The Value Of Stocks Is Based On The Future Of Earnings

If you are asking yourself why stocks keep rising you are not alone. The U.S. economy is in the throes of its deepest recession ever, unemployment claims have topped 20 million, unemployment will probably hit 20% in April, and the end is not exactly in sight. By all respects, the broad market (SPY) should still be in freefall, right?

Wrong. The reason the market is rising right now is simple. While the true value for a stock is based on its worth today, the fair value of the stock is based on what it will be worth tomorrow. Fair value, the price agreed to by willing market participants, is a discounting mechanism based on future expectations.

The stock market correction we experienced in February and March was based on an EXPECTATION the economy would go into recession, not the reality. Along with this recession is an expectation that earnings will fall too, and that is why the market corrected. The sell-off was driven by an expectation of future earnings decline, not the value of the market at the time.

The very word Correction can tell you a lot. The market “corrected” because prices, fair value, had not yet taken the pandemic into account. The market was, in effect, wrong and needed to “correct” back to a more reasonable version of “fair value”.Stocks are rising now because the recession, today's reality, is expected to be short-lived. What this means is the newly corrected prices are once again wrong. With an end to the recession in sight, there is an expectation for economic activity to resume, expansion to begin, and corporate profits to rise.

The Earnings Picture, A Mixed Bag To Be Sure

The outlook for earnings is a mixed bag to be sure. The outlook for 2020 earnings has gone straight into the dumper. The only ray of light is that the 2nd quarter is expected to be the bottom of the recession. From there, the trajectory of growth is upward and accelerates into 2021. Where 2020 is expected to see an EPS decline of -15.2% for the average S&P 500 stocks 2021 is expected to see 23% growth. That’s why stocks are rising. Next year’s growth.

The earnings outlook my be behind the rise in stocks but investors and traders should beware. The trajectory for growth is upward but the outlook for 2020 is still in decline. Declining EPS outlook is behind the correction we just experienced and likely to drive another deep plunge in stocks before the recovery is well and truly underway.

One of the factors that set the market up for such a big fall was valuations. Valuations for S&P 500 stocks hit a long-term high of 19X EPS just before the selling started. The high valuation was driven in part by rising prices and in part by falling estimates, the very same conditions we face today. At today’s prices, the forward P/E for the S&P 500 is above 19.1X earnings and getting worse by the day.

The Technical Outlook: Sector Rotation And Chopping Wood

The technical outlook for the S&P 500 is bullish, very bullish in my opinion, but volatility should be expected in the near to short-term. The market has just undergone a major correction driven by a black swan event guaranteed to alter the way we live and work forever and that will take time to work through. The phrase “chopping wood” refers to the whipsaw action volatile markets can make while they “hammer out a bottom” and it is a bottom the market is hammering out.

In the near-term, look to sector rotation as a driving force of the market. Stocks now out of favor (global, industrials, growth, poor balance sheets, no dividends, unable to cope with social distancing) are being traded for those now in favor. Stocks now in favor are blue chips, dividend payers, tech, and those able to produce growth in the post-pandemic world. When the market is up, bears are going to take a bite and set it up for the next buying opportunity.

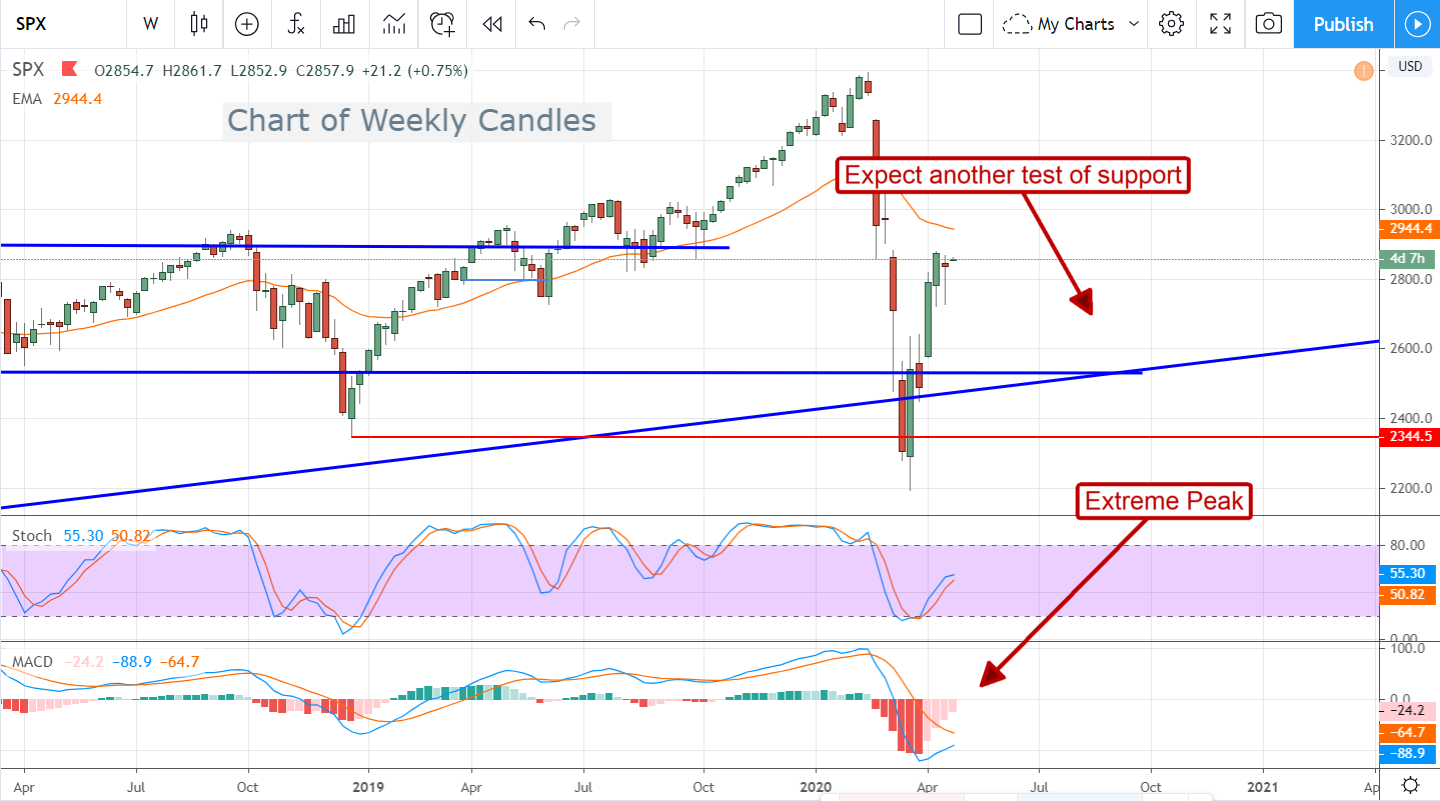

For this article, the chart of weekly prices is best I think. The weekly chart shows the index making a strong bounce from secular-grade support and moving higher. The caveat is that MACD is still bearish (after setting an extreme peak) and the market has only bounced once. Do not expect a Vee-shaped recovery in the broad market, more like a wanky W-recovery that may take till the end of the year or longer to complete. Until then, stay focused on those solid, blue-chip dividend payers and you should come out better on the other side.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.