Another week has passed with shares of Meta Platforms NASDAQ: META outperforming the overall market, closing the prior week up 0.38% while the overall market was down almost 1%.

META recently made headlines after the company hosted its annual Connect product conference. It has continued to buck the overall market trend and remain firmly above its critical support.

The company also finds itself on the Top-Rated Stocks list, a list of 100 companies that have received the highest average rating among equities research analysts in the last twelve months, and is one of the Most-Upgraded Stocks, a list of companies that have been upgraded by Wall Street analysts most frequently during the previous 90 days.

So, as the fourth quarter begins, could META be a top pick and smart investment choice? Let's take a closer look at the news and technical setup.

META Announces Product Updates and Launch During Connect

Meta Connect 2023 spotlighted the Meta Quest 3, which received significant attention in the tech community. This new mixed-reality device aims to compete with Apple's Vision Pro headset, capitalizing on Apple's reported production delays.

Alongside this announcement, Meta unveiled a range of innovations, including the well-received Ray-Ban Meta smart glasses, the Emu text-to-image model, Meta AI for chatbots, and AI Studio for custom chatbot development.

These developments underscore Meta's commitment to making metaverse technology affordable and accessible. Mark Zuckerberg, Meta's CEO, emphasized this aspect during his keynote address, highlighting the importance of inclusivity as the company works toward its metaverse ambitions.

Analysts are Bullish on META

A host of analysts reiterated their ratings and boosted their price targets following the Connect event. Guggenheim reiterated its rating and increased its target from $375 to $380, seeing just over 27% upside for META. Notably, Morgan Stanley reiterated its rating as Overweight with a price target of $375, as did JPMorgan Chase & Co., with a price target on the high end at $425.

Overall, META has a Moderate Buy rating based on fifty-two analyst ratings. Of the fifty-two, forty-four have the stock as a Buy, one as a Strong Buy, five as Hold, and just two as Sell. The consensus analyst price target of $320.34 sees almost a 7% upside for the stock, which is impressive considering that META is already up nearly 150% year-to-date.

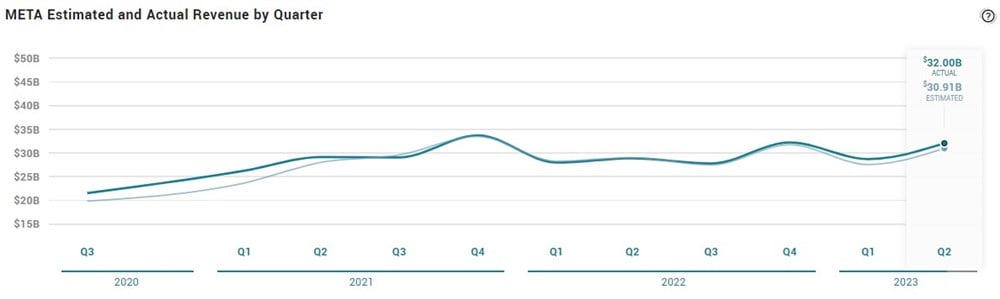

A Snapshot of META's Earnings

In its latest earnings report on July 26, 2023, Meta Platforms exceeded expectations with earnings per share (EPS) of $3.23, surpassing the consensus estimate of $2.87 by $0.36. The company reported quarterly revenue of $32 billion, exceeding analyst estimates of $30.91 billion. Over the past year, Meta Platforms has generated $8.58 in earnings per share and maintains a price-to-earnings ratio of 34.9. Analysts anticipate a 26.92% earnings growth for the company in the coming year, increasing from $13.26 to $16.83 per share.

META Continues to Hold Over Key Support

The range of META has continued to contract, along with the convergence of short to medium-term key moving averages, like the 5-day SMA and 50-day SMA. The price action can be seen as bullish, as the stock has recently outperformed the overall market and remains steadily above its rising 200-day SMA. A move above the resistance of the wedge pattern would signal a breakout and the potential for the continuation of the stock's uptrend.

Before you consider Meta Platforms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meta Platforms wasn't on the list.

While Meta Platforms currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.