Build-A-Bear Workshop NYSE: BBW, Futu Holdings NASDAQ: FUTU, and SilverBow Resources NYSE: SBOW are all forming bases after previous rallies.

Build-A-Bear Workshop NYSE: BBW, Futu Holdings NASDAQ: FUTU, and SilverBow Resources NYSE: SBOW are all forming bases after previous rallies.

Areas of price consolidation following a prior run-up often precede a new uptrend.

That’s particularly true of companies with growing revenue and earnings, or other characteristics of leading investments, such as strong return on equity or healthy institutional support.

After a stock runs up, sooner or later it will retreat into a base as investors take profits. Far from being something discouraging, a base gives the next round of buyers a chance to enter at a lower price.

Eventually, big institutional buying can propel a stock to new highs. As the stock has enough upside momentum and institutional trading drives the price higher, retail investors can ride the wave.

Here’s a pitfall to avoid: Say you watch a stock form a base, and in hindsight, realize you could have made more if you’d entered earlier.

That’s a trap. Plenty of bases take months or even years to take shape, and you can’t necessarily tell whether a true uptrend has begun. If you try to nab a stock below a proper buy point, you may have to sit through a bigger downturn or get shaken out in a big selloff.

Build-A-Bear Workshop rallied to a six-year high of $21 on June 25, then pulled back. It’s currently holding 28.6% above its 50-day moving average, and 3.4% below its 10-day line.

It’s possible this consolidation may end up as a short pullback that presents a new entry point sooner rather than later, but it’s also possible it could form a base for a long time.

The company operates more than 400 retail locations offering customizable stuffed animals. It also sells stuffed animals and home party kits on its Web site.

The company next reports earnings on August 25, so there’s plenty of time to see whether it meanders along in a correction until then, or if it rallies ahead of results. As of now, the point to surpass is $21, but that could change if the stock forms a pattern such as a double bottom or cup with handle, which could offer a lower entry.

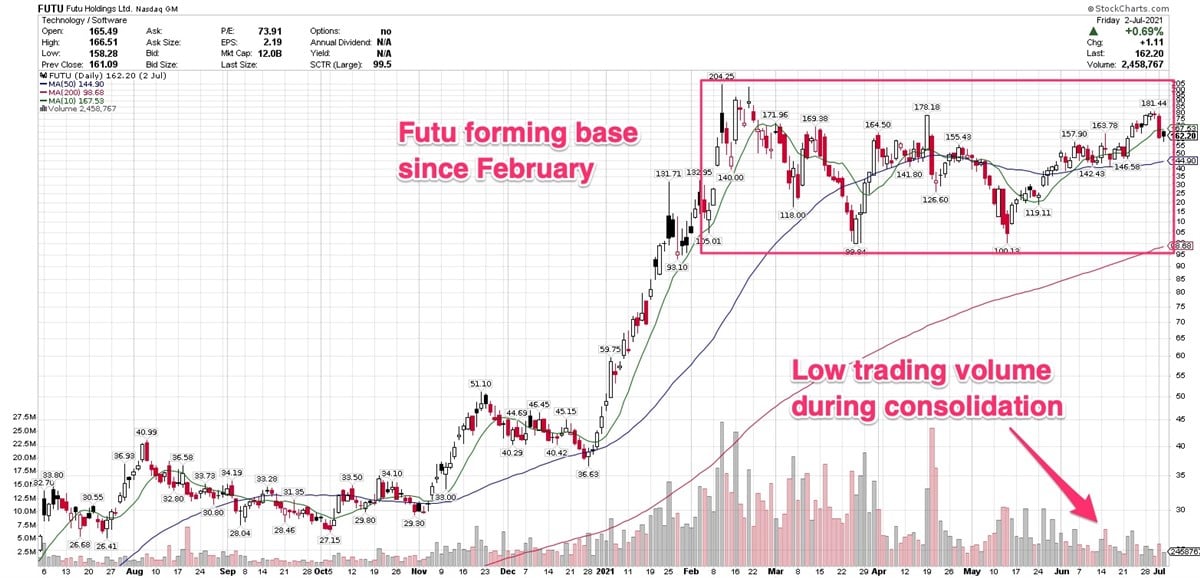

Futu Holdings, a China-based company that operates an investment brokerage platform, rallied to a high of $204.25 on February 10, following a rally of 254.54% year-to-date and 508.40% over the past 12 months. After that kind of run-up, it’s not at all surprising to see a pullback.

It’s currently forming a flawed double-bottom pattern. It pulled back once, then attempted a rally, hitting resistance at $178.18 before retreating again. The flaw is that the first leg down fell further than the second; you’d prefer to see the reverse, as a lower decline on the second leg shakes out remaining weak holders, and can set the stage for a healthy rally.

Futu offers a textbook example of a company with strong fundamentals, which makes it a good candidate for additional price gains. Revenue growth accelerated for the past six quarters, and earnings grew at triple-digit rates in the past five quarters.

Analysts see earnings growing a whopping 161% this year, to $3.32 per share. That’s expected to grow another 45% in 2022.

SilverBow Resources, a Houston company that specializes in oil and gas exploration and production, is consolidating below its June 23 high of $26.05.

Shares closed Friday at $24.34, up $0.88, or 3.75%. Friday’s price action put the stock 0.10% below its 10-day average, and 37.5% above its 50-day line.

This is another stock that’s posted triple-digit gains recently, advancing 358.38% year-to-date and 655.90% in the past year.

This is another pullback that may rally back quickly, or go on to form a recognizable base pattern. It’s too soon to say.

However, if the stock continues its rally and bounces decisively off its 10-day line in heavy upside volume, investors may find an entry point as it passes $26.05. This company reports earnings on August 4, so a miss or beat could serve as a catalyst in either direction, as could information contained in the release that either worries or cheers analysts.

Before you consider Build-A-Bear Workshop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Build-A-Bear Workshop wasn't on the list.

While Build-A-Bear Workshop currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report