Canadian communications and media giant

Rogers Communication NYSE: RCI stock made new all-time highs at $64.55 before pulling back down despite the

relative weakness in

benchmark indices. The broadband provider is seeking to complete and integrate its buyout of Shaw Communications, which it acquired for $26 billion in 2021, in the first half of fiscal 2022 pending final approvals from the ISED and Competition Bureau of Canada. The Company is leading in

5G coverage and performance in Canada. Rogers Communication is hitting

milestones in its 10G initiative by successfully testing 8 gigabit symmetrical, upload and

download speeds over its fiber powered networks. Prudent investors seeking exposure in the broadband communications and media segment in Canada can watch for opportunistic pullbacks in shares of Rogers Communication.

Q1 Fiscal 2022 Earnings Release

On April 20, 2022, Rogers Communication released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an earnings-per-share (EPS) profit of CAD0.91 excluding versus consensus analyst estimates for a profit of CAD0.83, beating estimates by CAD0.08. Revenues rose 3.8% year-over-year (YoY) to CAD3.62 billion falling short of analyst estimates for CAD3.63 billion. The Company declares a 50 cents per Class B Non-Voting and Class A Voting share dividend. Rogers Communication raised guidance for total service revenue to increase 6% to 8%, up from 4.6%. The Company expects adjusted EBITDA to rise 8% to 10%, up from $6% to 8%.

Conference Call Takeaways

Rogers Communication CEO Tony Staffieri outlined the three focus priorities which include better business execution across all segments, increased investments in customer service and network infrastructure, and successfully completing the Shaw acquisition in 1H 2022. He detailed the progress made in the quarter on each of the priorities. Each of its segments delivered better than expected revenues and profitability by targeting the acceleration of efficiencies and process improvement opportunities. The wireless service revenue climbed 7% YoY from improved churn and ARPU growth. Post-paid mobile phone added 66,000 with ARPU up 3% to $57.25. Cable revenues grew 2% and adjusted EBITDA rose 13%. Media revenues grew 10% with the return of in-stadium revenues from higher sports-related advertising. The Company plans to spend $3 billion on infrastructure investment. CEO Staffieri commented, “As you saw yesterday, we announced a major milestone in our 10G initiative, where we successfully tested 8 gigabit symmetrical, upload and download speeds on our fiber powered networks. Impressive by any standard, this technology will become available to customers in the not too distant future.” The Company generated $800 million in cash flow from operations, up 20% driven by higher adjusted EBITDA.

Shaw Communications Acquisition

The Company received CRTC approval in March 2022 for its acquisition of Shaw Communications. The financing is completed from the debt offerings. The Company is awaiting on two government bodies receive approvals from, ISED and Competition Bureau in Canada. The Company believes these approvals will pass, “…both the Rogers and Shaw teams believe the strength of this transaction is compelling for all stakeholders, especially Canadians. As we move forward, our Shaw acquisition will truly allow Rogers to accelerate innovation and drive competition nationally. Importantly, together with Shaw, we will have the necessary scale to meaningfully bridge the digital divide and do neither of us could do on our own.”

RCI Opportunistic Pullback Levels

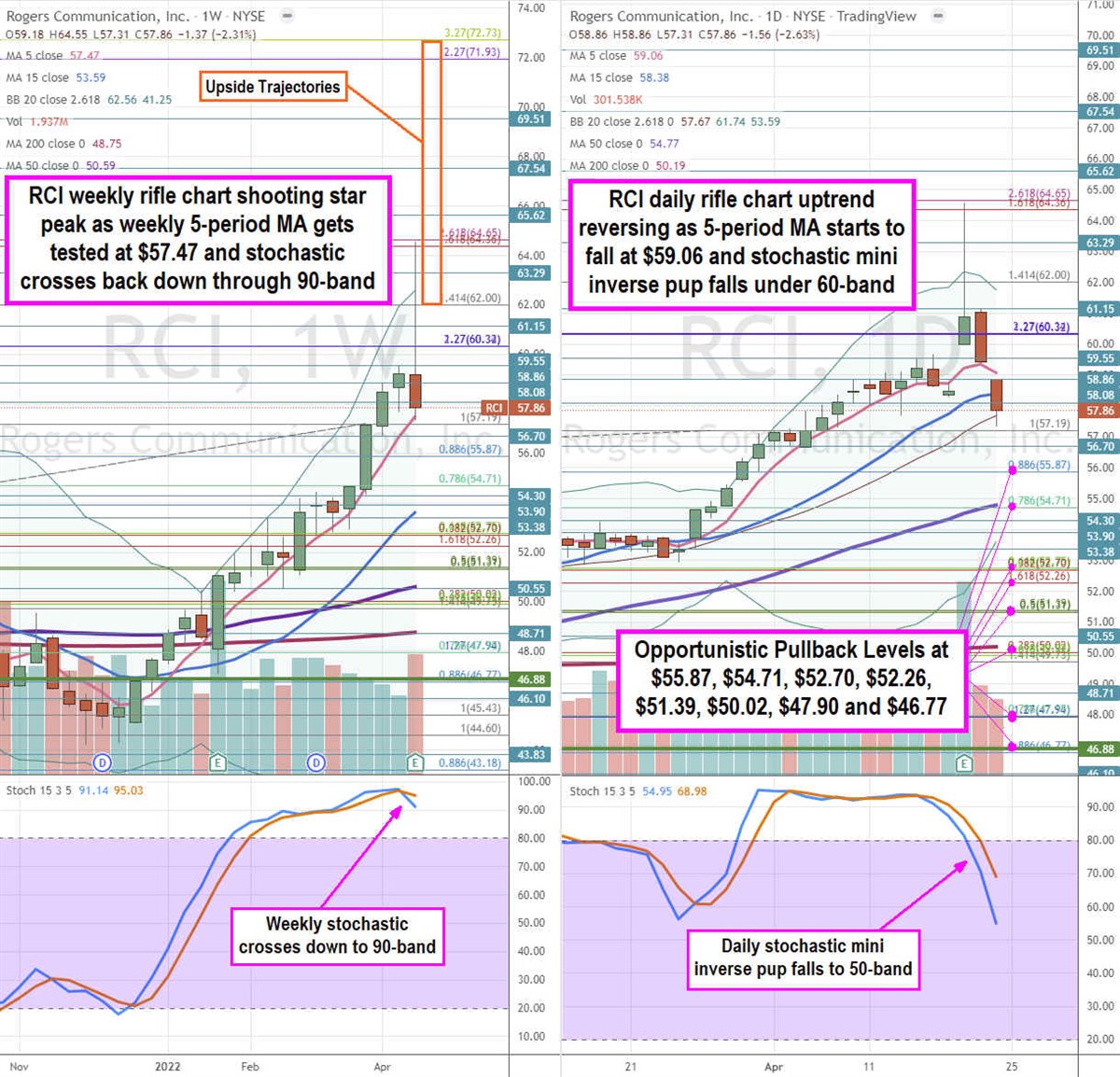

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for RCI stock. The weekly rifle chart peaked near the $64.65 Fibonacci (fib) level before falling sharply to the weekly 5-period moving average (MA) at $57.47. The weekly 15-period MA is rising at $53.59. The weekly upper Bollinger Bands (BBs) are at $62.56. The weekly stochastic peaked and crossed back down off the 100-band. The weekly 50-period MA support is at $50.59 and 200-period MA support sits at $48.75. The weekly market structure low (MSL) buy triggered on the breakout through the $46.88 level. The daily rifle chart uptrend stalled as the 5-period MA starts to slope down at $59.06 on a flat 15-period MA at $58.38. The daily 50-period MA sits at $54.77 and lower BBs sit at $53.59. The daily 200-period MA support sits at $50.19. The daily stochastic formed a mini inverse pup that fell through the 80-band oscillating down through the 60-band. Prudent investors can watch for opportunistic pullback levels at the $55.87 fib, $54.71 fib, $52.70 fib, $52.26 fib, $51.39 fib, $50.02 fib, $47.90 fib, and the $46.77 fib level. Upside trajectories range from the $62.00 fib up towards the $72.73 fib level.

Before you consider Rogers Communication, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rogers Communication wasn't on the list.

While Rogers Communication currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.