Melting, Melting, Melting Up

Melting, Melting, Melting Up

The stock has been melting up for many months leaving hordes of traders and investors behind. While some sit back wondering why it is, or when the next crash will come, I’m here to tell you that the S&P 500 (NYSEARCA: SPY) is about to hit a new all-time high. What’s better, the stage is set for a major secular break out for the broad market. The only risk is the upcoming election cycle. I don’t want to wax political but the historical market data suggest this market will go higher regardless of who wins in November.

Yes, Moderna’s news is helping the market. Having a vaccine would be the #1 catalyst for economic and earnings growth I can think of but it is, ultimately, not why the market is moving higher. Stocks are valued on their potential for earnings and the potential is good. You might think, the S&P 500 is trading over 22X it’s forward earnings and is extremely overvalued but consider this. The market’s earnings multiple is based on the analyst’s consensus. The market could fall to match consensus, or consensus could rise to match the market. It just depends on who is right, the analysts,or Mr. Market.

The Analysts Consensus Is Too Low

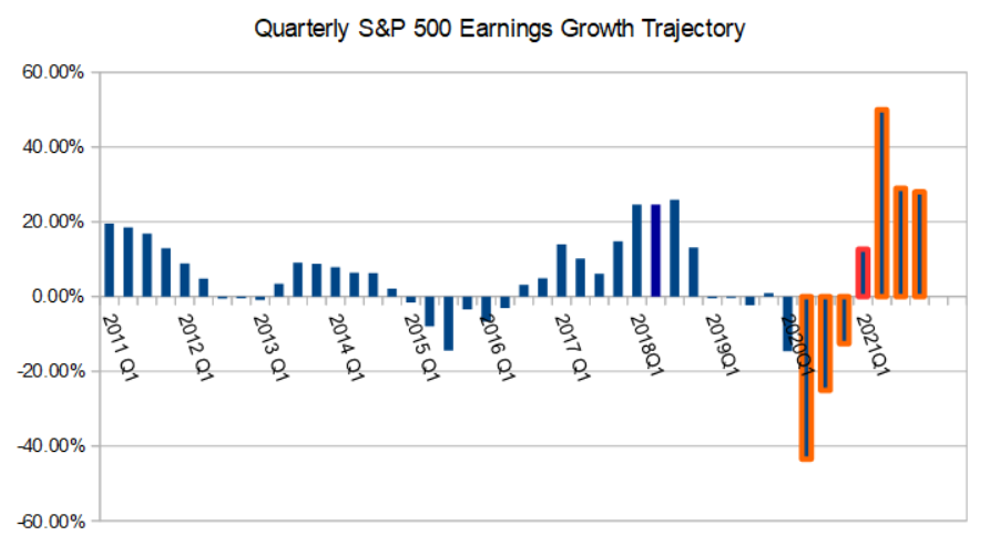

I’m not here to try and tell anyone that the average Wall Street is less smart than me, that is not the case. What I am here to say is the analyst’s current consensus for 2nd quarter earnings and the full year haven’t been corrected yet for the reality of today's situation. When the analysts lowered their targets there was no way of knowing how bad the COVID-19 pandemic would impact the economy and they planned for the worst. What actually happened was not the worst and that is shown in the data if not the earnings outlook. Yes, the economy is still on shaky ground but it has shown resilience and corporate America is mostly back to business.

The trend I am seeing in the earnings cycle is that 1) companies are beating consensus for the second quarter 2) those same companies are providing firm if not better than expected guidance and 3) the consensus for those companies is so low that full-year calendar 2020 results are going to smash right through them. This phenomenon is not limited to a single industry or sector either.

Here are just a few of the names I’ve noticed over the past two weeks:

The Technical Outlook: Bullish, Oh So Bullish

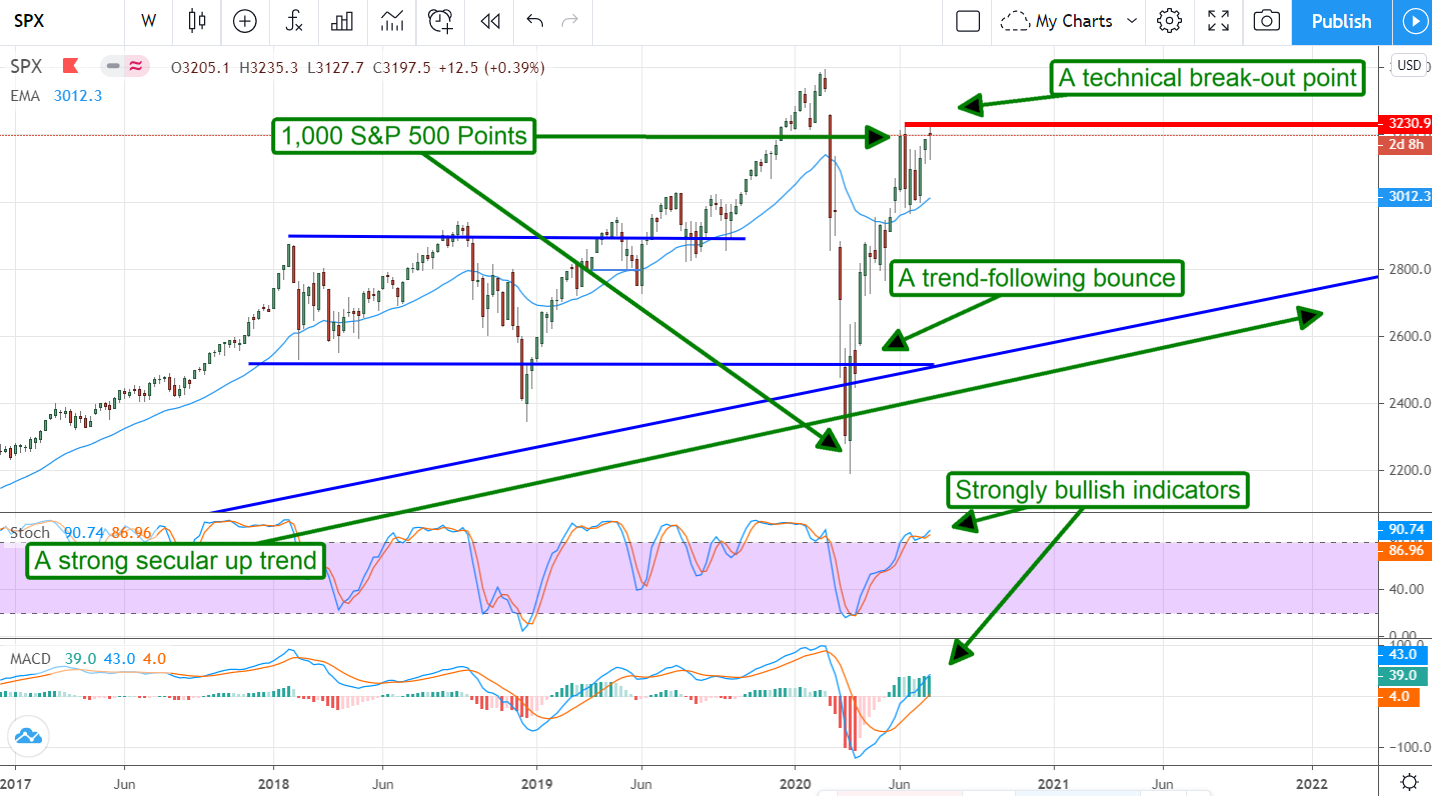

What this means for the earnings outlook is enormous. Despite the horrendous expectation for Q2 results the trajectory of earnings growth is positive from this quarter forward. The next two will be negative but improving and the next four will be positive. Add to this improving outlook in the form of rising consensus estimates further supported by an expectation of vaccine and you have a powerful tailwind. A tailwind powerful enough to drive the S&P 500 to retest if not break through its all-time high.  Today’s action has the S&P above near-term resistance in the premarket. A close above 3230 would confirm the break and likely lead to higher prices in the very near term. In fact, I think this move could unleash a wave of buying action that could last through the end of the 2Q reporting cycle. In that light, a move retest the all-time high is the least of my expectation. The post-pandemic bottom to the current price level is worth 1000 S&P points. Today's break could easily continue on for another 1,000 points putting the S&P 500 at 4,200 by year-end.

Today’s action has the S&P above near-term resistance in the premarket. A close above 3230 would confirm the break and likely lead to higher prices in the very near term. In fact, I think this move could unleash a wave of buying action that could last through the end of the 2Q reporting cycle. In that light, a move retest the all-time high is the least of my expectation. The post-pandemic bottom to the current price level is worth 1000 S&P points. Today's break could easily continue on for another 1,000 points putting the S&P 500 at 4,200 by year-end.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.