Before you consider Getty Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Getty Realty wasn't on the list.

While Getty Realty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report