It’s Time To Get Ready For The 3rd Quarter Reporting Season

It’s Time To Get Ready For The 3rd Quarter Reporting Season

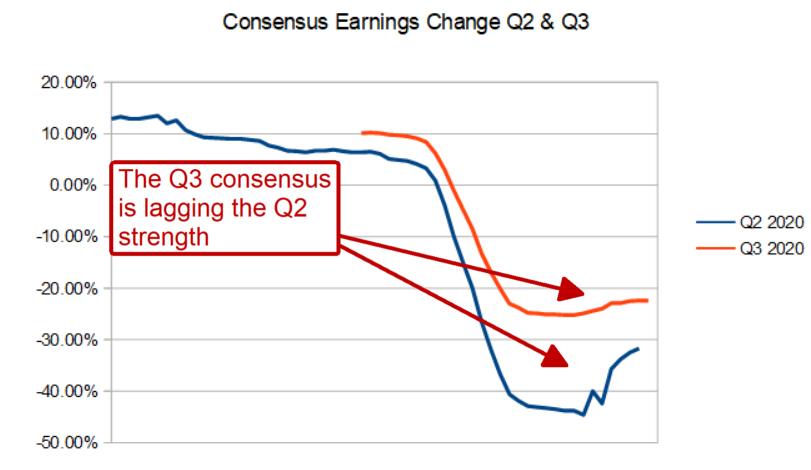

There is a situation developing in the market that you need to know about. The analysts have begun to issue their updates and the news is good. I can’t say I haven’t been warning you, this was bound to happen, the consensus estimates for the 2nd quarter and full-year were far to low, the rebound stronger than anticipated, which can only result in upward revisions from the analysts.

This is a very significant event. Much bigger than just a revamp of the outlook for this year. The analysts haven’t delivered a quarter of upwardly trending revisions for the S&P 500 (NYSE:ARCA) since the 2nd quarter of 2018. That’s a long time, I know, I’ve been waiting for this since the last time it happened because it is a very powerful bullish catalyst for stock prices.

What this means for the market is astounding. Not only is the trajectory of earnings growth positive, as in negative growth is expected to shrink in the 3rd and 4th quarters, but negative growth is also expected to turn positive and accelerate in 2021. With the analysts upping their targets, estimates, and ratings, there is really no reason not to be a buyer because there is a significant tailwind driving the market and it is going to blow for several quarters at least.

It’s Time To Buy, But Look For Value

Many of the stocks leading the rout are the ones who’ve seen the biggest gains in share prices since the pandemic-bottom. Even with the pullback, many of them are still trading at significantly higher valuations than their peers highlighting the need to focus on valuation. The trends driving the stock market today have not played out and those undervalued stocks will soon come into favor. What were are witnessing is not so much a correction but a rotation from the first round of winners to the second.

The upgrades I see today illustrate that point. Not one but three separate sell-side analysts issued statements on socks in three different sector groups all saying the same thing. This stock represents a value compared to its peers and is well-positioned to deliver shareholder value over the next year.

Wedbush added Bed Bath & Beyond (NASDAQ:BBY) to its Best Ideas list. They say the company is still trading at distressed valuations despite positive comps and an obvious return to profitability. Spotify (NASDAQ:SPOT), a music-streaming service, was upgraded to Outperform from Neutral at Credit Suisse. They point to growing subscriber numbers and the fact major labels are using the Marketplace to promote new music. Goldman Sachs upgraded Sanderson Farms (NASDAQ:SAFM) to Buy from Neutral citing its valuation and low consensus estimates in the poultry group, a double-tailwind for this stock. All are up at least 2.5% in premarket trading, two more than 5%.

The Technical Outlook: The S&P 500 May Fall Further

The technical outlook for the S&P 500 is a little mixed. The index just suffered a 7% decline and is indicated lower but there are already signs of support. The question is whether support is temporary or long-lasting and if the index will fall further or rebound. In the bull-case, the index is still in an uptrend and showing signs of support at/near the short-term moving average and the previous all-time high. If the market can hold this level and put in a bottom we will likely see new all-time highs within a few weeks.

\In the bear-case, Wednesday’s rebound was not able to close above the previous all-time high setting it up as a point of possibly very strong resistance. If the index isn’t able to hold support at the current level it will probably shed at least another 3% putting the pullback at full-blown correction levels. There are no few companies in the market today with double-digit short interest and that could weigh on the market in the near term. In either case, I am a buyer of value if it comes with a positive outlook for earnings and a nice dividend.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.