Agriculture producer

Village Farms International, Inc. NASDAQ: VFF stock fits almost perfectly into the popular environmental, social and governance (ESG) investment theme. The Company has expanded from simply growing greenhouse vegetables to operating a 7 megawatt clean energy power plant while supplying hemp and cannabis products. The transformation was progressive as it uses byproducts that complement its other products within the portfolio in synergy. For example, generating clean energy from landfill gases to generate heat for electricity and CO2 to boost photosynthesis that bolsters its greenhouse plant yields by 30% while simultaneously reducing the CO2 going into the atmosphere as plants convert carbon dioxide into oxygen. This also makes Village Farms a carbon neutral company. The

pandemic has put a premium on

sustainable food and

energy producers. Shares have surged up 23% year-to-date (YTD) blowing away the 1.4% YTD performance of the benchmark

S&P 500 index NYSEARCA: SPY. Prudent investors looking to get exposure into an ESG play benefitting from the clean energy, sustainable foods and cannabis momentum can monitor shares of Village Farms for opportunistic pullback price levels.

Q3 FY 2020 Earnings Release

On Nov. 13, 2020, Village Farms reported an adjusted earnings-per-share (EPS) profit of $0.01, beating consensus analyst estimates for EPS loss of (-$0.02), by $0.03. Revenues rose 12% year-over-year (YOY) to $42.9 million. The Company completed its acquisition of Pure Sunfarms, a cannabis products producer and initiated its global cannabis strategy with further investments in Altum International Pty Ltd and DutchCanGrow. The Company also renewed and extended its existing contract with City of Vancouver for landfill gas supply agreement to transition to a “more attractive long-term business model based on the conversion of landfill gas to high-demand Renewable Natural Gas”. The Company also completed a 9.4 million share direct offering at $5.30 per unit to institutional investors to finance the acquisition. Village Farms CEO, Mike DeGiglio summed it up, “ There is no cannabis supplier in Canada or the U.S. with our combination of experience, capabilities and more than ten miller square feet of greenhouse assets, and we are encouraged by the evolving regulatory environment in the U.S. and are developing multiple strategies to capitalize on any favorable U.S. regulatory developments in 2021.”

Conference Call Takeaways

Village Farms CEO, Michael DeGiglio, pointed out that Village Farms achieved positive EBITDA as legacy produce showed strong YoY growth. Newly acquired Pure Sunfarms produced its 8th straight quarter of positive adjust EBITDA. Net sales rose 75% sequentially from last quarter driving sequential quarterly income by 200% to $3.2 million. CEO DeGiglio believes they can supply 30% to 35% of the total Canadian cannabis flower market. The acquisition enables Village Farms to utilize its 2.6 million square foot Delta 1 facility for cannabis production. Average selling prices of tomatoes rose by 30% YoY. This was due to supply shortages from higher grocery store traffic volumes. The Company is also back to full production of its cannabis after pulling back in during Q3 reducing inventory levels. The Company closed the quarter with $22 million in cash. The transformation into a vertically integrated agricultural-based CPG business. Prudent investors can watch for opportunistic pullback levels for exposure.

VFF Opportunistic Pullback Levels

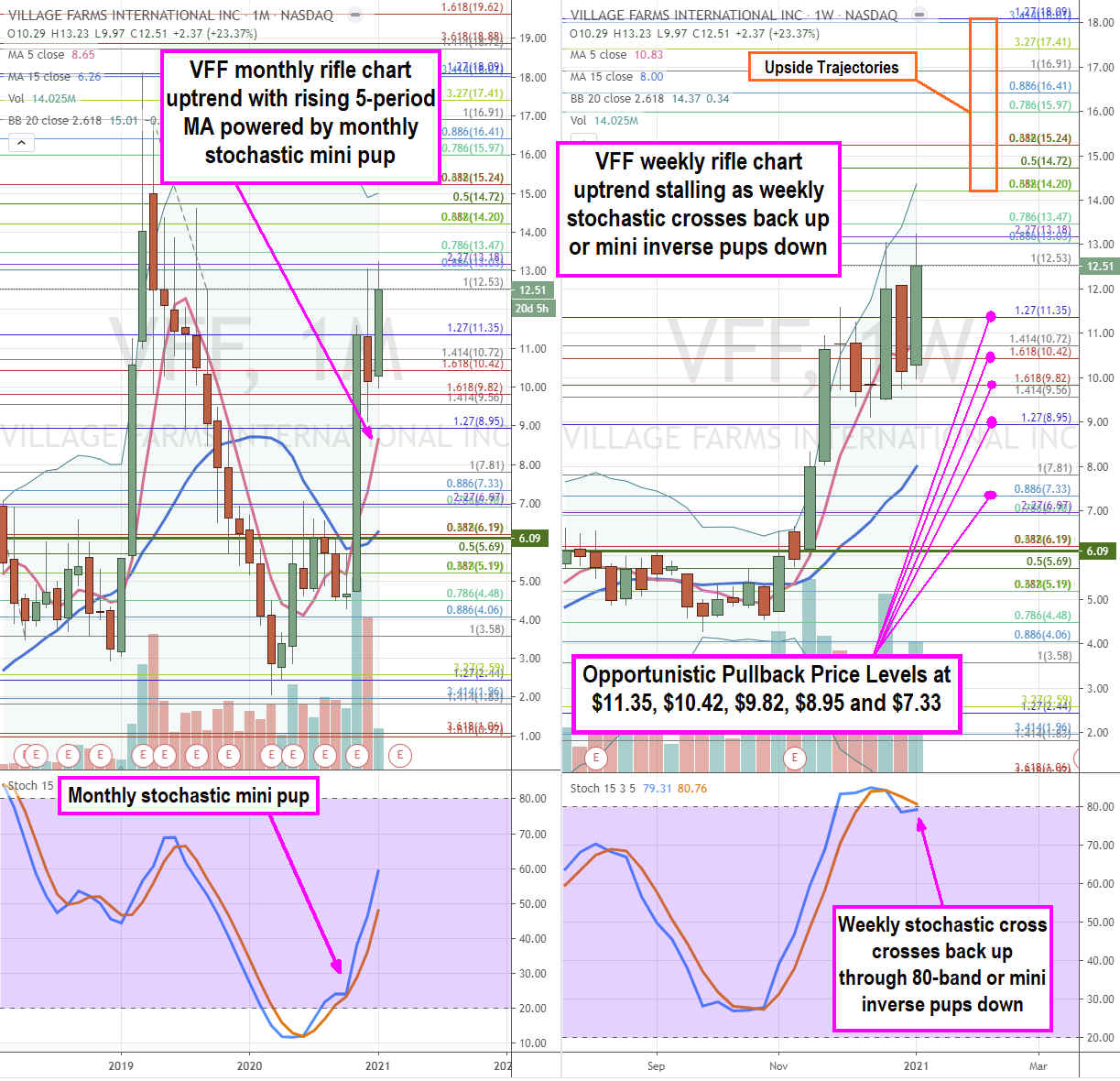

Using the rifle charts on the monthly and weekly time frames provides a broader complete perspective of the landscape for VFF stock. The monthly rifle chart has a strong uptrend powered by the stochastic mini pup. Shares formed a market structure low (MSL) buy trigger above $6.09 in November 2020 in reaction to its Q3 2020 earnings. The stop shot up to eventually peak at the $13.18 Fibonacci (fib) level. The weekly rifle chart has an uptrend with the 5-period moving average (MA) support stalling at the $10.72 fib as the weekly stochastic crossed down to test the 80-band. From here, the weekly stochastic can cross back up to fuel the next leg up towards the weekly upper Bollinger Bands near the $14.20 fib or slope back down to form a channel tightening pullback under the weekly 5-period MA. The weekly mini inverse pup can provide prudent investors with opportunistic pullback price levels at the $11.35 fib, $10.42 fib, $9.82 fib, $8.95 fib and $7.33 fib. While shares have spiked fast, the stock will either pullback to the MA supports or the MA supports will rise to the stock price levels. The upside trajectories range from the $14.20 weekly upper BBs to $18.09 fib, with potential into the $20s.

Before you consider Village Farms International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Village Farms International wasn't on the list.

While Village Farms International currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report