Steel producer

United States Steel Corporation NYSE: X stock has seen a strong surge in 2021 followed by a sharp decline but still performing well against the benchmark

S&P 500 index NYSEARCA: SPY. The demand for steel is bolstered by the recovering

automotive market,

housing,

construction, infrastructure, and

consumer products. The Company’s new Big River Steel flex mill is the template moving forward to accommodate the global initiative for

decarbonization through clean energy and sustainable materials, notably sustainable steel. Shares could get an ESG premium as they continue to migrate towards green processes.

Q4 FY 2020 Earnings Release

On Jan. 28, 2021, U.S. Steel released its fiscal fourth-quarter 2020 results for the quarter ending December 2020. The Company reported an earnings-per-share (EPS) loss of (-$0.27) excluding non-recurring items versus consensus analyst estimates for (-$0.65), a $0.38 beat. Revenues fell (-9.3%) year-over-year (YoY) to $2.56 billion beating analyst estimates for $2.51 billion. The Q4 adjusted EBITDA came in at $87 million versus $86.1 million analyst estimates and a YoY improvement by $4 million.

Conference Call Takeaways

U.S. Steel CEO, David Burritt, was resoundingly bullish moving forward, “I am bullish about the strong market we are seeing, and we are positioned more strongly than ever to capitalize.” The Company completed the Big River Steel transaction on Jan. 1, 2021. Big River Steel is the world’s first flex mill, which “merges the superior capabilities of integrated steel making with the agility of mini mill steel making”. It is also the only LEED certified steelmaker, with its sustainable steels. The recovery in Europe as prompted the Company to restart its third blast furnace in Slovakia. “The time is now to take sustainability to a new level in steel, and we look forward to boldly partnering with our customers to lead in this space.”

Secondary Offering

On Feb. 3, 2021, U.S. Steel commenced an upsized 42 million share secondary offering for gross proceeds of approximately $699 million, which would equate to around $16.46 per share. Shares fell on this news but has been hovering near the offering price level.

Fundamental Triggers

The key fundamental components that can drive shares of U.S. Steel higher would be the combination of a weaker U.S. Dollar (tightening supply), economic growth (rising demand), and maintenance of the steel import tariffs (prevent cheap overseas steel dumping into the U.S.). This would result in tight supply, increased demand and elevated steel prices which would go straight to the bottom line. The U.S. steel tariffs are now in the hands of the Biden Administration and whether he will eliminate or amend them to appease foreign allies. While Biden has endorsed a “Buy American” theme, the steel tariffs are the only way to truly enforce this. On Feb. 4, 2021, The U.S. Court of International Trade upheld Section 232 national security tariffs on steel imports denying a steel importer’s challenge to the 25% tariffs. On the flipside, the global decarbonization movement collides directly with the majority of current steel making processes. Up to 70% of steel production still uses the processing of burning coal. The migration to sustainable steel is highlighted boldly by its Big River Steel flex mill, which is a critical template. This can bring an ESG premium to the shares. Investors looking for a value entry on the recovery can watch for opportunistic pullbacks in shares of U.S. Steel.

X Opportunistic Pullback Levels

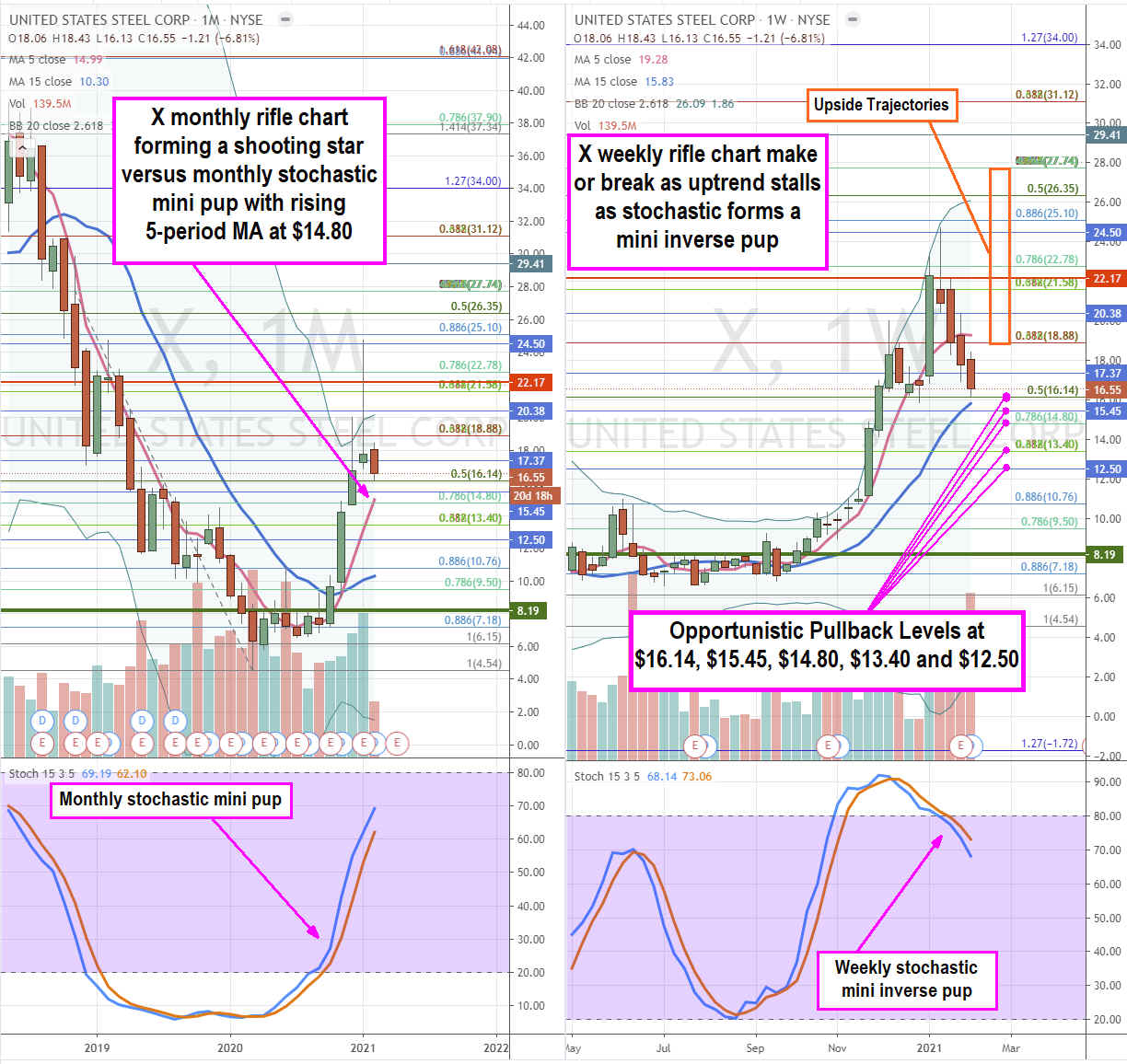

Using the rifle charts on the monthly and weekly time frames provide a broader view of the price action playing field for X stock. The monthly rifle chart exploded rapidly on the mini pup breakout triggering at the $8.19 market structure low (MSL) to peak near the $25.10 Fibonacci (fib) level. The monthly rifle chart formed a shooting star with potential for a month market structure high (MSH) sell trigger to be formed on the February 2021 candle close. The monthly 5-period moving average (MA) support is rising at the $14.80 fib with the monthly upper Bollinger Bands (BBs) at $20.16. The weekly rifle peaked out and the stochastic formed a mini inverse pup falling down through the 80-band forming a channel tightening to the 15-period MA at $15.83. The weekly uptrend has stalled out with a 5-period MA at $19.28. The weekly rifle chart is in a make or break that can form a pup breakout above the 5-period MA with a stochastic cross up or a breakdown on a 5-period MA crossover down through the 15-period MA as the stochastic continues its downside oscillation. The weekly mini inverse pup can provide opportunistic pullback levels at the $16.14 fib, $15.45 stinky 5s, $14.80 fib, $13.40 fib, and the $12.50 sticky 2.50s level. The upside trajectories range from the $18.88 fib to the $27.74 fib.

Before you consider United States Steel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United States Steel wasn't on the list.

While United States Steel currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.