Toy products maker Mattel, Inc.

NYSE: MAT has seen its shares continue to flounder as kids migrate to digital forms of entertainment. The bankruptcy of Toys ‘R Us marked the end of an era, both in terms of distribution and the preferences of the digital nomads of Generation Z. This evidenced by the 6.51-percent average five-year average revenue decline. Mattel just announced on Feb. 9, 2020, the closing of two factories in Asia and plans to close another factory in Canada as moves to outsource production in hopes to grow efficiencies in its global supply chain. JPMorgan expects a turnaround with the new management team, cost cutting and potential margin improvements from China tariff relief. Mattel bolstered their socially conscious ‘inclusive’ Barbie line and environmentally friendly bio-plastic sets for it Mega Bloks brand in partnership with privately held Lego. Investors await more visibility on the turnaround amidst negative industry sentiment.

Earnings Catalyst

Mattel reports Q4 2019 earnings post-market on Thursday, Feb. 13, 2020, followed by the 5:00 pm EST conference call. Consensus analyst estimates are for $0.02 EPS on revenues of $1.498 billion. Sentiment in the toy business turned negative following the Target NYSE: TGT Q4 2019 earnings release on Jan. 15, 2020, which revealed softness in the electronics and toys categories. More recently, Funko. Inc. NASDAQ: FNKO shocked investors with its Q4 2019 earnings shortfall and lowered guidance on Feb. 6, 2020, collapsing shares by nearly 50-percent. Key competitor Hasbro NYSE: HAS reports Q4 2019 earnings results two-days earlier on Tuesday pre-market on Feb. 11, 2020. Reaction to HAS earnings will shape the narrative heading into Q4 2019 results. However, it is worth noting the 44-percent of the float short interest as of Jan. 15, 2020. The sentiment bar may be set low enough to spur a potential short squeeze on any bullish surprise in forecast. Mattel also has the New York Toy Fair Analyst Day scheduled the following week on Feb. 21, 2020.

Rifle Chart Technical Analysis Trajectories: Longer-Term

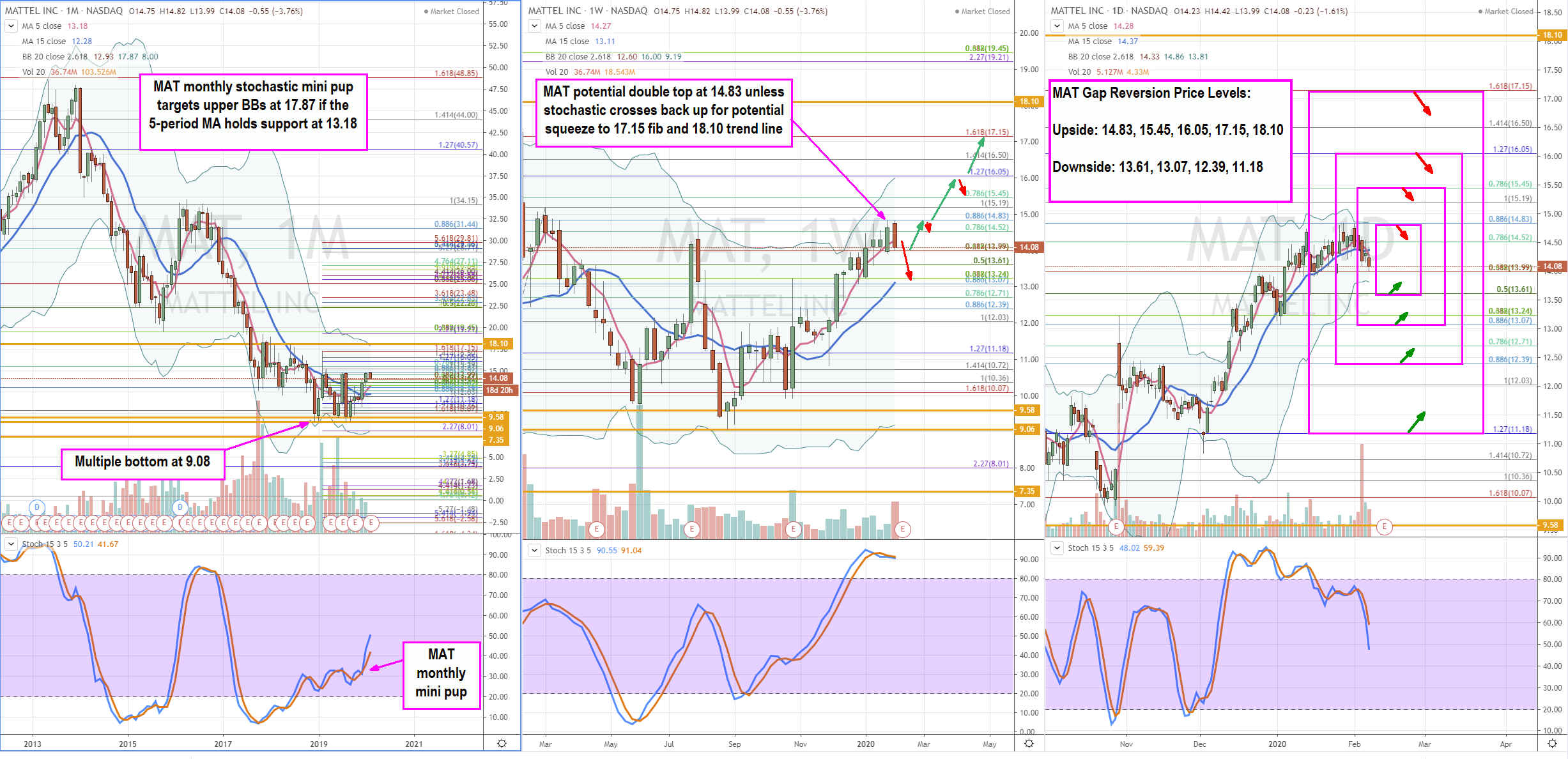

Utilizing the rifle charts on wider time frames suitable for swing traders and investors. MAT shares rallied back to the 14.83 Fibonacci (fib) level after establishing a multi-bottom at 9.08 in Sept. 2019. The monthly stochastic formed a bullish mini pup with 5-period moving average (MA) support at 13.18 with upper Bollinger Bands (BBs) at 17.87. The weekly stochastic peaked but still above the 80-band. A stochastic slip to the 80-band could trigger a channel tightening down through the 5-period MA at 14.27 towards the 15-period MA at 13.07 before coiling. This would also establish a double top at the 14.83 fib. The daily stochastic is currently falling as a potential breakdown forms if the 13.61 fib fails to hold support.

Sympathy Stocks

MAT earnings gap can impact HAS, FNKO and JAKKS Pacific NASDAQ: JAKK. Depending on which way HAS gaps on its earnings release the day before, expect MAT to accelerate downside for sympathy stocks if it gaps down. A strong gap up could trigger a spring-like coil on FNKO especially if MAT also expects/forecasts topline strength in the “back-half” of 2020, which echoes what FNKO management believes.

Trading Game Plan: Short-Term

This information is accommodative to intraday and short-term traders. MAT tends to move in a smaller range during a normal trading day. However, earnings reactions have recently resulted in price moves in excess of 15-percent for the past three quarters. Active traders should focus on trading the gap patterns in the morning session for the best volatility. Volatility can be expected but liquidity is abundant, and spreads will get tighter as the day wears. Nominal scalps ranging from 5-cents upwards of 30-cents can be expected the morning after the earnings release. Reversion scalps off the key price inflections levels can be played for the second gap reaction then shift focus to the third reaction trend move.

The gap price reversion levels for the upside gaps are: 14.83 fib, 15.45 fib/sticky 5s zone, 16.05 fib, 17.15 fib, 18.10 trend line. Downside gap reversion price levels are: 13.61 fib, 13.07 monthly 15-pd MA/fib, 12.39 fib/sticky 2.50s zone and 11.18 fib. If MAT gaps up over 20-percent, then monitor FNKO for an oversold bounce especially if it trades around the 7.50s sticky-price zone.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

We are about to experience the greatest A.I. boom in stock market history...

Thanks to a pivotal economic catalyst, specific tech stocks will skyrocket just like they did during the "dot com" boom in the 1990s.

That’s why, we’ve hand-selected 7 tiny tech disruptor stocks positioned to surge.

- The first pick is a tiny under-the-radar A.I. stock that's trading for just $3.00. This company already has 98 registered patents for cutting-edge voice and sound recognition technology... And has lined up major partnerships with some of the biggest names in the auto, tech, and music industry... plus many more.

- The second pick presents an affordable avenue to bolster EVs and AI development…. Analysts are calling this stock a “buy” right now and predict a high price target of $19.20, substantially more than its current $6 trading price.

- Our final and favorite pick is generating a brand-new kind of AI. It's believed this tech will be bigger than the current well-known leader in this industry… Analysts predict this innovative tech is gearing up to create a tidal wave of new wealth, fueling a $15.7 TRILLION market boom.

Right now, we’re staring down the barrel of a true once-in-a-lifetime moment. As an investment opportunity, this kind of breakthrough doesn't come along every day.

And the window to get in on the ground-floor — maximizing profit potential from this expected market surge — is closing quickly...

Simply enter your email below to get the names and tickers of the 7 small stocks with potential to make investors very, very happy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.