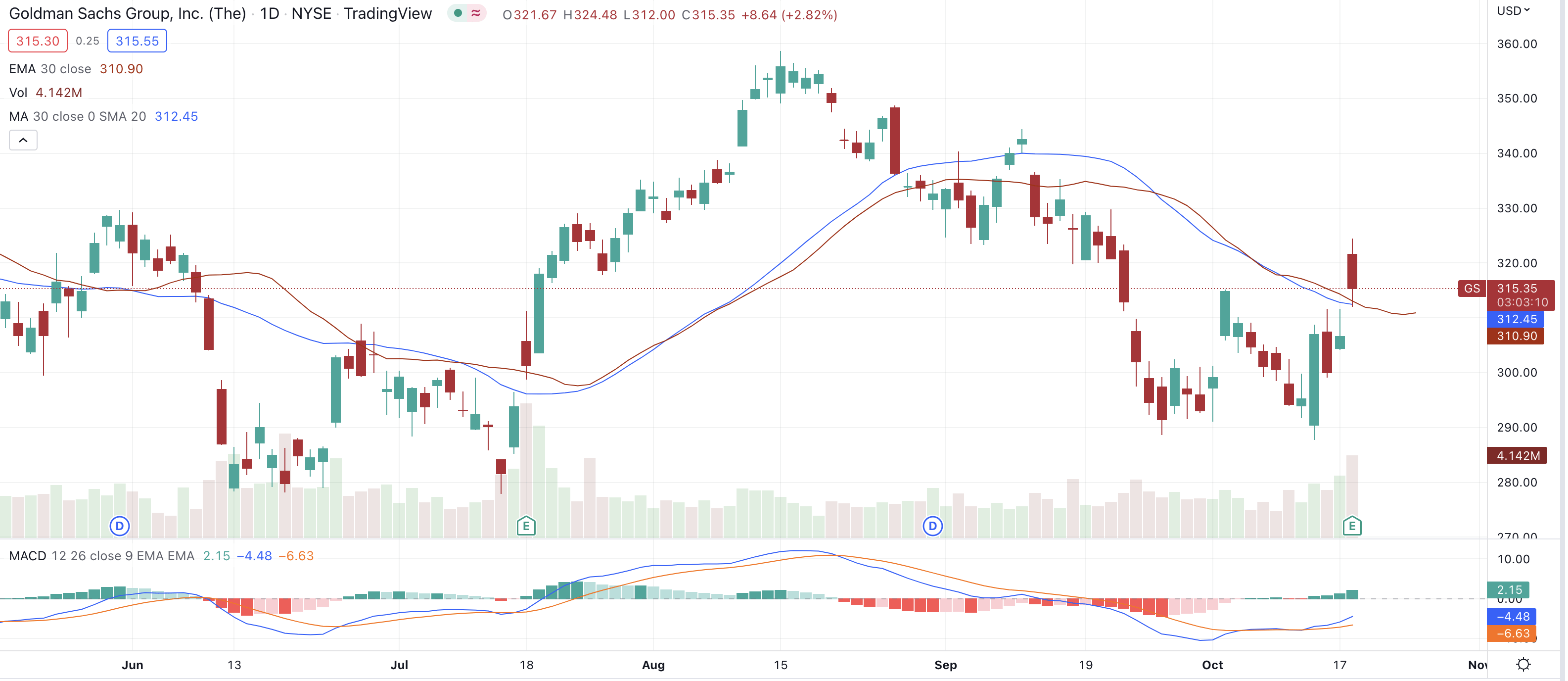

Coming into the start of June, it looked as though shares of Goldman Sachs (

NYSE: GS) were

on track to undo all of Q1’s damage and retake their 2020 highs by the middle or end of summer. After Thursday’s news and Friday’s trading session, it looks like investors might have to wait a bit longer before they start popping the bottles of champagne.

Shares of the banking giant shed close to 9% of their value to close out last week after the Federal Reserve rolled out fresh restrictions on US banks’ dividends and stock buyback programs. These moves came on the back of the Fed’s annual stress tests which is a required hypothetical analysis of how banks would perform in certain unfavorable economic conditions. In light of how volatile the economy has been in recent months, this was one of the most-watched stress tests of recent years. And as you might have guessed by now, the results weren’t great.

Dividends At Risk

The big headline and main catalyst for the Fed rolling out these seemingly heavy-handed restrictions was the fact that many of the big banks, including Goldman Sachs, were seen to approach their minimum capital requirement if the coronavirus pandemic continues to worsen. Given that several of the banks had already halted buyback programs in March, many on Wall Street might have thought they were ahead of the curve and would get through the stress tests unscathed.

It was not to be, however, and the Fed moved to halt buybacks until at least the end of Q3 while capping next quarter’s dividend payout at the same amount as what was paid out in Q2. And after Q3, dividends cannot exceed the average of the past four quarters’ earnings. Banks will also be required to update and resubmit their 2020 capital plans in light of recent events while additional analysis will be run by the Fed each quarter to see how things are shaping up. The ultimate goal here is for the preservation of capital which will help retain confidence in the banks and prevent any panic-driven and much-feared bank runs.

Fed Governor Lael Brainard was particularly hawkish about banks continuing to pay out dividends, and while they weren’t canceled completely, her comments will surely be making some investors nervous. In a separate statement last week she said "I do not support giving the green light for large banks to deplete capital, which raises the risk they will need to tighten credit or rebuild capital during the recovery. Temporarily halting shareholder payouts at large banks due to the COVID-19 shock would create a level playing field and allow all banks to preserve capital without suffering a competitive disadvantage relative to their peers".

Bumpy Road Ahead

Alongside Goldman, Wells Fargo (NYSE: WFC) was also particularly hard hit with both the overall results and these comments, with shares coming off more than 7% in Friday’s session. Analysts at KBW said in a note to clients after the announcement that “the Fed’s decision to have banks resubmit capital plans on likely more difficult scenarios is a negative sign for dividend payouts beyond the third quarter”. They weren’t slow about pinpointing Goldman and Wells Fargo specifically as being most at risk for additional restrictions, like these dividend cuts, in the coming months.

Analyst Dick Bove of Odeon Capital said that the results of the stress test "indicates that a number of banks must sharply reduce their payouts," and like his peers in KBW, pointed a finger at Goldman as being high on that list. The message for investors is clear, if the economy catches a cold, banks will certainly be sneezing. And with Goldman’s 2.6% dividend yield at risk, it looks like many investors aren’t confident enough to feed off pure capital appreciation at the moment.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.