A Preemptive Strike

When the market saw the black swan of coronavirus approaching it reacted in the only way it could. Instead of waiting for this thing to hit, waiting to see how bad it might be, the market started selling. The general thought went something like this “it’s better to be on the sidelines than in the line of fire” What the market wasn’t expecting was just how deep the selling got.

A combination of factors was already in place that had the market set up for its fall. A declining outlook for earnings growth, super-high stock valuations, and technical conditions suggested the S&P 500 (SPY) could fall 25% to 35% and it did.

Now the market is bouncing from a strong support target raising the question, is the bear market over? The bounce is supported by low valuations, positive long-term broad-market outlook, high yields, massive amounts of stimulus, and a little bit of hope so there is reason to believe the bottom is in.

The combination of value, outlook, yield, stimulus, and hope may keep the market trending higher in the near-term, the problem is that one bounce does not a reversal make. The bottom may be in but there is likely to be resistance as the market moves higher. In my opinion, there will also be another round of selling or two if not a retest of the recent low. The good news is that, when those sell-offs occur, I expect them to produce strong buy signals across the broad market.

Earnings Season Will Be A Big Hurdle

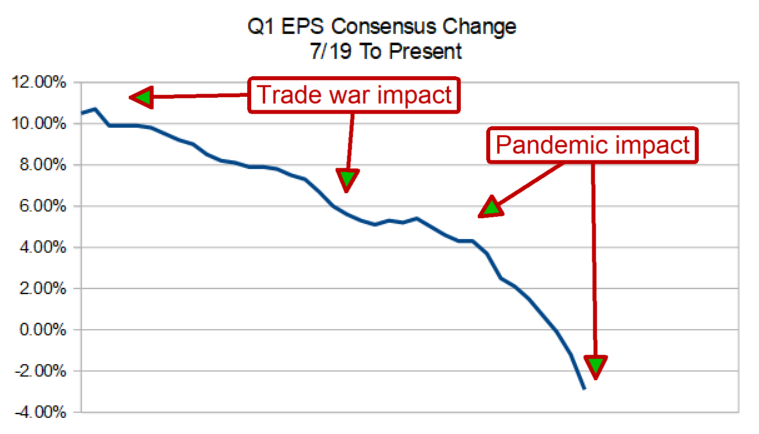

The first-quarter earnings season is fast-approaching and it is not going to be a good one. The consensus outlook for the S&P is mid-single-digit EPS contraction and the damage may be far worse than that. The consensus outlook has been falling like a rock since the coronavirus hit pandemic proportions and shows no sign of slowing. The deeper it falls the bigger the drag on market sentiment.

On average, the S&P 500 tends to beat the consensus figure at the start of each cycle by 5% so at these levels we may still see EPS growth in the 1st quarter. The risk for the market, though, is two-fold. The first is that EPS consensus will continue to fall and put the market back into EPS recession. The second is the analysts haven’t been bold enough in their downward revisions and the market will underperform. In either case, you can expect this to provide a drag on the market in the coming weeks.

The Bounce Is Strong And Momentum Is In The Bulls Favor

Because most economists and market analysts are still expecting GDP and EPS growth this year, we may not really be in a bear market, just a really deep correction and one that is still trying to discover “fair value”. Until we get some clarity in the form of EPS reports and corporate guidance the swings in volatility could be large. In this light, we can expect the market to move up, down and sideways over the next few weeks while the bulls and bears work things out.

On the weekly charts, the bounce from key, long-term, secular support looks strong even if it isn’t supported by the indicators. From the perspective of a momentum trader, keeping the long-term secular uptrend in mind, it looks like the market could make quite a large bounce before hitting its ceiling.

The daily charts have begun to look bullish but don’t let the signals fool you. Bullish crossovers in MACD and stochastic smack of buying activity but do not confirm a bottom is in place. There are a lot of investors and traders still reeling from this month’s selling and waiting for a chance to cut their losses. The bottom won’t be confirmed until support is retested and reconfirmed, and the market makes a new high.

In the near-term, if the rebound hasn’t already stalled, look for resistance between 2,635 and 2,710. If price action can get above there we may see a rally to 2,800 or even 3,000 before the earnings cycle begins. If not, traders should be ready for a possible retest of the recent low.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.