Staffing, risk consulting and recruiting solutions provider

Robert Half International NYSE: RHI stock is a benefactor from the jobs boom as companies desperately seek

qualified talent. The Company is the world’s largest specialized talent solutions firm. The tight jobs market is amplifying wage

inflation as qualified candidates continue to dwindle. The Company is a solid

reopening play after treading water during the

pandemic. The acceleration of

COVID vaccinations is speeding up the recovery cycle as workers return to the office. The Company is known for its temporary and permanent staffing solutions but also has burgeoning auditing and risk consulting segment which should benefit from the reopening tailwinds. The recovery in the employment market is a boon to Robert Half specializing in the much-needed accounting and finance sector. The value of its temporary staffing solutions can’t be underestimated especially during uncertain and volatile periods where organizations may not have the resources or the market clarity to commit to full-time and permanent positions. Rather than overwhelm budgets, Companies are opting to buy time with temporary or

remote staffing before making the investment to commit to permanent positions. Prudent investors who understand this can watch for opportunistic pullbacks to scale into a position in Robert Half International shares.

Q2 FY 2021 Earnings Release

On July 22, 2021, RHI released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported earnings-per-share (EPS) profits of $1.33 beating analyst estimates for $1.04, by $0.29. Revenues surged 42.6% year-over-year (YoY) to $1.58 billion beating the $1.47 billion consensus analyst estimates. Robert Half International CEO Keith Waddell commented, "We achieved record levels of revenues and earnings in the second quarter due to a broad-based, global acceleration in demand for our staffing and business consulting services. We are particularly pleased with the strength of our permanent placement and Protiviti operations, which grew year-over-year revenues by 102 percent and 62 percent, respectively. Protiviti reached its 15th consecutive quarter of revenue gains with very strong growth in each of its solution areas. Return on invested capital for the company was 49 percent in the second quarter."

Conference Call Takeaways

CEO Waddell set the tone, “Companywide revenues were $1.581 billion in the second quarter of 2021, up 43% from last year’s second quarter on a reported basis, and up 40% on an as adjusted basis. Net income per share in the second quarter was $1.33, increasing 227% compared to $0.41 in the second quarter a year ago. Cash flow from operations during the quarter was $165 million. In June, we distributed a $0.38 per share cash dividend to our shareholders of record, for a total cash outlay of $42 million. We also acquired approximately 717,000 Robert Half shares during the quarter, for $63 million. We have 8.4 million shares available for repurchase under our Board-approved stock repurchase plan. Return on invested capital for the company was 49% in the second quarter.” He elaborated on the need for their solutions in this new normal, “Our staffing results continue to reflect a faster pace of recovery than we’ve experienced in the past. Clients have lean staff levels as they begin to expand, which is exacerbated by generally higher levels of attrition. Also, as they look remotely to fill their needs, clients are elevating the experience requirements for their job openings, which further adds to the demand for our services. The recovery is also very broad-based and spans across industries, client size, skill levels, geographies, and lines of business.” He noted a key statistic from the National Federation of Independent Business (NFIB) that says 56% of small businesses had no qualified applications and 46% had job openings that weren’t filled. He noted that Forbes named Robert Half International America’s Best Professional Recruiting Firm. He concluded, ‘A year ago, the world faced an uncertain future with extraordinary challenges ahead. Along the way we have continued to invest in our tenured, high performing workforce. We also strengthened our investments in advanced AI technologies, enabling our professionals to help clients with critical talent and consulting needs and find solutions across broad resource pools. As a result, we closed the quarter with an employee base that is more engaged and productive than ever, with all-time high revenues, and strong momentum leading into the second half.”

RHI Opportunistic Pullback Levels

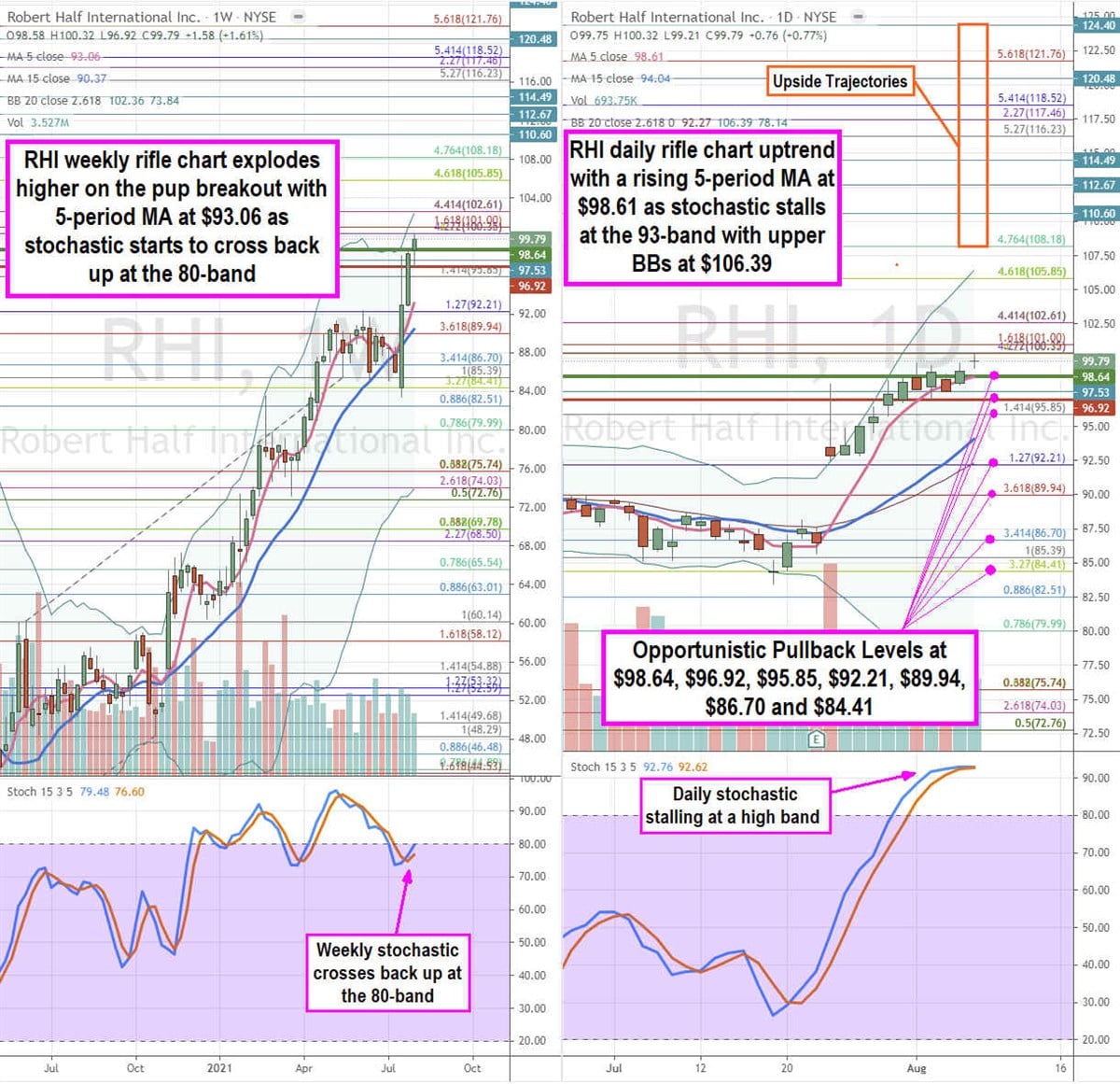

Using the rifle charts on the weekly and daily time frames provide a broader view of the price action playing field for RHI stock. The weekly rifle chart formed a powerful pup breakout that accelerated on earnings to form an initial peak off the $100.33 Fibonacci (fib) level. The weekly 5-period moving average (MA) support is still rising trying to catch up at $93.06. The weekly upper Bollinger Bands (BBs) sit near the $102.61 fib. The daily rifle chart has been grinding higher with a rising 5-period MA at $98.61, which also coincides with the weekly market structure low (MSL) buy trigger on the $98.62 breakout. However, there is a daily market structure high (MSH) sell trigger on a breakdown below $96.92 with the daily 15-period MA at $94.04. The daily chart is lofty with the stochastic stalling near the 93 band extreme overbought level. Prudent investors can monitor for opportunistic pullback levels at the $98.64 fib, $96.92 fib, $95.85 fib, $92.21 fib, $89.94 fib, $886.70 fib, and the $84.41 fib. The upside trajectories range from the $108.18 fib to the $124.40 level.

Before you consider Robert Half, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Robert Half wasn't on the list.

While Robert Half currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report